Katana: A Unified DeFi Layer for Productive Capital

Introduction & Thesis Overview

DeFi’s Growth Story Has a Hidden Catch

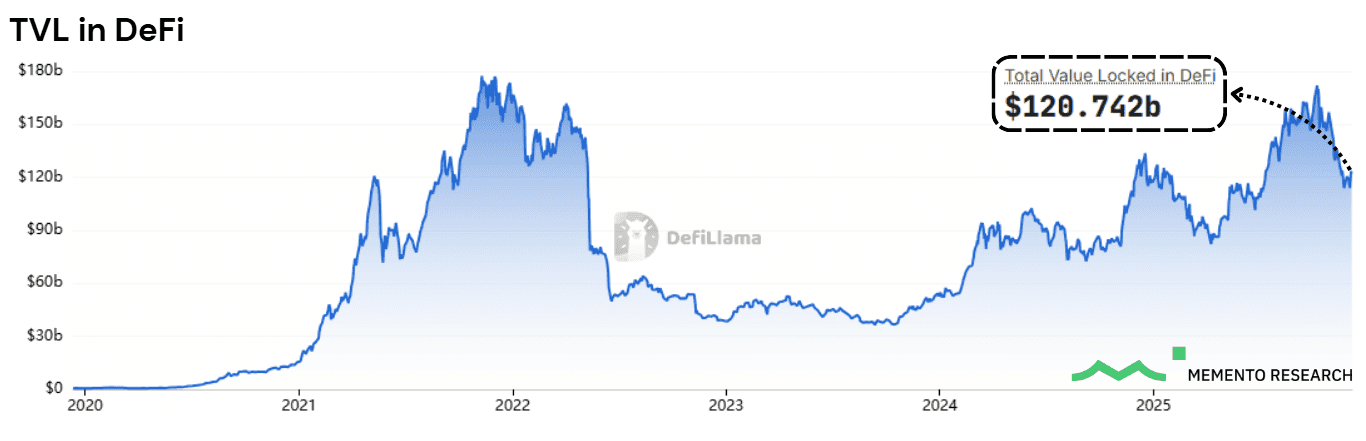

Over the past few years, decentralized finance (DeFi) has grown into a multi-billion-dollar market powering on-chain lending, trading, and yield generation. As of Q4 2025, over $120 billion in total value is locked across DeFi protocols, a headline figure that seems to reflect strength, adoption, and resilience.

TVL in DeFi Data - Source: DeFiLlama

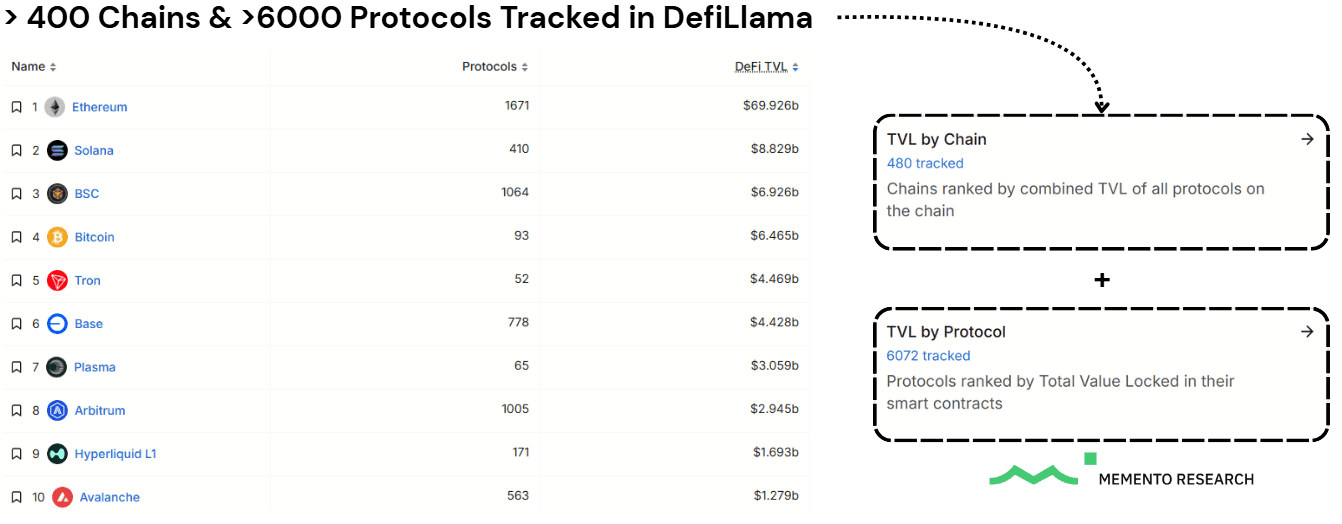

But this number only tells part of the story. According to DeFiLlama, this liquidity is shattered across more than 400 blockchains and over 6,000 protocols. Ethereum holds the lion's share, but Solana, Arbitrum, and hundreds of other chains each have thriving DeFi ecosystems, all completely disconnected. What looks like healthy diversity is actually a fragmented maze where users juggle separate wallets, bridge assets at significant risk, and manage multiple gas tokens just to access basic yield strategies. Billions sit locked in disconnected pools, barely earning, while protocols burn through unsustainable emissions chasing liquidity.

Chains & Protocols Tracked - Source: DeFiLlama, Memento Research

This isn't just inconvenient. It's the bottleneck preventing DeFi's next phase of growth. The problem isn’t capital scarcity; it’s the lack of coordinated infrastructure that lets capital move intelligently across chains. Without unified execution or native yield routing, even the best protocols remain trapped on their chains. Liquidity and opportunity exist everywhere, but coordination infrastructure exists nowhere.

But the real fracture runs deeper. It is not just between chains, it is within them. On every network, liquidity tears itself apart. Dozens of DEXs, lending markets, and perpetual platforms compete for the same pool of capital, each one isolated from the rest. The result is a market that strains under its own weight. Liquidity thins, capital becomes underutilized, and the system loses the very efficiency DeFi was built to deliver. What DeFi needs is a capital engine that orchestrates liquidity and executes strategies seamlessly. That engine is Katana.

The Katana Thesis: A Unified DeFi Layer for Productive Capital

Katana is built on a simple but powerful thesis: DeFi users don't need more chains, they need deeper liquidity and greater yields. Incubated by Polygon Labs and GSR, Katana is purpose-built for on-chain finance. Rather than functioning as a general-purpose chain, it operates as a sector-specific financial network where every transaction reinforces shared liquidity and drives productive capital formation, while returning chain-revenue back to active DeFi users.

Built on advanced blue-chip protocols, Katana forms a secure and scalable foundation for institutional-grade DeFi. Its architecture is intentionally opinionated: liquidity is concentrated into a tightly curated set of battle-tested primitives within each major category such as lending, spot markets, and token launches, rather than scattered across competing DeFi apps and money markets. Katana delivers what fragmented protocols can't: deeper pools, tighter spreads, and sustainably higher yields. It transforms liquidity into a cohesive network engineered to push capital efficiency to its limits.

