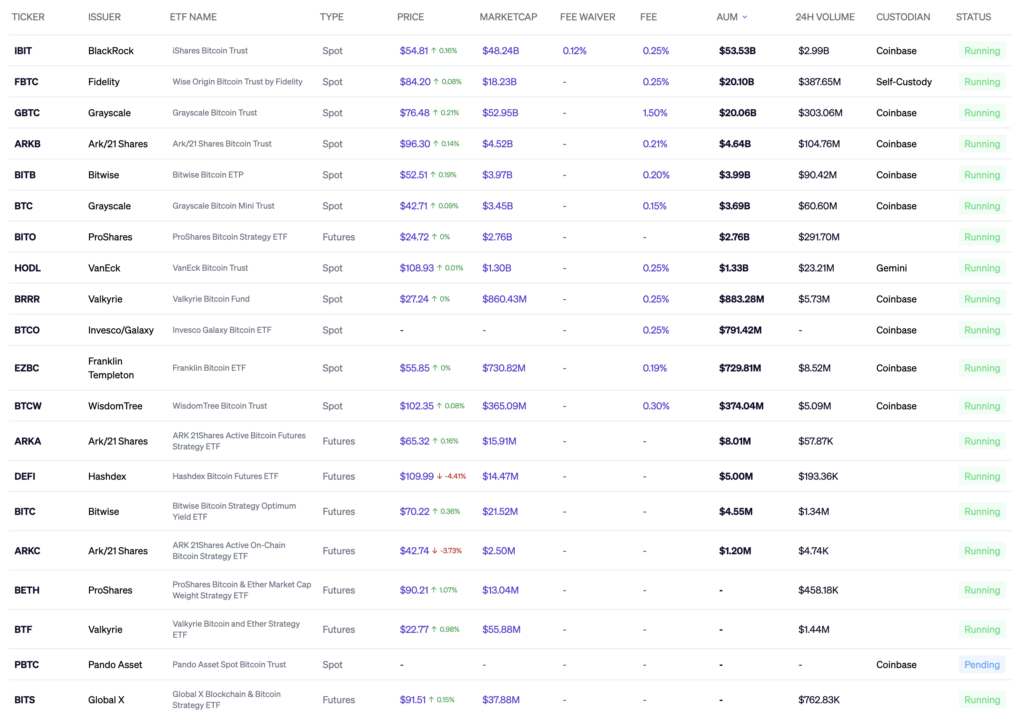

2024 was a landmark year for Bitcoin, marked by the long-awaited approval of the spot BTC ETF by the SEC after a decade of rejections. Fast forward to today, the ETF sector has flourished, achieving $4.3 billion in total volume and $113.01 billion in assets under management (AUM), with BlackRock dominating the sector at 46.9% market share.

Bitcoin Spot ETF Tracker – Source: Blockworks ETF Tracker

This milestone propelled Bitcoin into the mainstream financial spotlight, catalyzing its rise to an unprecedented $100,000 all-time-high price (per Bitcoin) and a market capitalization nearing $2 trillion.

