Bullet: The Clean Shot

Introduction

The Market Window for a New Trading Layer

Permissionless trading has entered a new stage of maturity. Liquidity is deeper, users are more sophisticated, and infrastructure across major chains has improved significantly.

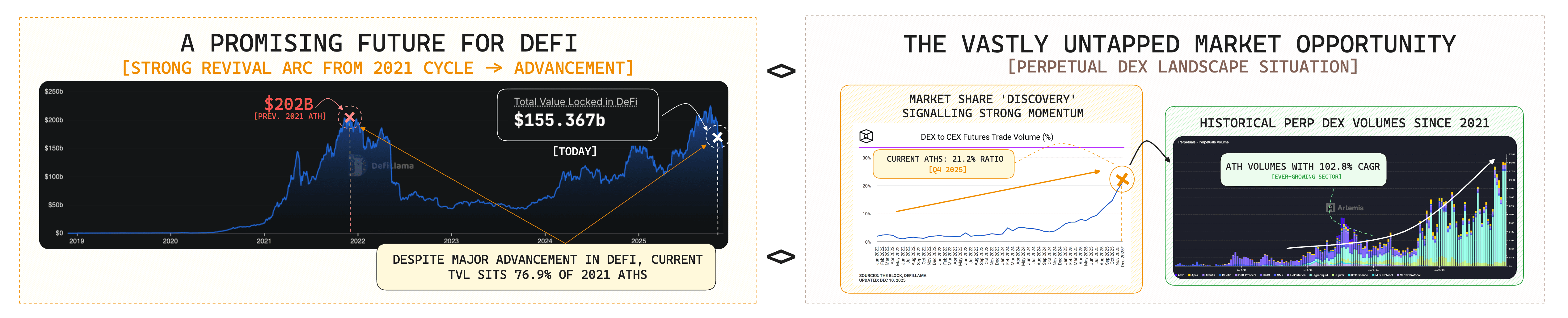

Historical DeFi TVL Trend; Historical DEX-to-CEX Ratio; Historical DEX Volume Trend - Source: DeFiLlamma, TheBlock, Artemisxyz

Even so, structural indicators show that onchain trading remains early: historical DEX-to-CEX ratios have never exceeded ~20%, and despite near all-time-highs in DeFi TVL and a 102% CAGR in perpetual DEX volumes, onchain derivatives still represent a small fraction of global trading flows. The opportunity remains wide open. Yet the core elements of mature market structure remain missing on-chain. Low-latency execution degrades during volatility, cross-margining is fragmented, and risk engines are inconsistent or opaque. Deterministic ordering often breaks under load, and settlement assurances are constrained by shared blockspace. These shortcomings create a structural disadvantage versus centralized exchanges, where execution guarantees and operational predictability are foundational.

A New Trading Paradigm

At the same time, the industry is undergoing a shift away from isolated, single-primitive protocols toward vertically integrated trading environments. Hyperliquid’s rise illustrates this clearly. Traders gravitated toward a venue that unified execution, collateral management, and product surfaces under one system: purpose-built around speed, capital efficiency, and predictable behavior. The success of this model signals a broader market demand for application-specific execution layers where performance and UX compound instead of being constrained by general-purpose blockspace.

A Clean Bullet(-Proof) Thesis

Bullet emerges directly within this context. Rather than operating as another protocol on shared infrastructure, Bullet extends Solana’s high-throughput L1 with a dedicated execution substrate engineered specifically for trading, offering 1-millisecond latency with 20,000+ orders per second throughput. The system combines Solana’s inherent performance characteristics with Bullet’s own risk engine, margin framework, and settlement architecture. By integrating spot trading, perpetual futures, and lending into a unified platform, Bullet creates an environment where collateral, execution logic, and risk management operate coherently rather than as siloed modules stitched together across multiple protocols.

The objective is clear: deliver CEX-grade execution inside a trust-minimized, verifiable environment. By pairing deterministic, high-speed execution with transparent state transitions and composable collateral, Bullet aims to make Solana a viable home for institutional-scale derivatives, structured products, and multi-asset trading flows through a unified financial infrastructure that extends to support complementary primitives. In doing so, Bullet aims to set a new benchmark for institutional-grade markets.

Bullet’s Technical Architecture Deep-dive

The Inherent Constraints of DEXs

Understanding Bullet’s architecture begins with recognising the core structural limitations general-purpose blockchains inevitably places on trading systems. Even the fastest L1s remain far slower than the millisecond-level cadence required for high-frequency price discovery, which leaves most perps DEXs (regardless of design) trailing CEXs in both speed and execution quality. These platforms also inherit blockspace-related issues such as network congestion, unpredictable fees, and wallet-driven latency, all of which limit their ability to support tight spreads and reliable order updates as lagging secondary price venues.

Recognising the pitfalls and strengths of blockchain infrastructure, Bullet addresses these constraints with a network extension: an application-specific execution layer that uses Solana for settlement but operates independently for performance. By running its own blockspace and custom runtime, Bullet executes the trading loop off-L1 while still benefiting from the ecosystem’s trust guarantees and composability. This creates a high-speed execution environment that achieves CEX-level performance without sacrificing decentralization or verifiability.