While other chains compete to host as many protocols as possible, Katana positions itself as the institutional-grade execution layer, backed by one of crypto's largest market makers and built with deeply embedded interoperability via AggLayer for seamless onboarding. In a market where inflated TVL metrics mask idle capital across fragmented ecosystems, Katana measures what matters: productive TVL. This is the concentrated liquidity engine that makes every dollar work exponentially harder.

Report Overview

Katana doesn’t aim to reinvent DeFi but to refine it, building a unified financial layer where idle assets become productive, liquidity gets deeper, and value flows back to users through sustainable yield. This report will cover:

Katana’s Unified Liquidity Layer for Productive Capital: An in-depth look at Katana’s purpose-built architecture designed to concentrate liquidity, optimize yield generation, and enable seamless capital mobility across DeFi.

Katana’s Ecosystem: An overview of the core primitives that anchor liquidity and activity on Katana.

Performance Highlights & Market Traction: Assessing Katana’s on-chain activity, liquidity depth, and yield efficiency as indicators of growing adoption and network strength.

Risk Considerations: A balanced view of Katana’s risks and their mitigations.

Katana’s Unified Liquidity Layer for Productive Capital

The Anatomy of a Unified Layer

Katana redefines how liquidity is measured and mobilized in DeFi. Instead of treating TVL as a static metric, Katana introduces productive TVL, capital that continuously deploys, earns, and reinforces itself. Liquidity doesn't sit locked in isolated protocols. It circulates across a single composable layer built for constant motion.

Anchored on Polygon's AggLayer, Katana integrates shared security and seamless cross-chain interoperability directly into its architecture. Capital moves more freely between markets, protocols, and strategies, reducing the friction and fragmentation typical of legacy multi-chain setups. Productive TVL isn't a goal, it's the inevitable outcome of a system where yield, fees, and collateral flow through one interconnected circuit.

Katana’s Core Design Principles

Katana's architecture is built on principles that transform liquidity from fragmented to fluid, from idle to productive:

Interoperability: Deep integration with Polygon’s AggLayer, combined with Succinct’s ZK infrastructure and GSR’s support, enables seamless cross-chain mobility, secure validation, and synchronized execution across ecosystems.

Sustainability: VaultBridge and Chain-Owned Liquidity recycle yield and protocol fees directly back into the ecosystem, creating a compounding feedback loop that strengthens liquidity organically rather than draining it through emissions.

Cohesion: Sushi and Morpho anchor trading and lending, while Kensei supports new asset launches. These primitives do not compete for liquidity but operate as a shared circuit that reinforces depth and execution quality across the network.

Clarity: Consolidating liquidity into core apps gives users and developers a dependable base and removes the friction of fragmented markets.

Composability: Every asset in Katana can serve multiple roles at once, being traded, lent, or used as collateral through unified infrastructure that keeps liquidity in motion.

Collectively, these principles position Katana as a unified liquidity infrastructure in which capital remains active and productive.

Institutional Foundation: Incubated by Polygon Labs and GSR Markets

Katana was incubated by Polygon Labs and GSR Markets, fusing ecosystem infrastructure with institutional-grade liquidity expertise. Polygon provides the AggLayer foundation and multi-chain connectivity. GSR brings deep capital markets expertise and strategic guidance to drive the project’s growth. This isn't a protocol hoping for liquidity, it's a system engineered with it from day one.

Katana’s Interoperable Framework

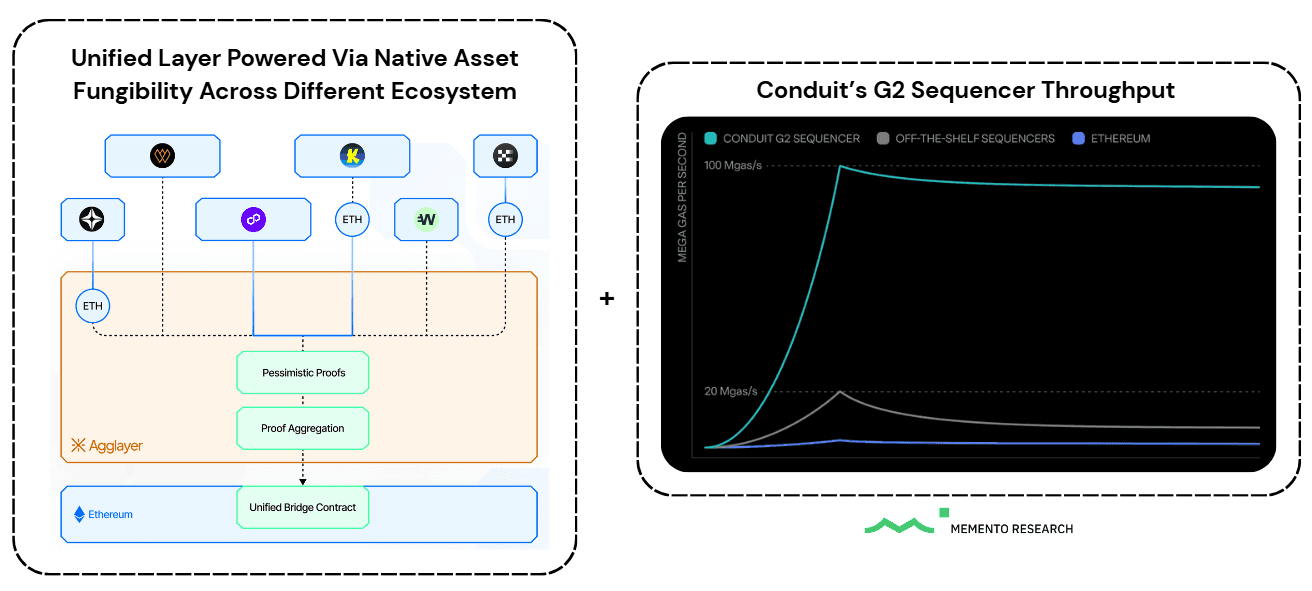

Katana is built on the AggLayer Development Kit (CDK), specifically the CDK OP Stack (cdk-opgeth) configuration running on Ethereum’s most battle-tested execution client, Geth. AggLayer serves as the connective layer of Polygon’s ecosystem, allowing assets and messages to move freely between connected chains through the Unified Bridge, its trustless cross-chain communication system. This enables Katana to operate as a fully integrated execution layer where capital moves seamlessly instead of fragmenting across isolated ecosystems.

Through AggLayer, Katana becomes interoperable with an expanding network of connected chains such as X Layer, Wirex Pay, and Lumia. These integrations span distinct verticals across DeFi, payments, and real-world assets. Capital flows freely between Katana and the broader AggLayer network, creating a shared liquidity reservoir rather than isolated pools. As more chains join, the ecosystem's collective liquidity doesn't dilute. It compounds. Each new connection amplifies capital efficiency across the entire network, converting scale into shared strength and collective depth.

The infrastructure is powered by Conduit, including their G2 Sequencer, which provides natively connected AggLayer operation with shared liquidity and unified state across chains. This isn’t experimental technology, but technology that is production-grade and already running across multiple chains, designed for the heaviest workloads DeFi can generate.