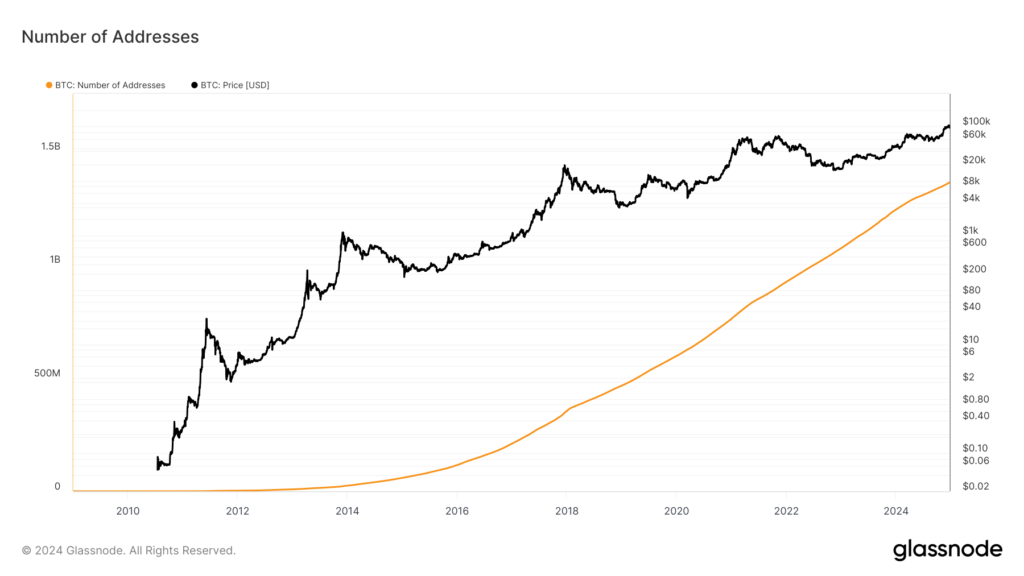

Historical Number of Bitcoin Address – Source: glassnode

The rapid pace of accumulation doesn’t end here. The exponential growth of unique Bitcoin addresses, now totaling 1.359 billion, underscores its expanding adoption as price discovery and accumulation accelerate with each cycle. Coupled with nations like El Salvador and Venezuela formally adopting Bitcoin, and a pro crypto administration under President-elect Donald Trump, this signals an era of increased institutional acceptance. Plans for state-level Bitcoin reserves and public pension funds incorporating Bitcoin into their portfolios highlight its growing role as a strategic financial asset.

As Bitcoin’s narrative continues to evolve, it further solidifies its position as a decentralized reserve currency and a revolutionary hedge against inflation, shaping the next era of financial innovation.

Bitcoin’s Untapped Potential

Despite dominating the cryptocurrency market with 56% market share and becoming a cornerstone asset in traditional finance (TradFi), the vast majority of Bitcoin holdings remain idle, generating little to no yield. From ETFs to corporate treasuries, institutions have accumulated significant reserves of Bitcoin, but its potential as an income-generating asset remains underutilized, representing billions of dollars in untapped economic value.

The pressing question: How can Bitcoin’s full financial potential be unlocked as a multi-trillion-dollar asset class while preserving its core role as a store of value?

The Rise of BTC-Fi: Bitcoin Meets DeFi

The answer lies in the convergence of Bitcoin’s programmability with decentralized finance (DeFi) is catalyzing the emergence of BTC-Fi—a transformative sector poised to redefine Bitcoin’s utility. By integrating Bitcoin into DeFi ecosystems, BTC-Fi unlocks unprecedented opportunities for liquidity, accessibility, and yield generation.

As innovative staking solutions and yield strategies emerge, Bitcoin is no longer confined to its traditional roles but evolves into a dynamic asset capable of powering the next wave of decentralized financial innovation.

Enter Solv Protocol

Solv Protocol positions itself as the ultimate “on-chain Bitcoin Reserve”, unlocking the untapped potential of over $1 trillion in Bitcoin assets. By leveraging its innovative Staking Abstraction Layer (SAL), SolvBTC, and SolvBTC.LSTs (Liquid Staking Tokens), Solv enables seamless access to yield-generating opportunities. This goes beyond staking, it integrates Bitcoin into the broader DeFi ecosystem, maximizing its utility and transforming idle assets into active, productive ones.

Report Summary

This report will cover:

- The emerging BTC-Fi landscape and the inherent limitations of Bitcoin that constrain its growth.

- Solv Protocol’s innovative Staking Abstraction Layer (SAL), positioning SolvBTC as a unified Bitcoin reserve with advanced security and unique yield-generating features.

- Solv Protocol’s ultimate vision to unlock Bitcoin’s potential, bridging DeFi ecosystems and TradFi markets for universal adoption.