The Core Architecture: A Modular High-Performance Trading Stack

Bullet is built as a modular system where each part of the stack is optimized for a single responsibility.

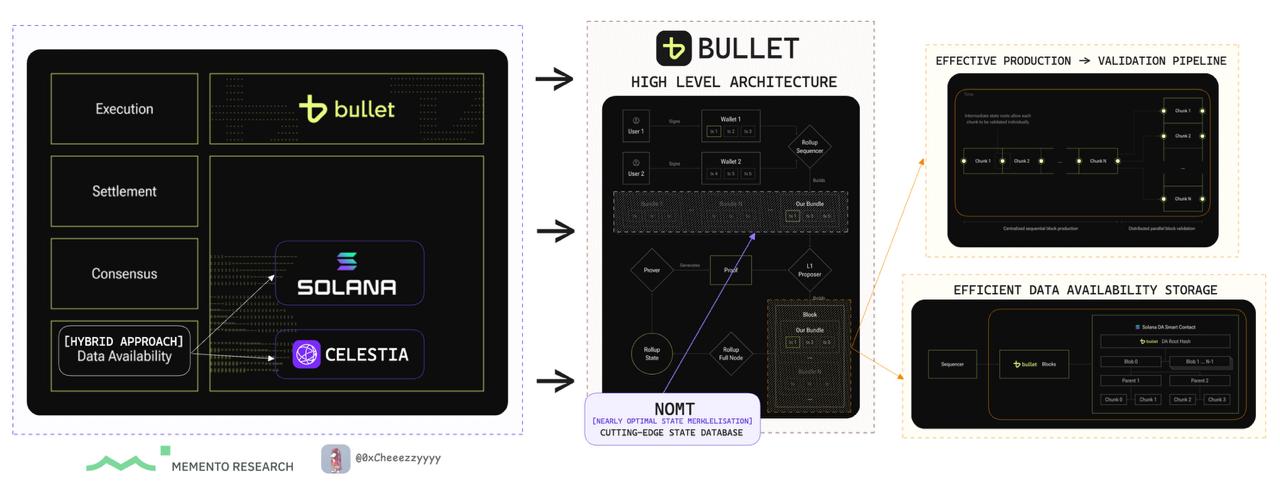

Bullet’s Technical Architecture Outline - Source: Bullet Documentation

The technological stack comprises of four core components:

1. Execution Layer: Bullet Core (Rust, Sovereign SDK-based)

Bullet Core serves as the system’s high-performance execution engine, built entirely in Rust and free from the constraints of Solana’s compute budgets or virtual machine rules. Instead of processing transactions in discrete blocks, Bullet uses a continuous-stream sequencer that applies updates as they arrive, delivering soft confirmations in roughly one millisecond.

This complements the integration with Pyth Lazer that introduces exchange-grade, ultra low-latency oracle feeds that fulfil the needs for any high-frequency trading environment. This architecture enables deterministic, application-specific ordering and unlocks a level of throughput that supports real-time risk evaluation across hundreds of markets. By allowing developers to implement complex financial logic natively, Bullet Core is structurally attuned more like a CEX-grade matching and risk engine.

2. Settlement Layer: Solana

Although execution occurs off-chain, Bullet anchors its finality and balances directly to Solana. The sequencer periodically submits batched state commitments to the L1, which acts as the canonical ledger and trust foundation for the system. This approach preserves Solana’s decentralization and validator-driven security model while keeping Bullet fully interoperable with native Solana assets and wallets. Importantly, settlement on Solana ensures that users retain self-custody and that the system remains trust-minimized.

3. Data Availability: Celestia

To ensure that all transaction data remains publicly accessible and independently verifiable, Bullet utilizes Celestia as its data availability layer given its high-throughput, cost-efficient data publishing specifications. By separating DA from settlement, Bullet secures a scalable pipeline for broadcasting execution traces without compromising on transparency or verifiability. This integration allows the system to maintain low operating costs while guaranteeing that no operator can obscure, censor, or falsify state transitions.

4. Zero-Knowledge Proving: Succinct SP1 zkVM

The integrity of Bullet’s off-chain execution is guaranteed through zero-knowledge proofs generated using Succinct Labs’ SP1 zkVM. SP1 can execute Bullet’s native Rust runtime directly and produce succinct cryptographic proofs attesting that every transaction was processed according to the correct logic. These proofs are then verifiable on Solana, eliminating the need to trust the sequencer and converting it into a provably correct executor. As proving costs continue to fall and SP1 scales to larger batches, Bullet gains the ability to validate thousands of state transitions at a fraction of a cent, making verifiable high-frequency execution economically viable.

Collectively, Bullet’s core architecture comes together as a tightly integrated execution pipeline that mirrors the real-time throughput and responsiveness of a centralized venue while retaining full decentralized assurances. But it does not stop there.

Application-Specific Sequencing

The benefits of Bullet’s architecture goes beyond just optimising for performance. Structurally, Bullet is also tailored to define its own sequencing logic and since the sequencer operates within an application-specific domain, it is no longer constrained by global fee markets or L1 mempool competition. This allows Bullet to implement deterministic ordering rules that promote healthy market microstructure, such as prioritizing maker placements and cancellations over taker flow or enforcing fairness constraints that eliminate latency races and toxic order flow.

