State of 2025 Token Launches: Year-in Review

State of 2025 Token Launches

Data as of 20 Dec 2025. Metric: % change from TGE opening → today (FDV + MC)

Executive Summary

We tracked 118 token launches in 2025 and the data is brutal:

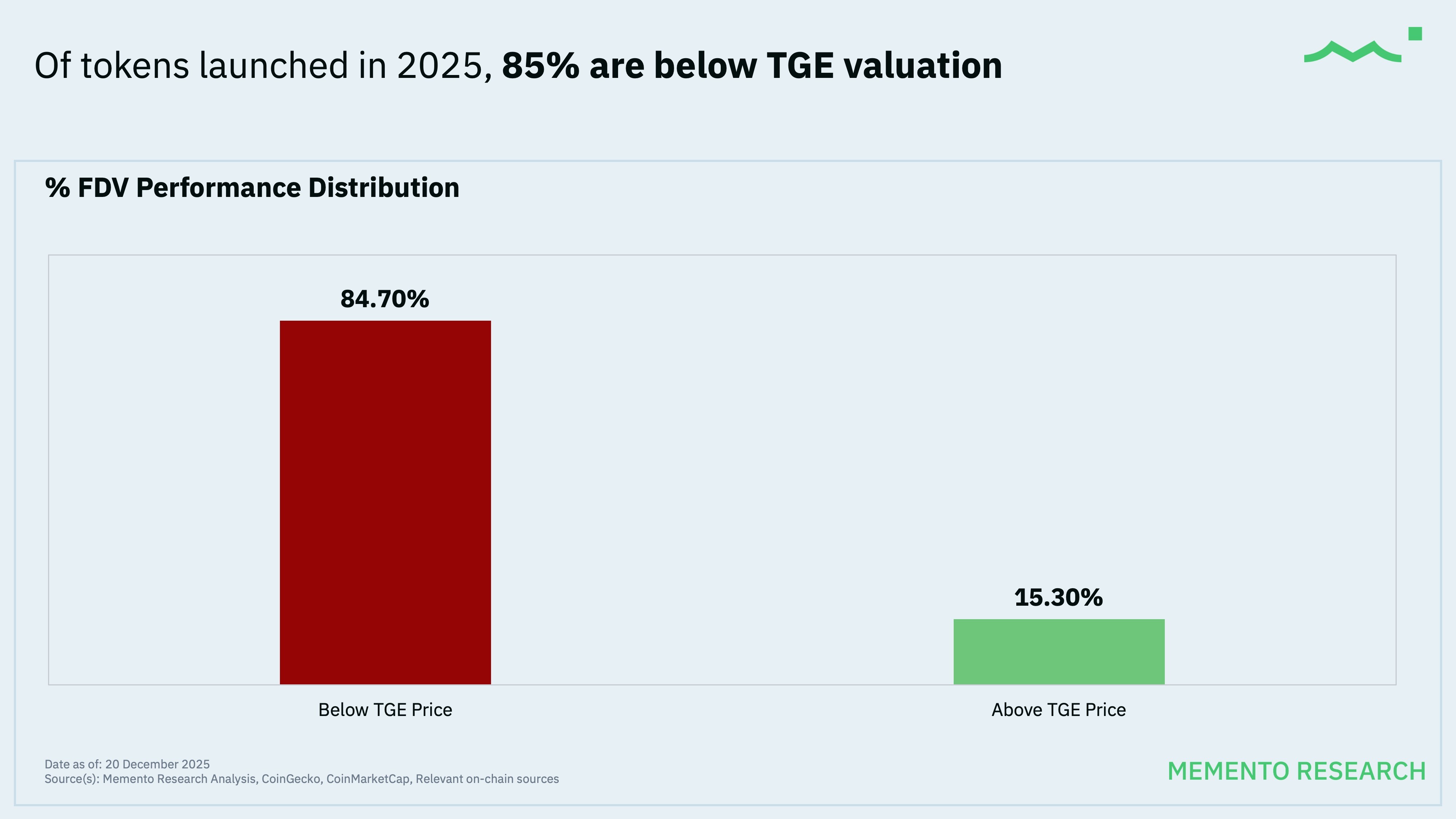

84.7% (100/118) are below TGE valuation → where ~4 out of 5 launches are all in the red