Katana’s Interoperable Framework and Sequencer Performance - Source: AggLayer, Conduit, Memento Research

The CDK OP Stack is ideal for high-performance DeFi chains, capable of handling heavy data workloads, sustaining high throughput, and enabling a smooth migration path toward ZK-based architectures. Paired with Conduit's G2 Sequencer, Katana achieves industry-leading scalability with throughput exceeding 100 Mgas/s, far surpassing standard rollup sequencers and Ethereum's base layer.

ZK-Backed Finality for Institutional Execution

In collaboration with Succinct Labs, Katana strengthens this architecture with zero-knowledge validity proofs, delivering sub-hour finality, verification costs below $0.005 per transaction, and trustless interoperability across the AggLayer. Users don't wait days for withdrawal security, they get cryptographic proof of correctness in minutes at costs so low they're essentially invisible.

This combination of speed, security, and interoperability cements Katana's foundation as a next-generation execution layer for productive capital, delivering institutional-grade execution today.

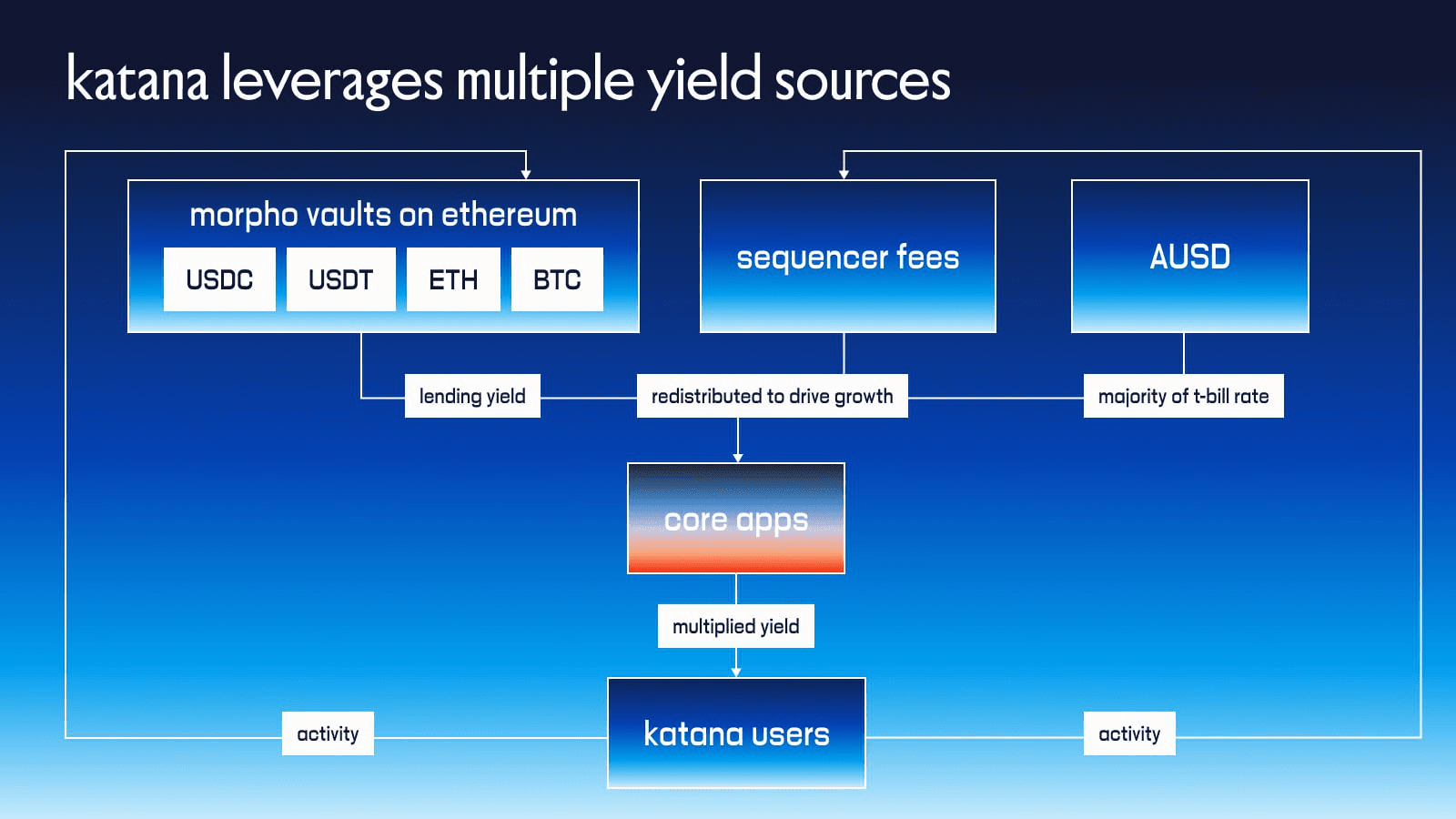

The Productive Capital Engine

With interoperability and proving infrastructure established, Katana is built on another core belief that liquidity should never sit still. VaultBridge and Chain-Owned Liquidity (CoL) embody this principle by keeping capital in constant motion, bringing assets in, deploying them productively, and returning yield back into the network. This strategy is further reinforced by the integration of AUSD, Katana’s native stablecoin backed by US Treasuries and other cash-equivalent assets, which adds another layer of liquidity by sharing a portion of its yield with the Katana Foundation to deepen AUSD-denominated liquidity on the network. This creates a highly diversified revenue stream that goes far beyond conventional L2 sequencer fees. The result: Katana captures value at every layer where capital moves.

VaultBridge: Turning Idle Assets into Productive Capital

Created by the AggLayer team, VaultBridge is a DeFi App built on Ethereum, with Katana becoming the first chain to integrate it natively into its liquidity architecture. Bridged assets usually wait idle, earning nothing. VaultBridge turns that downtime into yield, keeping liquidity active between Ethereum and Katana. Crucially, this adds a cool dynamic of the possibility of multi-layered yield paths for bridged assets by maximizing on the open composability of DeFi assets.

When users deposit USDC, USDT, WETH, or WBTC on Ethereum, their assets are automatically routed into Morpho Vaults, where they begin earning real-time lending yield (with strategies curated by Gauntlet and Steakhouse Financial). At the same time, users receive equivalent vbTokens (such as vbUSDC or vbETH) on Katana, unlocking immediate liquidity across the network’s core markets.

The innovation lies in how the yield flows. Revenue generated from these Ethereum-side Morpho strategies continuously streams back to Katana, where it's distributed as boosted rewards across core DeFi applications like Sushi and Morpho lending markets. But here's the critical design choice: vbTokens sitting idle in wallets earn nothing.

Only users who actively deploy their vbTokens into lending pools, DEX liquidity pairs, or other productive strategies receive the upstream yield boost. Every bridged dollar generates Ethereum yield that fuels Katana's economy, but only active vbToken deployment earns the boost, making participation, not possession, the currency of reward.

Chain-Owned Liquidity: Foundation of Sustainability

While VaultBridge brings external yield into Katana, CoL ensures the value generated within the ecosystem stays and compounds. It establishes resilient liquidity that stays on Katana through volatile conditions and does not leave when incentives taper off. Net sequencer fees and other protocol revenue don't extract value, they recycle back into the system as long-term, self-sustaining liquidity.