These mechanisms create an environment that is structurally favorable for liquidity providers, reducing adverse selection and supporting tighter spreads and deeper books. This level of sequencing precision is not achievable on general-purpose chains, where all users compete through gas bidding. This approach effectively enables the core characteristics of ‘CEX-style order flow’ into a trust-minimized onchain environment.

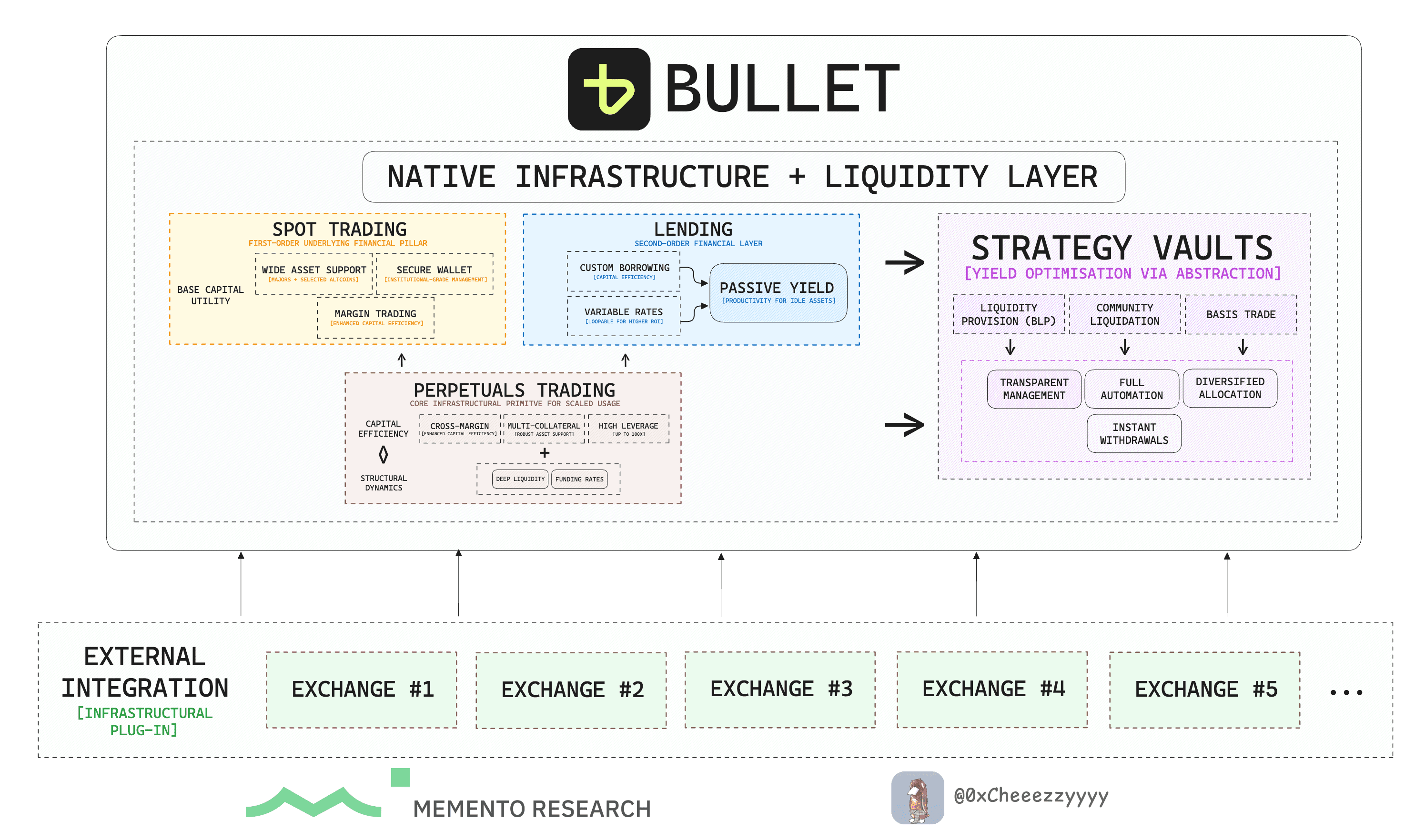

Extending Beyond Perpetuals: Multi-Dimension Asset Productivity

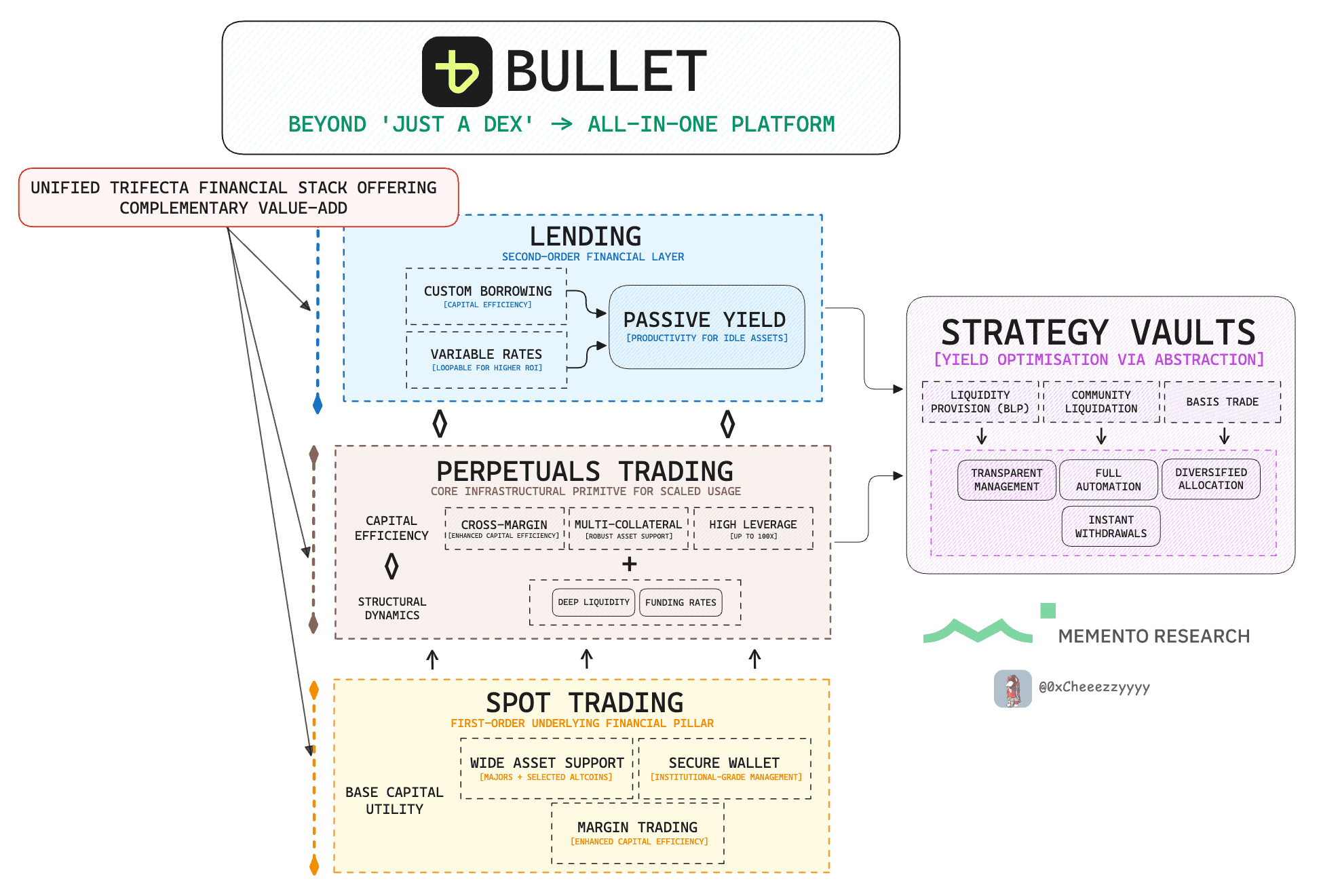

In terms of financial utility, Bullet moves beyond the typical single-product DEX model by launching a vertically integrated, multi-core financial stack composed of spot trading, perpetual futures, and lending/borrowing.

Bullet Multi-layered Financial Stack: The Trifecta - Source: 0xCheeezzyyyy, MementoResearch

Bullet’s architecture unifies borrowing/lending and derivatives under a single collateral and margin system, allowing these two pillars to share the same liquidity, risk engine, and execution logic. By contrast to siloed protocols, this eliminates cross-product fragmentation and enables a significantly higher level of capital efficiency where a single pool of assets can simultaneously support borrowing, leveraged trading, hedging, and collateralized yield strategies.

While spot remains structurally separate, the shared collateral base enables users to route productivity across products seamlessly. For example, users can deposit SOL into lending, have it count toward margin, and short SOL-perps to construct a basis trade all within one cohesive system.

This integrated design unlocks multi-dimensional asset productivity, allowing users to deploy capital across spot, perps, and lending within one ecosystem to maximize yield opportunities and risk-adjusted returns. On top of this foundation, Bullet introduces strategy vaults that operate across the lending and derivatives layers. These vaults offer transparent, automated yield strategies such as liquidity provisioning, liquidation participation, funding-rate capture, and basis/arbitrage-style trades. Importantly, they preserve liquidity with instant withdrawals while simplifying access to sophisticated, multi-legged positions.

Together, Bullet’s unified architecture elevates capital to a continuously productive state, where assets are cross-leveraged and algorithmically optimized within a single, coherent system. This aligns with the broader Superapp Thesis: users benefit most when execution, settlement, collateral, and products coexist in one tightly integrated environment rather than being scattered across fragmented protocols.

The Strategic Edge Against Existing Competitors

Bullet occupies a uniquely advantaged position in the current competitive landscape by combining superior trading-focused technical architecture with the distribution strength of Solana.