Unlocking Bitcoin’s Full Potential

The State Today

Bitcoin’s adoption in TradFi has soared, with over 1.18 million BTC held in ETFs and corporate treasuries.

Here’s the problem: While these holdings serve as a passive hedge against inflation, they remain largely idle and fail to generate returns for their holders. Despite its integration into financial portfolios, Bitcoin’s yield-generating potential remains underutilized, limiting its broader impact within the financial system.

Limited Opportunities, Yet High Demand

Of course, attempts have been made to expand the horizons of enabling capital-efficient opportunities outside of the Bitcoin network since the early days of DeFi. However, yield-generating opportunities for Bitcoin have historically been constrained, limited to either centralized custodial providers requiring KYC deposits or basic DeFi primitives like lending markets.

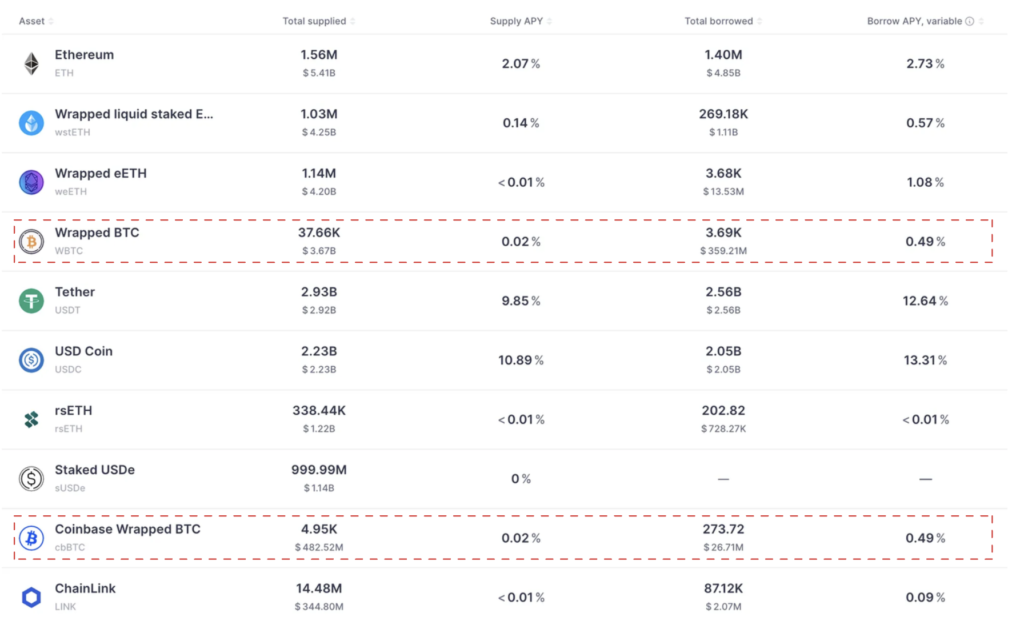

Aave Core Markets on Ethereum Mainnet (17th Dec 2024) – Source: Aave

Even within DeFi, yields remained underwhelming—Aave, Ethereum’s largest lending market, offered just merely 0.2% APY for the Wrapped BTC and cbBTC, despite holding over $3.6 billion in locked value. This lack of meaningful returns highlights the need for innovative solutions to unlock Bitcoin’s true yield potential.