Each transaction on Katana generates fees and revenues that flow into CoL, a pool currently managed by the chain with over $300k deployed. The capital is redeployed as liquidity across Sushi, Morpho, and the network’s perpetual trading markets. The more users trade, the deeper the liquidity becomes. Unlike mercenary capital that chases temporary yields and exits during downturns, CoL takes long-term, strategic positions chosen to strengthen Katana's core markets, ensuring lasting stability, consistent returns, and user confidence. Every block, trade, and position strengthens the network’s foundation, turning activity itself into the engine of liquidity growth.

AUSD: Stability Backed by Real-World Returns

Katana's native stablecoin, Agora USD (AUSD), is backed by U.S. T-bills that generate real-world returns for the network. A portion of the T-bill yield flows to the Katana Foundation, which deploys it to deepen liquidity and enhance rewards for active DeFi participants. Instead of relying on unsustainable emissions, AUSD provides a steady revenue stream that reinforces Katana's economic foundation with real-world cashflows.

Together with VaultBridge, CoL, and sequencer fees, AUSD expands Katana’s revenue streams and strengthens the resilience of its liquidity model. Looking ahead, the integration of a perpetual DEX will seamlessly add derivatives trading as a fifth revenue pillar. The result is a network where liquidity is diversified and built to last.

How It Comes Together

Katana Yield Sources - Source: Katana Blog

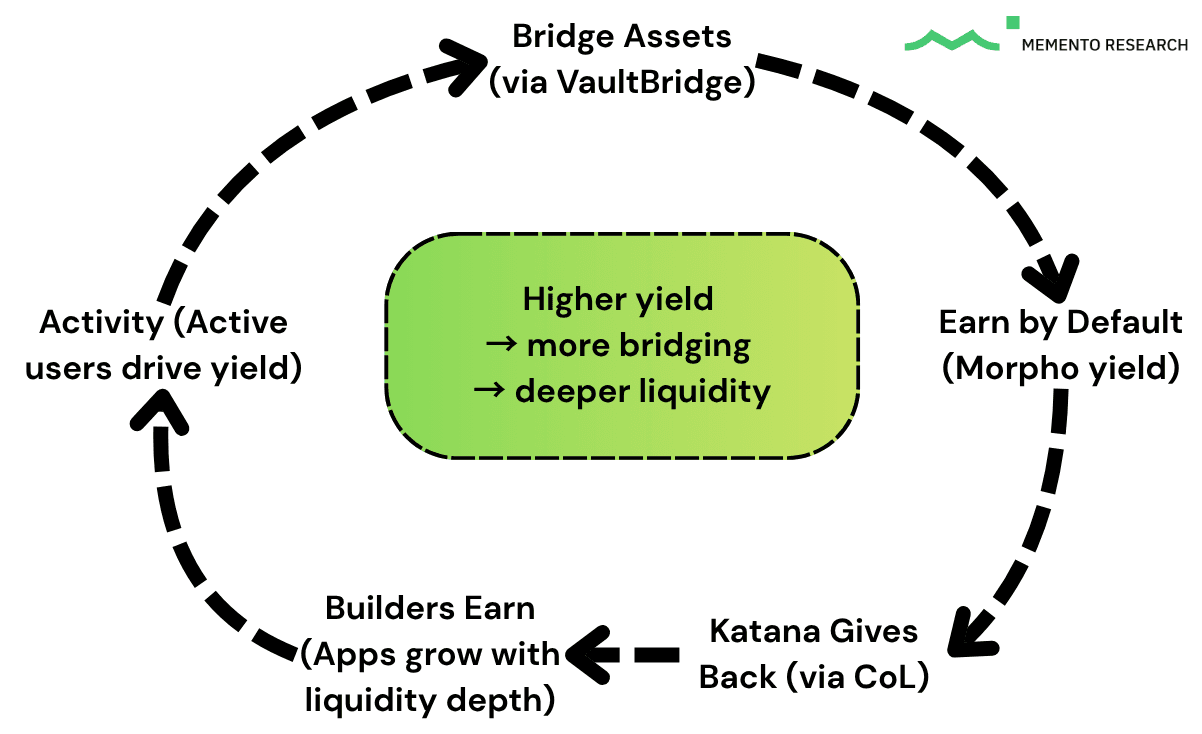

Katana rewards activity, not inertia. Active users earn, and as they earn, the apps powering them earn too. It’s a feedback loop where growth feeds yield and yield feeds liquidity. Users win, apps grow, and the network compounds in strength.

Katana Flywheel - Source: Memento Research

The idea is simple: capital flows in, earns, compounds, and flows back stronger. Over time, the result is a self-reinforcing liquidity engine where external yield, on-chain activity, and ecosystem mechanisms all compound into one productive system. Every deposit strengthens the next, turning Katana into a network that grows not through emissions, but through motion itself.

KAT: The Token Powering Productive Liquidity

Katana's economic architecture revolves around a singular principle: align incentives so tightly that productive behavior becomes the only rational strategy. KAT is Katana's native token, distinct from the network's gas token, which is ETH. It is not a governance gimmick; it is a capital coordination mechanism that rewards users who deploy liquidity, generate activity, and strengthen the ecosystem. With 10 billion tokens and zero venture capital allocation to date, KAT represents one of the most community-aligned tokenomics structures in DeFi.

Community-First Distribution

The first tokens to unlock go directly to users who deposit capital and participate in the ecosystem. There are no VC investors. No presale. No preferential insider unlocks. The first KAT in circulation belongs to users who supply liquidity and generate activity. This isn't optics, it's structural design that puts users first.

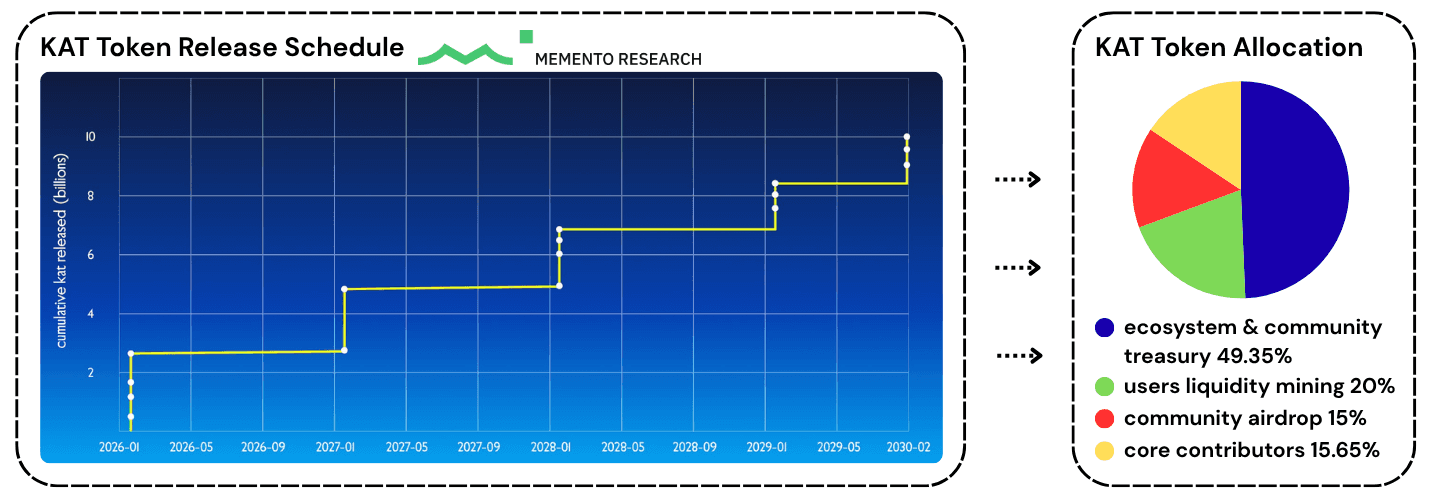

KAT Token Release Schedule - Source: Katana Blog

The allocation breakdown makes it explicit:

20% to users and liquidity mining, distributed through core app incentives and TVL commitments.

15% to Polygon community airdrops, rewarding the POL stakers who incubated Katana through the AggLayer program.

15.65% to core contributors, locked for four years with equal quarterly unlocks.

49.35% to ecosystem treasury, ensuring long-term sustainability without short-term dilution.

The release schedule unfolds gradually over four years and all KAT distributed at launch remains locked for nine months, reducing early sell pressure and encouraging long-term participation, with transfers expected to open around February 2026 pending community approval.

vKAT: Governance Through Participation

KAT’s utility extends far beyond passive holding. Its strength lies in the vKAT system, inspired by the ve(3,3) governance paradigm that fuses token utility, yield distribution, and long-term alignment. Users lock KAT to mint vKAT, gaining voting power over future KAT emissions distribution and earning a share of pool fees and vote incentives from the pools they support. vKAT voters direct where emissions flow across the network's liquidity markets, choosing which pools to boost while earning fees, incentives, and the potential for additional "bribes" from future liquid locker protocols.

This creates a powerful alignment mechanism where the most committed participants earn the most and shape how capital is directed across the ecosystem. Through this structure, governance becomes an active yield engine where capital commitment and productive behavior drive liquidity depth, optimize incentives, and compound network value.

Katana Ecosystem: The Network in Motion

Katana’s Core Apps

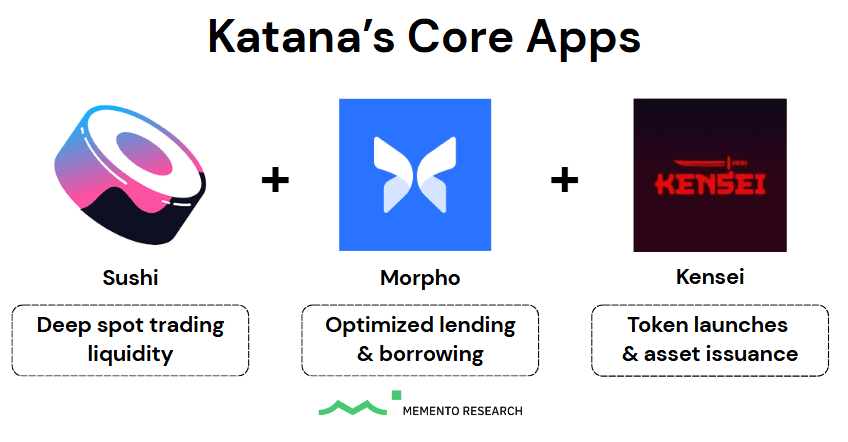

Katana's core stack revolves around Sushi, Morpho, and Kensei, which together form the foundation of its on-chain liquidity engine.

Katana’s Core Apps - Source: Katana

Sushi drives deep spot liquidity and efficient routing, ensuring frictionless asset flow across the network. Morpho unifies lenders and borrowers into a single peer-to-peer credit market, concentrating liquidity and stabilizing rates without fragmentation. Kensei powers token launches on Katana through reputation-based launch mechanics that support fair issuance and sustainable liquidity.

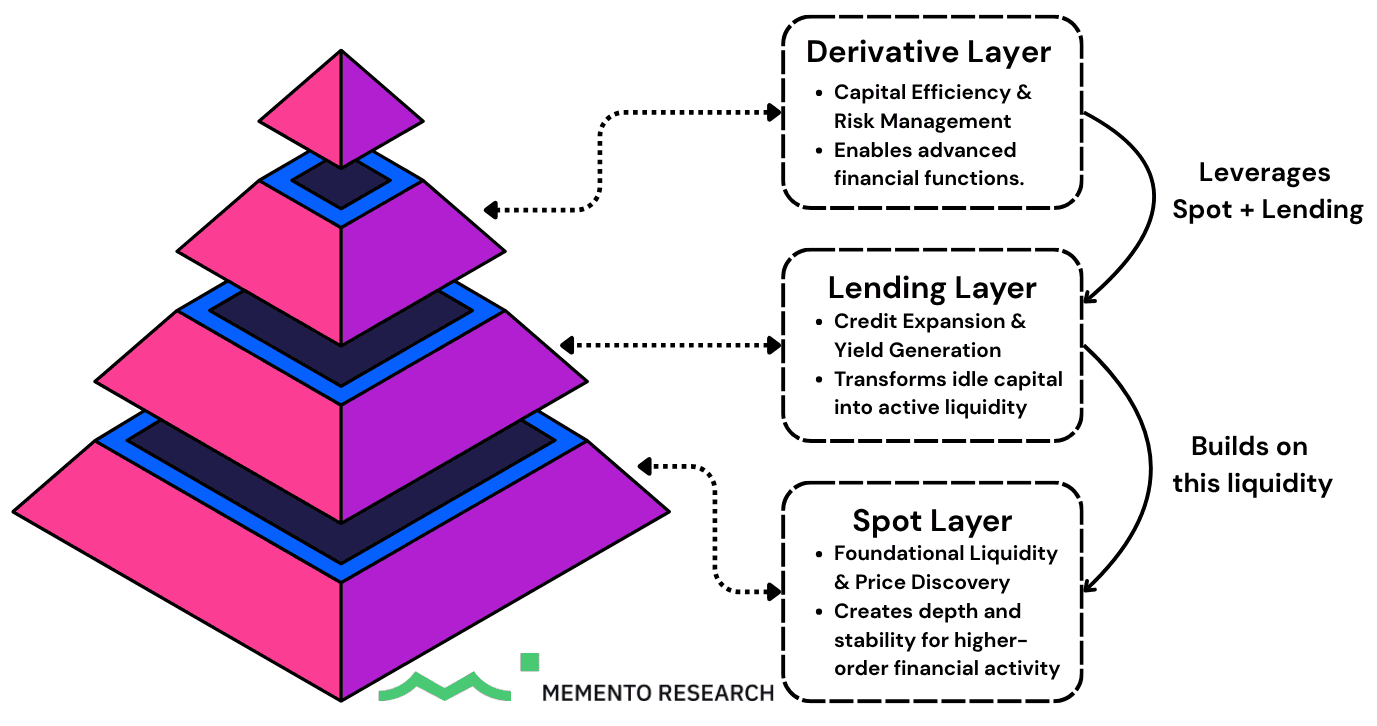

Apps Dynamics - Source: Memento Research

Each protocol plays a distinct role, yet their true strength lies in how they interlock to form a self-reinforcing system where every layer amplifies the next. Together, these protocols form Katana's unified execution layer. Spot, lending, and perps don't compete for capital, they share it.