Median performance: -71.1% FDV and -66.8% MC from launch

The “average” hides the carnage → While the equal-weighted basket (FDV) is around -33.3%, the FDV-weighted basket paints a more dire picture with -61.5% (this means big, hyped launches did worse)

18/118 (15.3%) are green; the median green token is +109.7% (≈2.1x) while the other 100 are red; the median red token is -76.8%

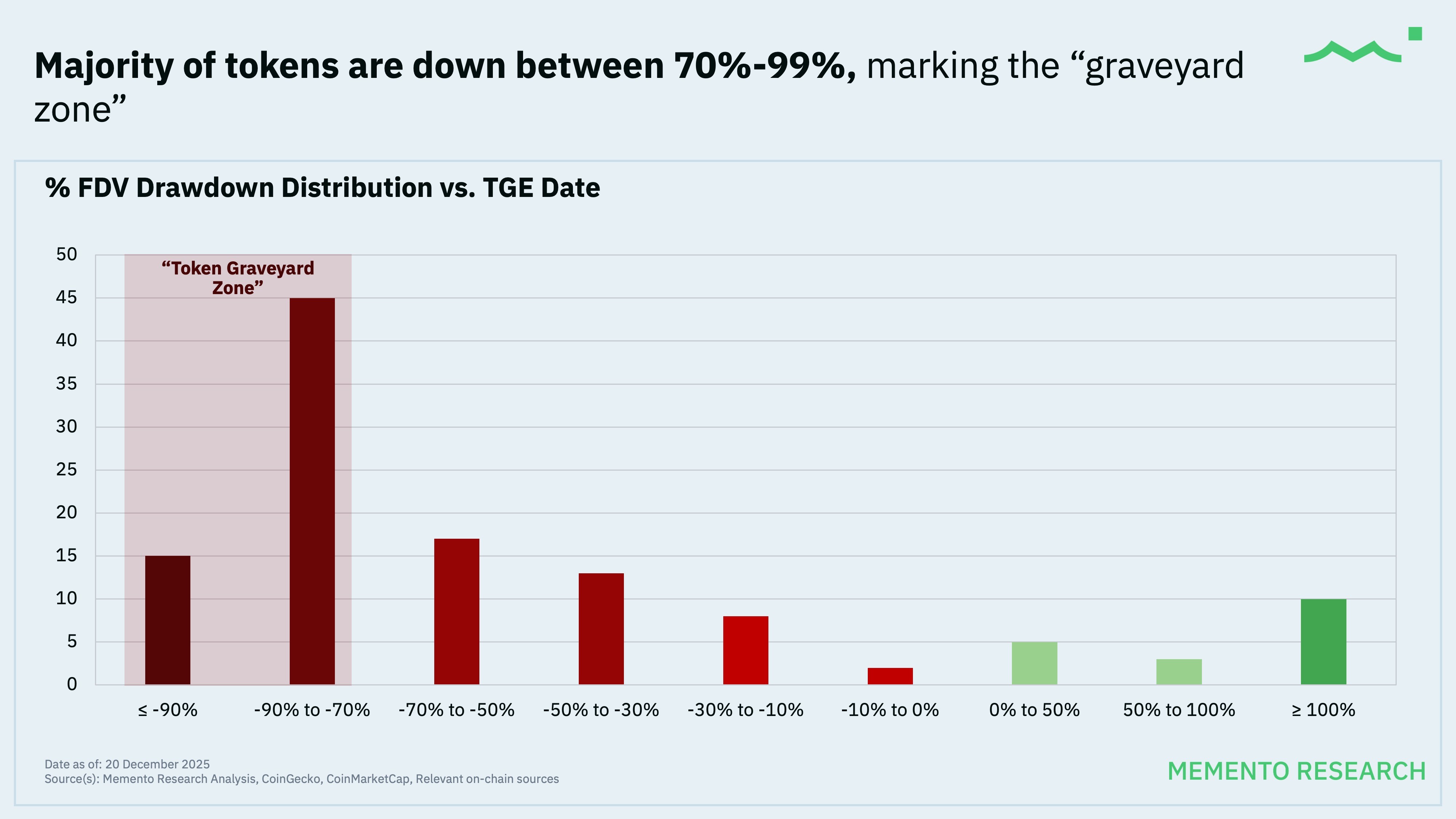

The FDV Drawdown Distribution

To summarise the state:

Only 15% of tokens are still above the TGE valuation

A massive 65% of launches are down ≥50% from TGE, with 51% of them down ≥70%

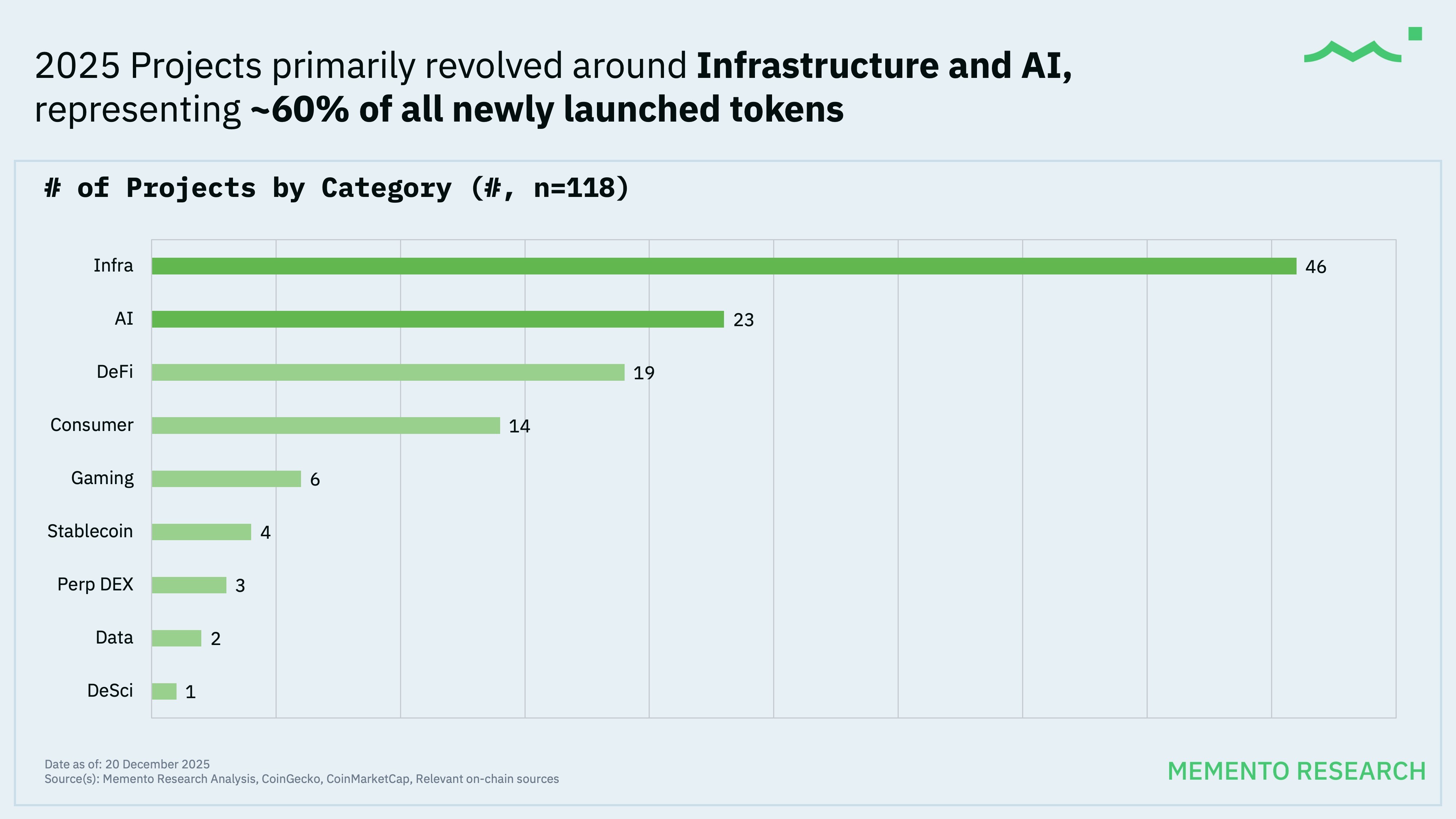

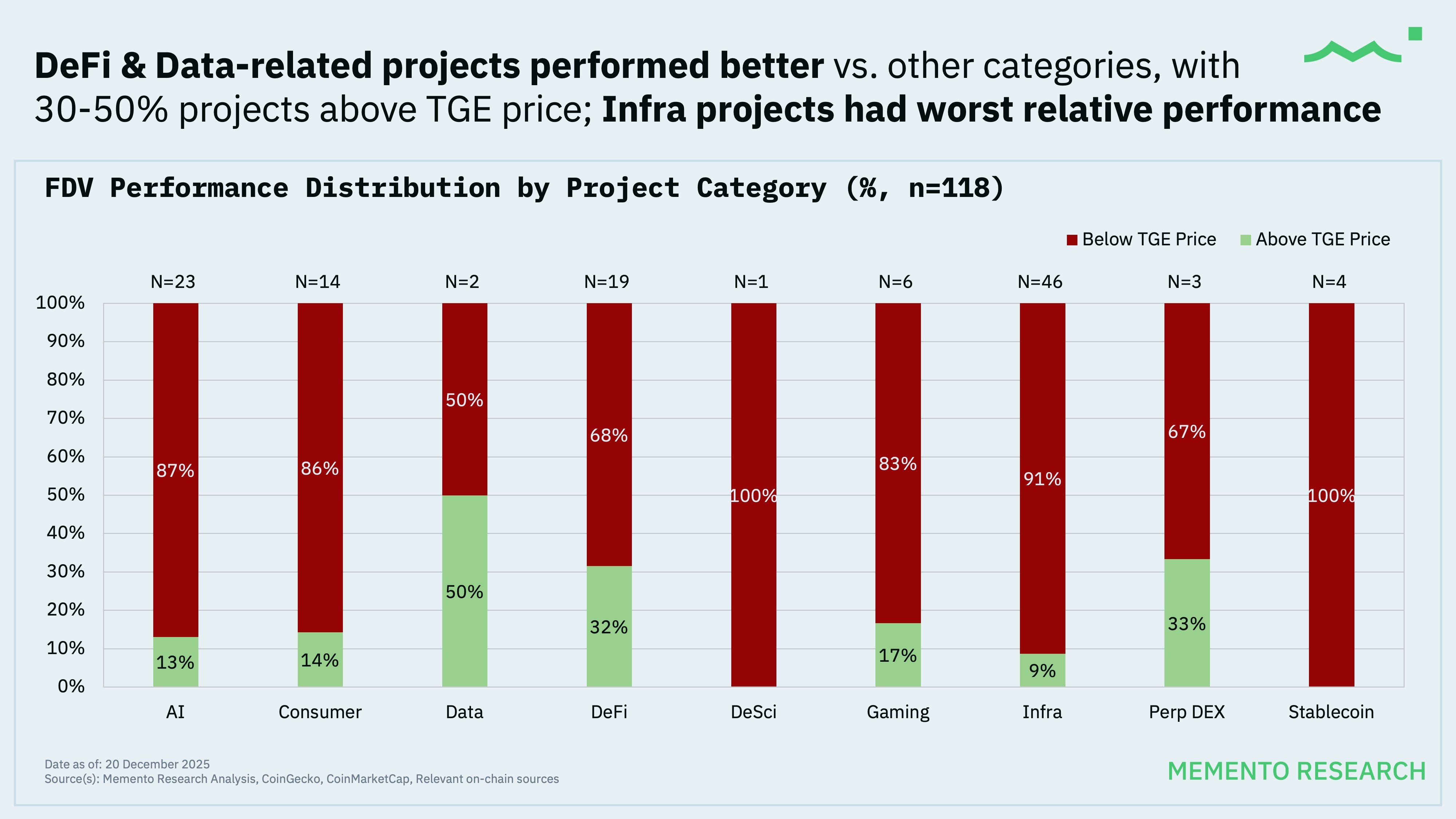

2025 Projects by Category and Relative Performance

2025 projects were concentrated in two main buckets which were Infra and AI, where they represent 60% of all newly launched tokens. However, what was interesting was their average and median return per category