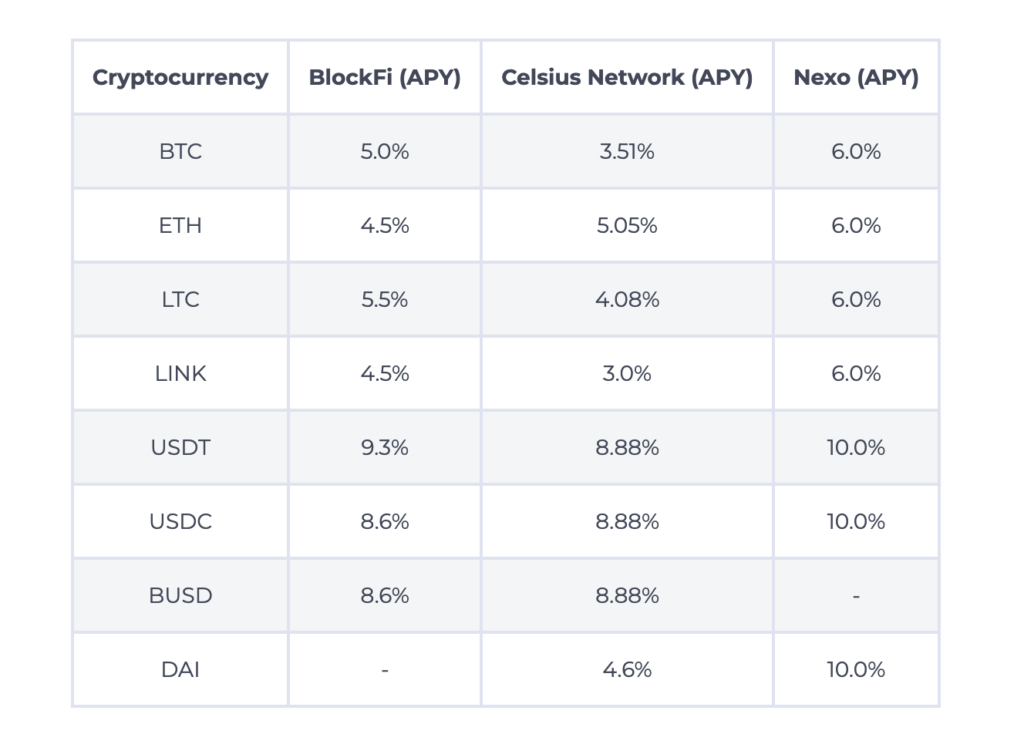

Centralised Crypto Lending Platform Comparison: BlockFi vs Celsius vs Nexo 2021 – Source: Seedly

In 2021, DeFi savings protocol Celsius gained significant traction reaching $20 billion in assets under management (AUM) and attracting $1.2 billion monthly by offering up to 8% BTC yields.

While the platform ultimately imploded, its rapid growth underscored the immense demand for Bitcoin yield opportunities and highlighted the untapped potential in this emerging market.

The Rise of Bitcoin Staking: Babylon Ecosystem

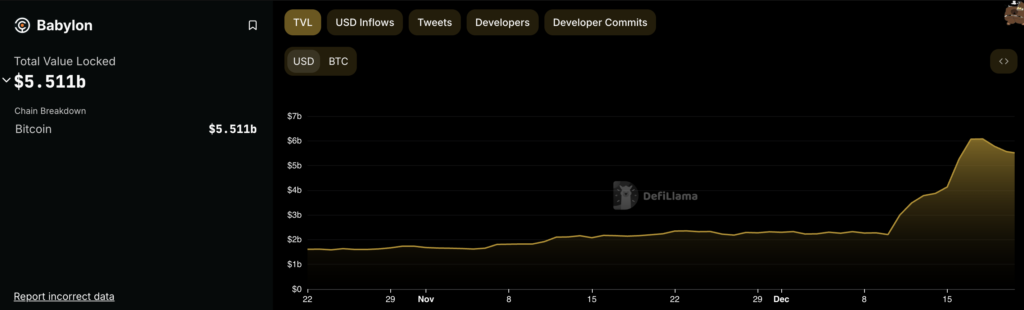

Babylon Historical TVL – Source: DeFiLlama

In Q3 2024, the Bitcoin staking landscape saw a significant breakthrough with the launch of Babylon, a transformative protocol enabling Bitcoin holders to earn passive yields while enhancing crypto-security. Babylon introduced a self-custodial approach, empowering users to validate external Proof-of-Stake (PoS) chains without third-party trust or bridging.