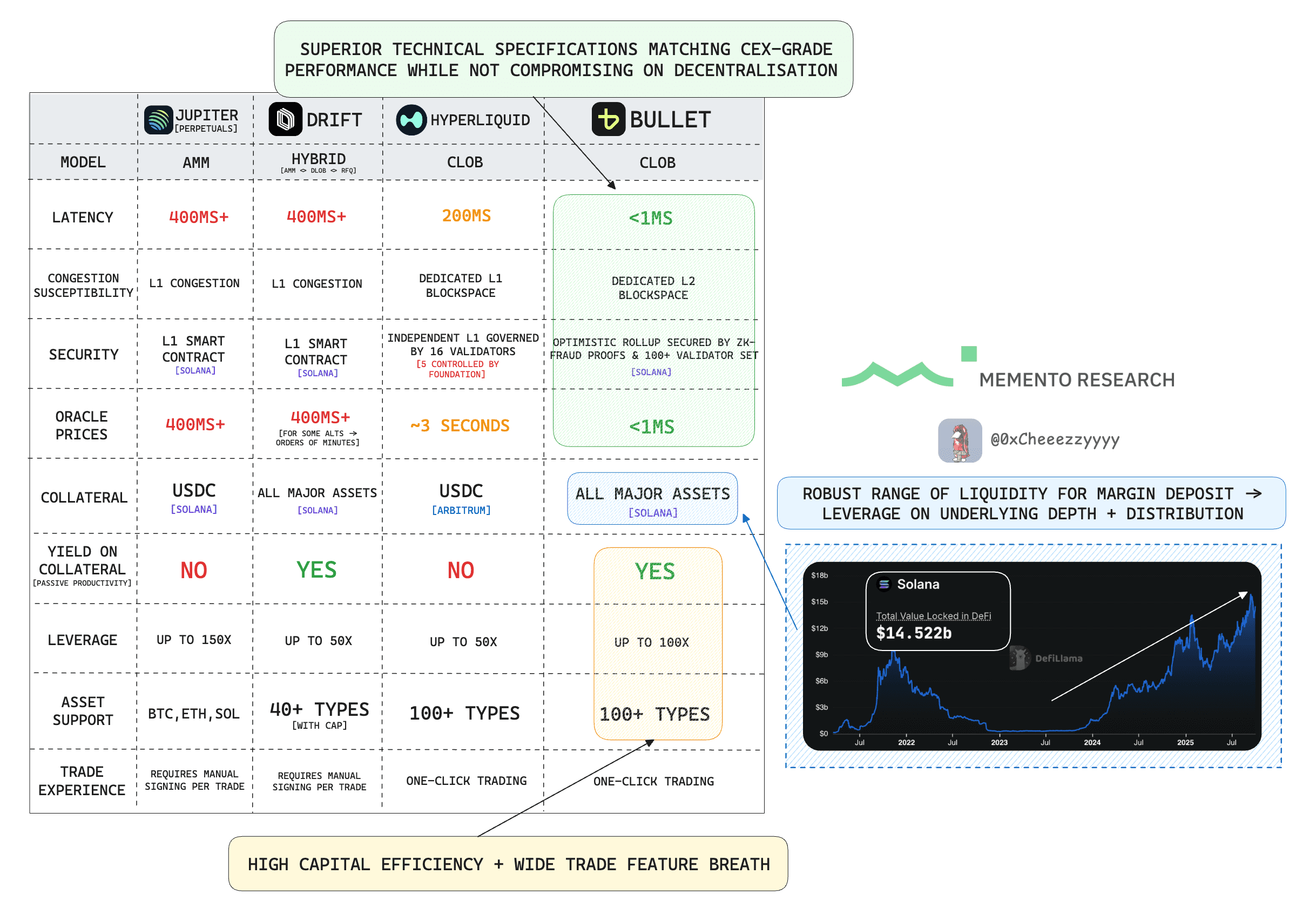

Perpetual DEX Landscape Comparison Highlight on Bullet - Source: Bullet, DeFiLlamma

Solana-native CLOBs such as Phoenix and OpenBook provide strong base-layer execution but lack unified margining, shared collateral, and multi-product cohesion. Derivatives platforms built before the emergence of execution-layer design also struggle to scale into a full trading stack, as they were never architected to manage coordinated spot, perps, and lending flows under one substrate.

AMM-based perpetuals like Jupiter Perps, and hybrid architectures like Drift, are ultimately constrained by the limitations of general-purpose L1 blockspace. Their execution paths depend on shared network conditions, making it difficult to deliver deterministic, low-latency performance or a capital-efficient, unified margin system. These constraints cap their long-term viability as institutional or high-frequency venues.

Bullet avoids these structural bottlenecks entirely. Its optimized execution engine delivers sub-1ms performance (over a 400x improvement relative to standard Solana transaction throughput) while still operating natively on the L1. This gives Bullet the rare combination of app-chain-level specialization and immediate access to Solana’s deep liquidity, mature user base, and dominant distribution channels, eliminating the cold-start problem faced by standalone chains.

Even against leading app-chains such as Hyperliquid, Bullet introduces meaningful functional advantages. Collateral deposited into Bullet’s unified margin engine can simultaneously earn yield, serve as trading collateral, and be deployed into automated strategies.