Trading volume on Sushi strengthens CoL across the network. Liquidity supplied to Morpho gets borrowed and redeployed into Sushi pools, deepening markets and generating fees. As Katana expands into perpetuals, those markets will leverage the same CoL backing, allowing leveraged traders to tap into the same deep liquidity. It's a closed-loop circuit where every transaction compounds liquidity and yields across all three markets simultaneously.

This isn't isolated applications, it's a composable infrastructure where capital circulates continuously and exponentially multiplies with each interaction. Built around long-standing blue-chip protocols with years of scaled adoption and trust, Katana’s design ensures depth, resilience, and sustainable liquidity growth.

A key part of this resilience comes from how incentives are concentrated: CoL rewards, VaultBridge boosted yields, AUSD treasury income, and KAT emissions all flow into these core apps rather than being scattered across dozens of competing protocols, preventing liquidity fragmentation and reinforcing depth where it matters most.

Expanding Beyond : Katana’s Growing Ecosystem

Building From Within: Native Ecosystem Strength

Katana’s growth isn’t linear; it’s exponential, fueled by an expanding Web3 network of interconnected protocols.

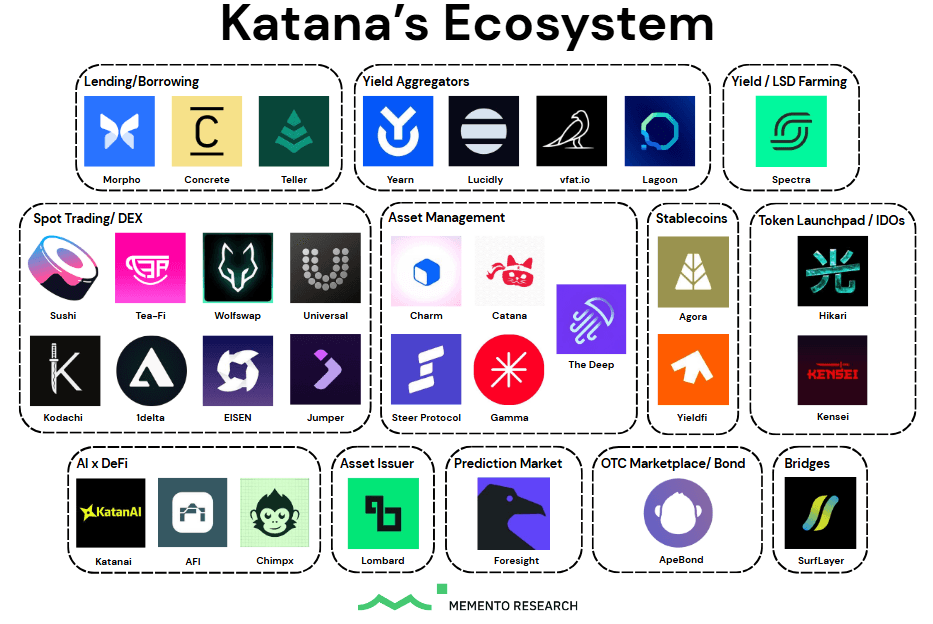

Katana’s Ecosystem - Source: Katana, Memento Research

Expanding beyond its core applications, Katana has evolved into an interconnected ecosystem spanning DeFi, AI, and real-world assets, amplifying liquidity circulation and deepening Katana’s DeFi footprint. The ecosystem demonstrates a strategic balance: established core DeFi primitives like Morpho and Lombard provide foundational credibility, while emerging protocols across yield aggregation, asset management, AI-powered DeFi, and prediction markets showcase strong external interest and differentiation. This isn't just another new chain; it's a curated environment where proven primitives coexist with cutting-edge experimentation, creating a sustainable infrastructure that attracts both capital and innovation organically.

Expanding Outward: Accessible Capital via AggLayer

Through AggLayer, this expansion extends beyond Katana’s own borders, enabling other connected chains to access its deep liquidity and rely on it as a core DeFi liquidity engine. While Katana builds density internally, AggLayer unlocks externalized growth, transforming Katana from an isolated chain into a liquidity hub that other ecosystems can tap into seamlessly.

Katana’s Promising Early Traction

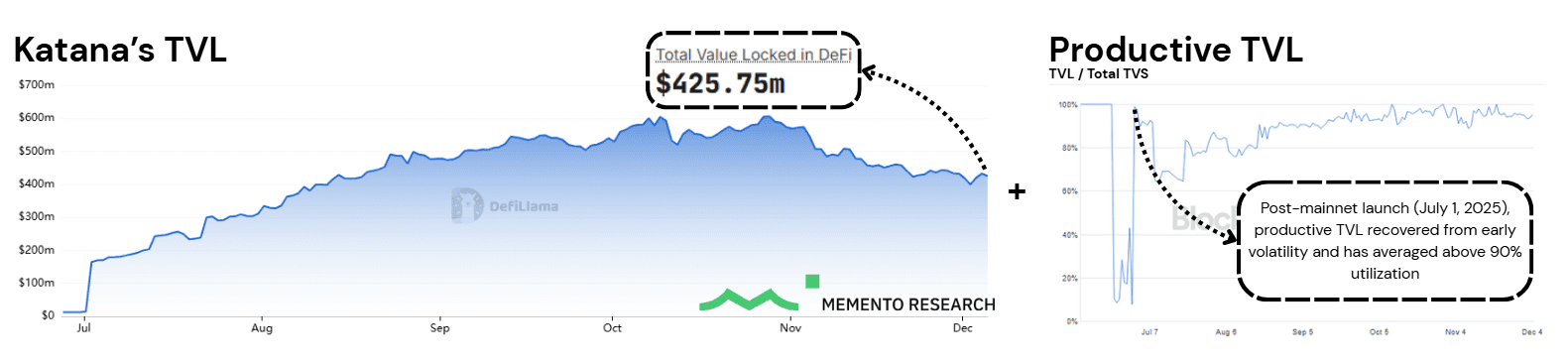

Since its mainnet launch on July 1, 2025, Katana has attracted $425 million in TVL, a significant achievement for a chain barely six months old.

Katana’s Revenue - Source: Blockworks , DeFiLlama

This demonstrates not only strong trust in the protocol’s design but also that it has overcome the “cold-start” trap that sinks many new Layer 2s, turning what is usually a slow, uncertain launch into a fast-moving, active ecosystem from day one.

But raw TVL tells only part of the story. Katana’s TVL has remained highly productive, consistently averaging above 90% utilization, ensuring that deposited capital is actively deployed instead of sitting idle.