Babylon’s innovation sparked a wave of interest in Bitcoin staking, amassing $5.51 billion USD locked today, leading to the development of diverse protocols that introduced unique mechanisms for managing Bitcoin-based assets.

Where Are We Heading Towards?

While the sector remains nascent, the strong demand for decentralized and innovative yield solutions is evident from both historical and current metrics. The emergence of protocols like Babylon that seeks to address the longstanding underutilization of Bitcoin holdings marks a significant step toward establishing Bitcoin as a yield-generating asset. As these innovation mature, Bitcoin’s potential will eventually be fully realized.

However, there is still a long road ahead.

Key Challenges in Bitcoin Yield

Inherent Limitations of Bitcoin Network

Bitcoin’s Proof-of-Work (PoW) consensus mechanism, coupled with its limited programmability, inherently restricts its ability to generate native yield through staking. Unlike PoS networks, Bitcoin cannot natively produce staking rewards within its ecosystem. Holders are instead required to rely on external mechanisms—purchasing, trading, or mining—to acquire Bitcoin and generate yield.

Evolving Landscape of Bitcoin Staking

The emergence of protocols like Babylon has introduced new opportunities for Bitcoin staking but has also highlighted significant challenges. Different Liquid Restaking Token (LRT) protocols employ varying approaches to manage the complexity of staking, leading to diversification that can be categorized into three primary types:

- Layer 1/Layer 2 PoS Chains: Protocols like Stacks and Rootstock adopt Bitcoin’s security to enable PoS-like systems, integrating smart contracts and decentralized applications similar to Ethereum staking.

- Service-Oriented Protocols: Examples such as Portal and Threshold Network utilize Bitcoin assets to power decentralized services like oracles and cross-chain bridges, mirroring Ethereum’s restaking mechanisms.

- Generalized Staking Protocols: Platforms like Ethena and Jupiter leverage Bitcoin-based assets (e.g., WBTC) for yield generation through staking or collateralized lending, expanding Bitcoin’s role in DeFi ecosystems.

While these innovations have broadened Bitcoin’s staking landscape, they have also introduced challenges such as liquidity fragmentation and complexity in Liquid Staking Token (LST) issuance, which impede seamless adoption.

Liquidity Fragmentation

One of the most obvious and pressing issues in Bitcoin staking is fragmented liquidity, as protocols operate in isolation without a unified framework:

- Centralized Solutions: Options like WBTC and BTCB provide high liquidity but are restricted by centralized governance and chain-specific designs, limiting their cross-chain usability.

- Decentralized Alternatives: Protocols such as tBTC and dlcBTC mitigate custodial risks but suffer from low adoption and liquidity constraints.

- Siloed Ecosystems: Solutions like BTC.b (Avalanche) and M-BTC (Merlin) confine liquidity within isolated chains, preventing seamless movement of assets across blockchains.

This fragmentation results in inefficiencies, higher transaction costs, and slippage during periods of high demand. Users face unnecessary friction in accessing Bitcoin’s staking and yield-generating capabilities.

Complexity in Liquid Staking Token (LST) Issuance

Issuing LSTs for Bitcoin is inherently more complicated than for Ethereum, primarily due to Bitcoin’s lack of native smart contract functionality:

- Technical Barriers: LST issuance requires intricate interactions between Bitcoin’s mainnet and EVM-compatible chains, which introduces significant operational challenges.

- Cross-Chain Friction: The process of moving assets across chains involves multi-step procedures that must balance security, liquidity, and usability. These processes are often time-consuming and prone to error, deterring adoption.

These challenges not only stifle innovation by developers but also hinder user accessibility. The resulting complexity discourages participation, limiting Bitcoin’s potential as a productive, yield-generating asset in the broader DeFi landscape.