This produces higher capital efficiency, enabling users to take on more leverage with less fragmentation and lower idle capital. The integration of spot, perps, and lending under a shared liquidity and margin framework compounds this effect through multi-levelled asset utilisation across the stack. This vertically integrated structure mirrors the strengths of Hyperliquid’s HyperEVM extension, which proved how a unified execution environment accelerates distribution and liquidity growth.

Together, these elements create a reinforcing competitive dynamic:

CEX-grade speed → L1-scale distribution → unified products → superior capital productivity.

The result is a trading layer that surpasses the capabilities of every existing DEX, L2-based perps venue, or app-chain competitor, establishing Bullet as the most complete and institution-ready execution environment in the market today.

Beyond DeFi: The Institutional Execution Layer

As digital asset markets mature, the profile of their participants is shifting from retail speculation toward institutional-scale capital. With this shift comes a new set of requirements: execution environments must offer not only extreme performance, but also deterministic behavior, transparent risk logic, and verifiable correctness. Bullet fills this gap by pairing CEX-level performance with transparent, auditable, and trust-minimized execution: purpose-built to support the standards, safeguards, and operational integrity required for true institutional participation.

The Emphasis on Open Verifiability

The core prerequisite for institutional participation is verifiability. Large firms cannot operate on infrastructure where execution is opaque, non-deterministic, or dependent on operator trust. They require deterministic behavior, traceable state transitions, and full transparency into how risk is computed. This need was underscored by the largest liquidation event in crypto history on October 10th, where more than $19 billion in leveraged positions were wiped out due to opaque liquidation engines, undisclosed risk models, and latency-driven execution gaps.

Such incidents highlight the systemic fragility inherent in centralized exchange infrastructure, where users are exposed not only to market volatility but to the hidden mechanics of black-box systems. Bullet’s architecture is purpose-built to eliminate these risks, delivering an execution environment that is transparent, auditable, and provably correct. This offeres a level of verifiability that far exceeds the opaque models of CEXs which shifts the system from trust-based to trustless.

Robust Security & Governance

To establish trust, robust security and governance frameworks must be institutionalised. Bullet provides institutional-grade security by separating high-speed execution from final settlement and anchoring all outcomes to a decentralized base layer, ensuring executed trades cannot be altered by operators. The potential integration of Succinct’s SP1 zkVM strengthens this further by enabling low-cost validity proofs economically viable for high-frequency usage.

This means democratising state verification as SP1’s parallel proving model and recursive aggregation allow entire chains of state transitions to be compressed into a single, cheaply verifiable proof. This makes independent verification accessible to light clients, custodians, and institutional validators.

Governance operates on the same verifiable foundation. Updates to margin rules, risk parameters, listings, and operator requirements are executed transparently, with zk-validity proofs guaranteeing that state transitions strictly follow protocol logic. This combination of deterministic settlement, efficient proof generation, and democratized verification provides institutions with a security and governance model that surpasses the assurances offered by CEXs.

Institutional-Grade Compliance Alignment

With verifiability and secure settlement established, Bullet naturally extends into institutional compliance. Every collateral movement, liquidation, funding update, and settlement is programmatically executed and immutably recorded onchain, creating a complete audit trail without the need for private logs or post-hoc attestations. When paired with zk-validity proofs, institutions can verify not only the outcomes but also the correctness of the underlying logic that produced them.

This produces a compliance framework significantly stronger than traditional exchanges, where reporting relies on internal systems and opaque attestations. For institutions, Bullet offers a venue where operational transparency, verifiable correctness, and regulatory alignment are built into the architecture itself. This essentially makes it suitable for more regulated financial products and large-scale institutional participation.