Category | Count (N) | Avg FDV Change | Median FDV Change | % Green |

Infra | 46 | -45% | -72% | 9% |

AI | 23 | -52% | -82% | 13.% |

DeFi | 19 | -34% | -52% | 32% |

Consumer | 14 | -28% | -61% | 14% |

Gaming | 6 | +17% | -86% | 17% |

Stablecoin | 4 | -70% | -77% | 0% |

Perp DEX | 3 | +213% | -31% | 33% |

Data | 2 | +0.7% | +0.7% | 50% |

DeSi | 1 | -93% | -93% | 0% |

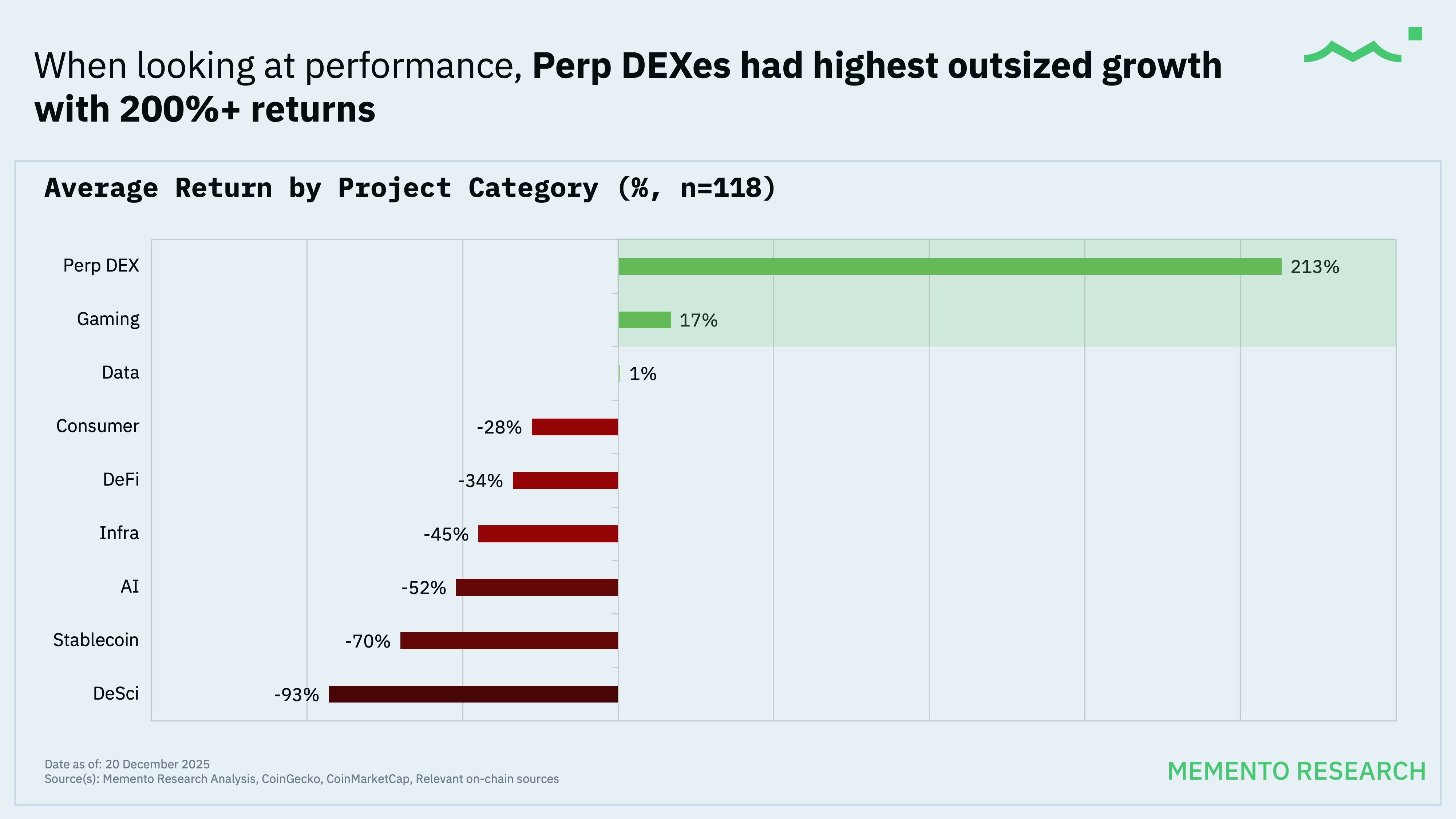

Interpreting this data:

The theme for 2025 was the growth of Perp DEXes, led by Hyperliquid and during Q4 when Aster launched as well. Perp DEX (+213% average) was basically “one monster winner” in a tiny sample where the median is still negative.

Sample size for gaming is too small to meaningfully conclude anything and skewed by an outlier, which gave it a positive average but median is -86%

DeFi is quietly the best hit-rate (32% green) more “some survivors” than “home runs”

Infra + AI were crowded and punished: -72% to -82% medians

Correlation between Higher Starting FDV vs. Performance

Starting FDV bucket | N | Median Starting FDV | Median FDV Change | % Green |

$25m - $200m FDV | 35 | ~$126m | -26% | 40% |

$210m - $489.1m | 24 | ~$335m | -73% | 13% |

$500m - $940m | 29 | ~$680m | -82% | 3% |

$957.6m - $28.1b | 30 | ~$1.58b | -83% | 0.0% |

The cleanest finding in our data:

28 launches had a starting FDV ≥ $1B

0% of them are green today, and median is roughly -81%