Paving the Way for Solutions

Addressing these challenges requires a unified framework that fosters seamless interoperability, simplifies the issuance of LSTs, and optimizes liquidity across protocols and blockchains. By overcoming these pain points, Bitcoin can evolve into a scalable and productive asset, unlocking its full potential within DeFi while maintaining its core decentralized values.

Solv Protocol Staking Abstraction Layer (SAL)

The Next Evolution: Building a Unified Framework for Bitcoin Staking

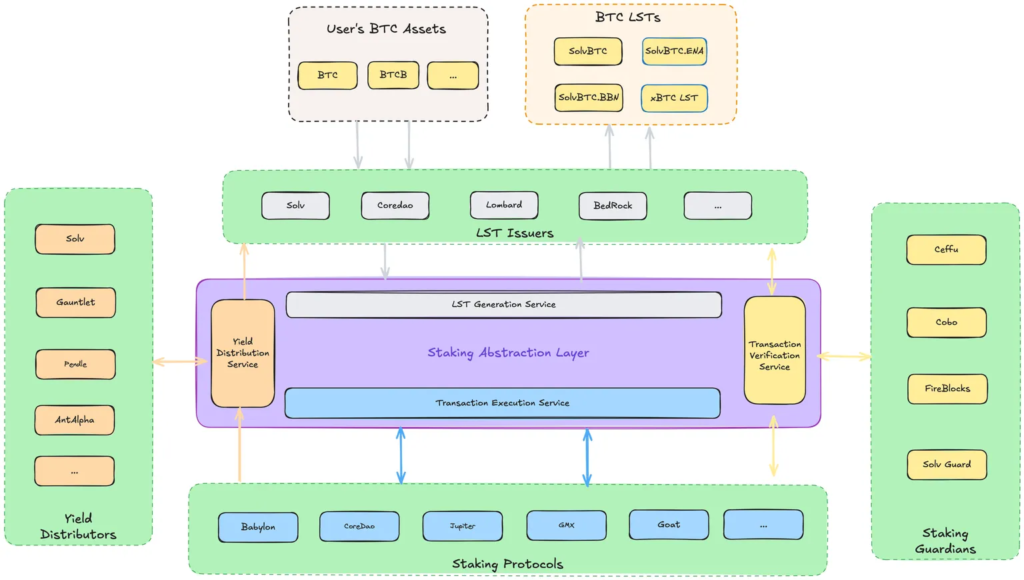

Solv Protocol’s SAL: The BTC Staking Ecosystem – Source: Solv Protocol Documentation

At the heart of Solv Protocol’s innovation is the Staking Abstraction Layer (SAL)—a unified infrastructure that streamlines and standardizes Bitcoin staking across diverse ecosystems.

Unlike Ethereum, where staking is natively integrated, Bitcoin staking relies on independent third-party protocols, resulting in a decentralized yet fragmented process. The SAL solves this complexity by orchestrating and coordinating key stakeholders in the Bitcoin staking ecosystem:

- LST Issuers

- Staking Protocols

- Staking Guardians

- Yield Distributors

By aligning these roles, SAL delivers transparency, security, and a seamless user experience throughout the entire Bitcoin staking lifecycle. This innovation removes friction, enhances usability, and sets the foundation for a more unified and efficient BTC-Fi ecosystem.

SAL: The Solution to Existing Challenges

The SAL offers a standardized system that unifies roles and processes, ensuring a seamless and secure staking experience. By coordinating independent actors and simplifying complex interactions, SAL safeguards user assets while enabling efficient cross-chain yield acquisition. This architecture enhances transparency and security while addressing critical challenges:

- Simplifying and Unifying Staking: SAL provides a consistent, user-friendly experience across multiple blockchain ecosystems.

- Eliminating Liquidity Fragmentation: By facilitating cross-chain fluidity and accessibility for staked Bitcoin, SAL creates a unified and efficient staking ecosystem.