However, even productive TVL has nuances worth acknowledging. Assets supplied to Morpho might show as productive, but if utilization rates are low and borrowing is minimal, capital effectively sits underutilized earning baseline yields. DEX liquidity on Sushi v3 might be deposited outside active trading ranges, inflating metrics without providing real execution depth.

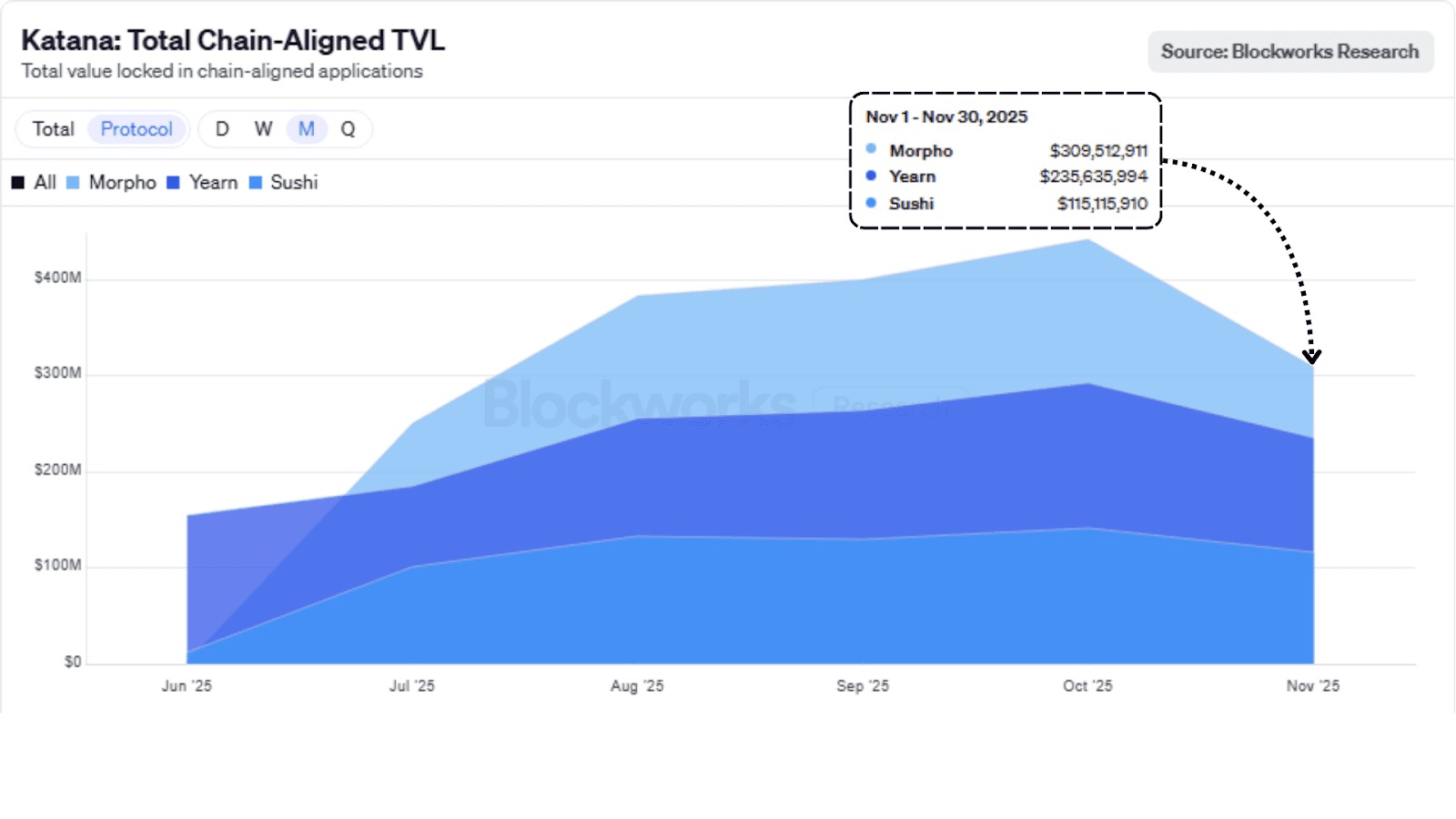

Katana’s Total Chain-Aligned TVL - Source: Blockworks

Katana addresses this through Chain-Aligned TVL (CAT), a more sophisticated metric isolating only assets actively contributing efficient, measurable economic value back to the ecosystem. This encompasses native assets like AUSD, vbTokens, and strategically aligned collateral types deployed within concentrated ranges and high-utilization lending markets. While averaging above 90% utilization in productive TVL signals strong early traction, Katana's laser focus on maximizing CAT ensures growth translates to genuine liquidity depth and sustainable yield generation, not inflated vanity metrics.