This is why the FDV-weighted index (-61.5%) is so much worse than the equal-weighted (-33.3%). Big launches dragged the whole year down

Key Takeaway: Opening valuations are set way too high and above its fair value, resulting in worse long-term performance with larger % drawdowns

2025 Recap & Moving Forward

A few takeaways from the data above:

TGE has more-often-than-not been a worse off entry point for most tokens where the median outcome is basically “down ~70%”

TGE is not early anymore and represents the “top” for over-hyped launches with poor fundamentals

Projects that launched at high starting FDVs didn’t “grow into it”. Instead they got repriced much much lower

Same all story where most TGE projects were infra (and AI as well since we are in a bubble) but were the source of the bulk of pain

If you’re planning to buy TGEs, you’re implicitly betting on finding rare outliers, because the base rate is an ugly situation

When you split the year by starting FDV quartiles, the pattern is clear: the cheapest and lowest FDV launches were the only bucket with a meaningful survival rate (40% green) and a relatively mild median drawdown (~-26%), while everything above mid-pack basically got repriced into the floor with median losses of ~-70% to -83% and almost no greens.

So if there’s one lesson from this dataset, it’s that TGE in 2025 was a valuation reset period: most tokens bled, a tiny number of outliers did all the upside, and the “bigger” the FDV debut, the worse the drawdown.