Through these innovations, SAL redefines Bitcoin staking, laying the groundwork for it to thrive as a scalable, interoperable, and user-friendly component of DeFi. This makes Bitcoin staking more accessible, efficient, and adaptable for a broader range of participants.

SolvBTC: The Reserve for Bitcoin Staking

The vision of SolvBTC is to become a “Bitcoin Reserve for Everyone,” unlocking Bitcoin’s full potential through yield generation, flexible and liquid representations, and seamless integration with DeFi ecosystems.

SolvBTC directly tackles challenges like liquidity fragmentation and complex asset issuance, creating a more unified and accessible Bitcoin staking experience for users and protocols alike.

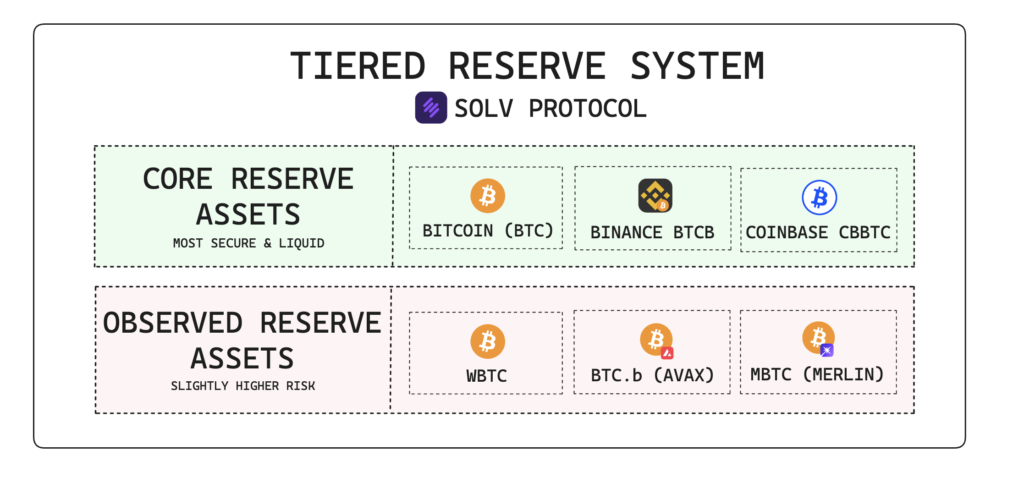

Enhanced Risk Management: Tiered Reserve System

To establish a universally abstracted Bitcoin staking product, SolvBTC employs a tiered reserve system to manage the varying risks associated with different types of wrapped BTC assets. This modular, isolated design ensures that vulnerabilities are contained without compromising the integrity of the entire system.

- Core Reserve Assets: These secure and highly liquid assets form the foundation of SolvBTC’s reserves, providing maximum reliability and security for the system. Assets include:

- Native Bitcoin (BTC)

- BTCB (Binance’s wrapped BTC)

- cbBTC (Base’s wrapped BTC)

- Observed Reserve Assets: These assets carry higher risk profiles and are closely monitored to mitigate systemic exposure. Risks such as de-pegging, smart contract vulnerabilities, or liquidity constraints are carefully managed to protect the overall reserve structure. Examples include:

- WBTC (Ethereum-based wrapped BTC)

- BTC.b (Avalanche wrapped BTC)

- M-BTC (Merlin wrapped BTC)

History has shown that all-in-one pools often create cross-exposure risks, where a single point of failure can compromise an entire reserve. Solv Protocol’s innovative tiered reserve system addresses these vulnerabilities, enhancing efficiency, security, and user experience.

Key benefits of this approach include:

- Risk Isolation: Risks are confined to specific categories, ensuring that high-risk assets do not destabilize the core reserves.

- Enhanced Security: The modular design allows for tailored risk mitigation strategies for each category, ensuring that assets in the core reserves maintain their integrity even in volatile conditions.