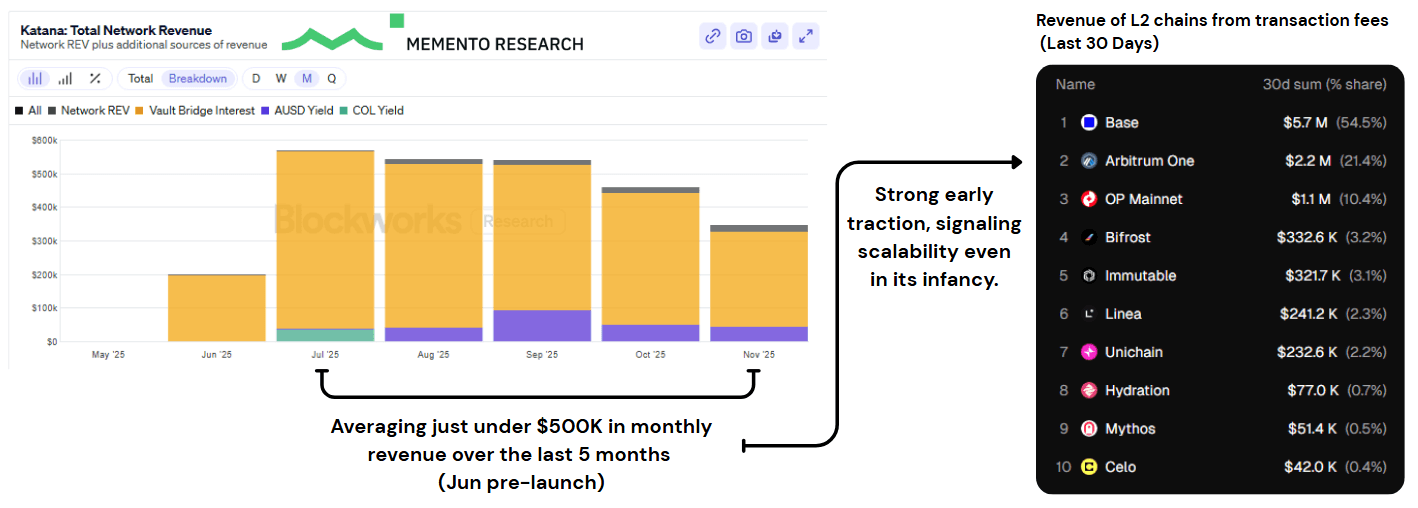

Katana’s Revenue - Source: Blockworks , Token terminal

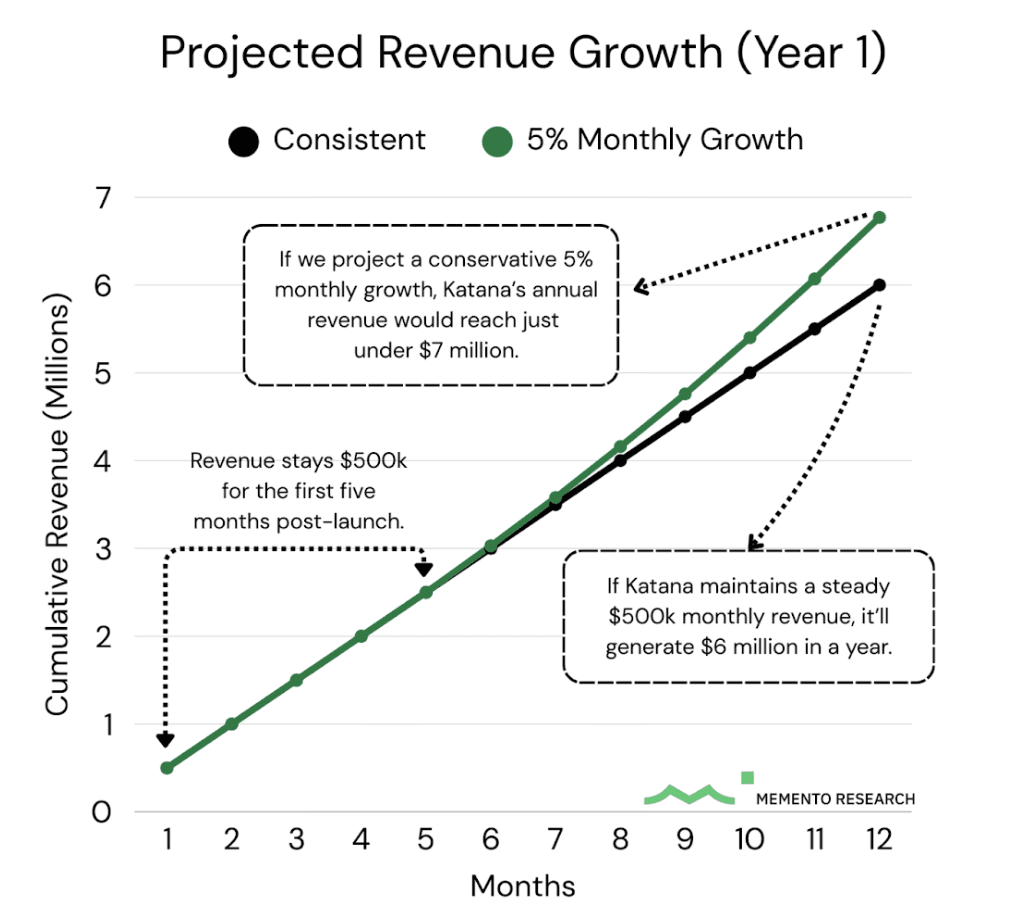

Most L2s live and die by transaction fees. Katana built a different economic engine. Thanks to VaultBridge interest, AUSD treasury yields, and CoL returns, Katana's financial inflows are driven primarily by on-chain yield rather than user gas fees. The network has averaged just under $500K in total monthly revenue over its first five months, where yield-generation accounts for most of the inflows.

For context, the comparison on the right shows pure fee revenue from established L2s, a metric where Katana would naturally rank lower given its recent launch and smaller user base. But comparing fee revenue alone misses the point. Katana designed a model where protocol sustainability doesn't require massive transaction volume or fee extraction from users, it derives revenue from productive capital deployment instead.

Katana’s Revenue - Source: Memento Research

With approximately $2.8 million in total revenue already secured, if Katana sustains its current momentum, the network is on pace to generate over $6–7 million in first-year revenue, even under a conservative 5% monthly growth outlook. Rather than depending on fees, Katana’s yield-driven engine compounds real on-chain returns, creating a flywheel of sustainable growth. This model grows exponentially, positioning Katana to be one of the most economically resilient and self-sustaining Layer 2 ecosystems in the market.

Evaluating Katana’s Risk Surface

Like any DeFi protocol, Katana operates within a complex risk landscape spanning smart contract security, liquidity mechanics, and external dependencies. While the architecture is designed with multiple safety mechanisms, users must understand the risk involved.

Risk Category | Description | Mitigation |

Technical & Protocol Risk | Vulnerabilities in smart contracts, ZK proof systems, or accounting proof system. Cryptographic implementation errors could compromise state validation or enable unauthorized withdrawals. | Formal audits, bug bounties, enforce upgrade timelocks, and multi-sig approvals |

Liquidity & Market Risk | VaultBridge deploys user assets into third-party Ethereum yield vaults, meaning vbTokens are backed by vault positions rather than idle collateral. In extreme redemption scenarios, liquidity at the underlying vaults could become a bottleneck, potentially leading to withdrawal delays or slippage. Stablecoin depegs could trigger cascading liquidations. Periods of low network activity may reduce sequencer fees, impacting CoL sustainability. | Reserve buffers maintained; CoL acts as backstop; VaultBridge and AUSD provide external yield; Cork Protocol provides an additional structured liquidity buffer, offering instant liquidity even at high collateral utilization. |

Third-Party Dependency Risk | Reliance on external curators and developers (e.g., Gauntlet, Steakhouse, Morpho, Yearn) means curator decisions can affect performance and asset recoverability without Katana’s direct oversight. | Use institutional-grade curators with proven track records; diversified strategy allocation; implement emergency withdrawal/mechanisms to safeguard assets during third-party or vault failures. |

KAT Token Liquidity Risk | KAT’s non-transferable phase (until February 20, 2026) limits liquidity and exit options. Once transfers open, rapid unlocks may trigger sell pressure and short-term volatility. | Gradual unlock schedule, and incentive programs rewarding users who retain or stake KAT during the early post-unlock period. |

Risk is inseparable from innovation in DeFi, but what defines lasting protocols is not how little risk they take, but how effectively they manage it. Katana’s architecture shows early signs of maturity, with measurable safeguards and transparent systems across liquidity, proofing, and dependency layers.

The project’s long-term resilience will depend on how well these mechanisms adapt as the network scales and as market conditions evolve. Sustained vigilance, not blind optimism, will determine whether Katana can earn lasting trust in an increasingly competitive DeFi landscape.

Conclusion: Why Katana?

DeFi has long been a puzzle of disconnected parts. Katana brings those pieces together into one coordinated engine where trading, lending, and yield feed the same cycle of growth. Every component serves a purpose, and every transaction strengthens the system that powers it forward.

If Katana continues to uphold its core ideology of deeper liquidity and greater yield, its success will hinge not just on infrastructure, but on continuous innovation, disciplined execution, and an engaged community that believes in productive capital as the future of DeFi.

Authors: @houhowhou, Memento Research

This report was written in partnership with Katana. This report has been prepared for informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the report’s content as such.