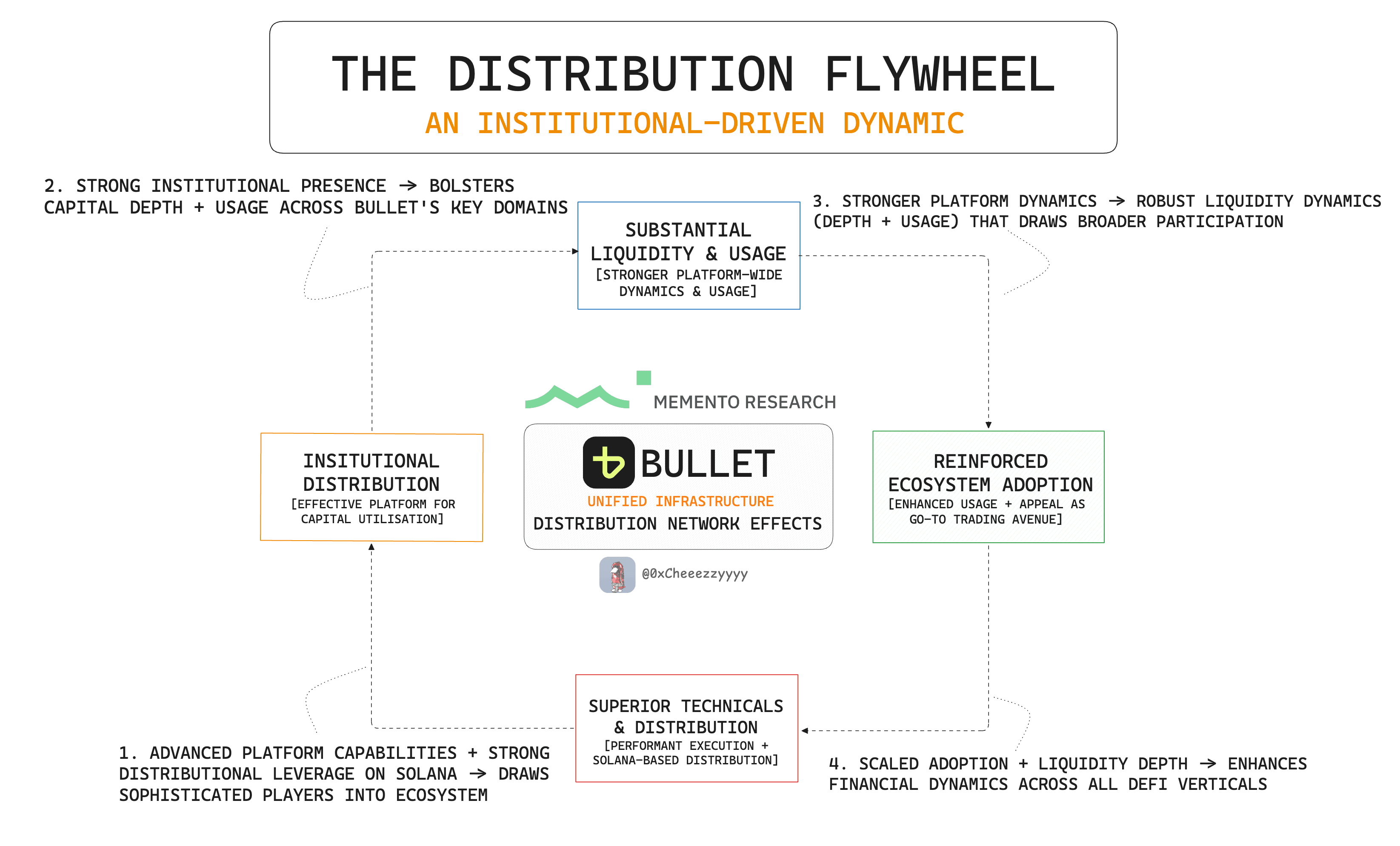

An Institutional-driven Distribution Flywheel

Bullet is positioned within Solana’s rapidly expanding institutional ecosystem, which includes market makers, proprietary trading firms, venture funds, and liquidity networks already operating at scale. Bullet’s performance advantages give these participants a compelling reason to route flow into the system. As more institutional players engage, distribution widens, which brings more users and more liquidity.

This liquidity deepens the books and improves execution quality, which in turn attracts more institutional flow. The effect compounds through a clear flywheel:

Bullet’s Distributional Flywheel Outline - Source: 0xCheeezzyyyy, MementoResearch

1. High-Performance Execution and Distribution Attracts Flow

Bullet’s superior technical architecture alongside with unified margin systems give trading firms a direct performance advantage, making the venue materially impactful as a go-to trading platform. This draws market makers and funds into the ecosystem, expanding institutional distribution easily.

2. Institutional Distribution Brings Users

As reputable trading firms become active with deep capital, retail and active traders follow, drawn by tighter spreads, deeper liquidity, and improved execution quality. This institutional presence builds credibility in the venue and drives steady user growth.

3. User Growth Expands Liquidity Dynamics

An increase in traders and volume deepens order books across all markets, reducing slippage and making more markets viable. With stronger liquidity conditions, Bullet becomes a more attractive environment for large, size-taking strategies.

4. Deep Liquidity Pulls in More Institutional Flow

Robust liquidity allows institutions to execute larger trades with minimal price impact, encouraging ongoing flow and more complex strategies. This sustained activity feeds directly into higher economic throughput, strengthening token accrual and reinforcing network effects.

Bullet’s execution layer acts as the catalyst, enabling each stage of this cycle to accelerate faster than general-purpose DeFi protocols.

Expansion Into Higher-Order Markets

Once the underlying execution infrastructure is secure, deterministic, and capital efficient, Bullet is positioned to scale beyond purely crypto-native markets. Its unified collateral engine and cross-margining framework serve as the foundational substrate for higher-order financial primitives such as extended DeFi primitives, structured yield products etc.

Infinite Asset Domain Support

Bullet’s architecture is intentionally generalizable: it is not limited to the crypto asset class. As onchain markets expand into new domains, Bullet can seamlessly accommodate them. The accelerating growth of real-world assets (such as tokenised stocks and commodities) as well as prediction markets, represents a rapidly emerging asset class where institutions increasingly require a robust, purpose-built trading venue.

Similarly, as onchain foreign exchange (FX) markets mature, Bullet can serve as the institutional-grade execution venue for funds seeking tight spreads, strong depth, and predictable market microstructure. Its composable, asset-agnostic engine enables horizontal expansion across any asset class that gains traction on-chain.

The Infrastructure Endgame

But more importantly, Bullet’s architecture provides a path towards Hyperliquid’s HIP-3–style expansion, where the platform becomes capable of serving as the underlying trading infrastructure powering exchanges.

Bullet’s Endgame: Infrastructural Support for Externalised Integration - Source: 0xCheeezzyyyy, MementoResearch

Bullet’s high-performance execution environment also enables deep integration with external exchanges and multi-venue liquidity sources, allowing Solana-native protocols (and even off-chain venues) to route flow into Bullet for matching, margining, or settlement. As internal products, third-party venues, synthetic asset layers, and external liquidity endpoints converge, Bullet becomes the connective infrastructure for a unified trading ecosystem.

Combined with its cross-asset expansion capabilities and permissionless product creation stack, Bullet is positioned to evolve into Solana’s default multi-asset execution venue to serve retail traders, quant desks, and institutional hedgers under one deterministic, capital-efficient system.

The $BULLET Token

$BULLET represents the consolidation of Zeta Markets into a unified, vertically integrated trading ecosystem as it transitions from a single-protocol token to the native asset of a full application-specific trading layer on Solana.

A Step-up Transition $ZEX → $BULLET

Previously, ZEX captured the economics of a single derivatives protocol. With the transition to $BULLET, that value capture is not only preserved but expanded across an entire ecosystem and network, reflecting a much broader system-wide economic proposition.

$BULLET Token Utility

Utility Category | Description |

|---|---|

Staking for Operator Participation | Staking $BULLET secures the execution layer and aligns sequencers/operators with network performance and uptime, with rewards sourced from real trading activity. |

Fee Rebates & Fee Routing | Stakers gain structural trading advantages such as reduced maker/taker fees, enhanced rebates, and eligibility for governance-defined fee routing mechanisms. |

Governance & System Control | Token holders govern key system parameters such as perps, spot, lending risk, listings, upgrades, operator standards, treasury policies, and incentive programs. |

Collateral Utility (Cross-Margin) | $BULLET serves as productive collateral across Bullet’s unified margin engine, boosting capital efficiency and enabling seamless use across perps, spot, and lending markets. |

Collectively, $BULLET’s utility focuses on tying value significance to its core ecosystem while enabling it as an asset that enhances capital efficiency, strengthens multi-product composability, and ties token ownership to deeper ecosystem participation.

Tokenomics Design

$BULLET’s tokenomics emphasise sustainability, economic transparency, and long-term alignment, with value anchored to actual economic activity rather than dilution-driven incentives.

Emissions are targeted and purposeful, directed toward operator incentives, staking rewards, and system sustainability instead of indiscriminate farming.

Native yield arises organically from real usage (trading fees, funding flows, liquidation residuals, and broader ecosystem activity) ensuring that returns scale with genuine throughput.

Value capture occurs across perps, spot, lending, and liquidations, with governance able to direct fee flows into buybacks, treasury accumulation, or routing mechanisms depending on the desired distribution framework.

The overarching intent is to create a token model that compounds ecosystem strength over time: sustainable economics that incentivise participation, deepen liquidity, enhance execution quality, and drive a virtuous growth flywheel across the entire Bullet trading stack.

A $BULLET-proof Strategic Moat

$BULLET operates as the connective tissue binding together traders, liquidity providers, operators, and governance participants. Traders benefit from reduced fees and improved execution economics:

Liquidity providers and market makers gain targeted incentives that scale with flow. (Incentives)

Operators and validators earn staking rewards tied to system performance. (Staking rewards)

Token holders shape the protocol through governance across risk, listings, incentives, and system upgrades. (Fee benefits)

This alignment creates a self-reinforcing flywheel: more trading activity drives more fees and operator incentives, which strengthens network security and liquidity depth, which in turn attracts more users and expands economic throughput. As each participant group benefits from deeper system engagement, $BULLET becomes not just a utility token but a strategic moat reinforces network effects, enhances ecosystem retention, and underpins the long-term competitiveness of the Bullet ecosystem.

Long-term Value Trajectory

Bullet’s long-term value capture is strengthened by the fact that perps represent one of DeFi’s most reliable cash-flow–generating primitives. As protocol revenue scales, its highly possible for the design to enable future buyback-and-burn mechanisms which providing amplifies direct return of value to tokenholders and accelerate value consolidation over time.

Together, these dynamics create an attractive long-term profile where ecosystem adoption compounds into both cash-flow and value-accrual, with Bullet trading at a relative discount to its closest market benchmarks.

Conclusion

Bullet marks a decisive shift in how onchain trading infrastructure is architected through its novel multi-faceted integration with a deeply embedded token economy into a single cohesive layer. By combining Solana’s throughput with a purpose-built execution substrate and deterministic, verifiable settlement, Bullet delivers CEX-grade performance without compromising the trust-minimized guarantees that define DeFi.

Positioned for a world where onchain traders scale from millions to tens of millions, Bullet stands to scale and leverage on an increasing distributional layer on top of Solana. With its integrated product suite, strong distribution advantage, this underpins a strong foundation to play a significant role in advancing the industry’s maturity.

Authors: @0xCheeezzyyyy, Memento Research

This report was written in partnership with BULLET. This report has been prepared for informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the report’s content as such.