- Improved Transparency: Clear categorization and monitoring of assets provide users with better visibility into the reserves’ composition and associated risks, fostering trust and confidence among Bitcoin holders.

- Optimized Liquidity: Segregation of reserves ensures that the most liquid and secure assets remain readily accessible, while observed reserves are managed to balance risk and liquidity without compromising the overall system.

- Flexibility for Users: The tiered system allows Solv Protocol to offer tailored solutions that meet diverse user needs, from secure passive holdings to higher-yield opportunities, without exposing all users to uniform risks.

Solv Protocol’s tiered system avoids the pitfalls of traditional pooling by isolating risks and offering a robust, secure foundation for Bitcoin staking. This approach not only safeguards the value of SolvBTC but also establishes it as the most reliable and versatile on-chain Bitcoin reserve token, setting a new standard for transparency, flexibility, and user confidence in the Bitcoin staking landscape.

Trust and Security: The Cornerstone of Leadership

In the highly competitive Bitcoin staking landscape, trust and security are fundamental to establishing and maintaining leadership. As Bitcoin remains the world’s leading store-of-value asset and a global hedge against financial uncertainty, ensuring the safety of user assets is not optional—it is a critical requirement.

Bitcoin holders demand exceptional security, given the immense value and importance of their holdings. Solv Protocol addresses this necessity by employing advanced technology and forming strategic partnerships to safeguard assets while maintaining the integrity of its ecosystem. This focus on trust and security empowers Bitcoin holders to move confidently from passive storage to active participation in DeFi.

Top-Tier Custody Services and Proof of Reserves (PoR)

Solv Protocol secures Bitcoin reserves through partnerships with top-tier custodians like Ceffu, Cobo, and Fireblocks, industry leaders known for their robust infrastructure and trusted asset management practices.

To reinforce transparency and user confidence, Solv is collaborating with Chainlink to develop a cutting-edge Proof of Reserves (PoR) solution. This system provides real-time verification of reserves, offering continuous assurance that all issued tokens are fully backed.

By combining reliable custody services with transparent, real-time reserve validation, Solv Protocol sets a new benchmark for security and trust in the Bitcoin staking ecosystem. These initiatives solidify its leadership position and enable a secure, transparent environment for all participants.

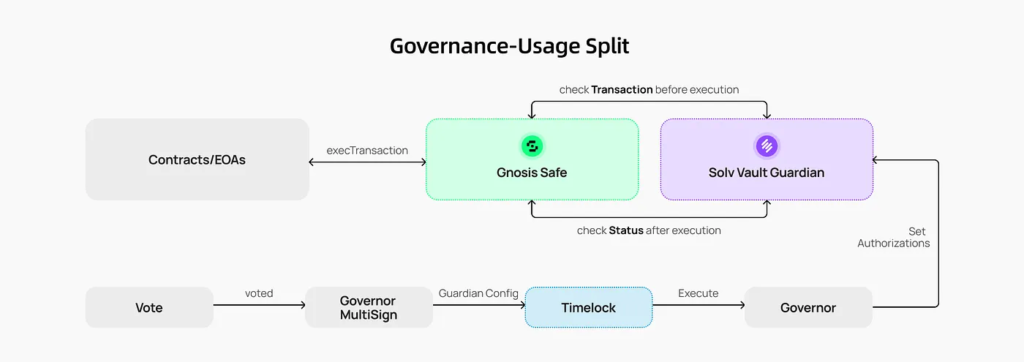

Solv Guard

Solv Guard is an advanced, in-house security framework engineered to safeguard user assets in the ever-evolving decentralized finance landscape. Leveraging the multi-signature capabilities of smart contract wallets, Solv Guard implements stringent controls over transaction permissions, fund flows, and asset manager activities to ensure maximum security.

Solv Guard Governance Usage Split Outline – Source: Solv Protocol Documentation

By configuring Vault Guardians with tailored permissions, Solv Guard restricts operations to pre-approved contracts and functions, minimizing the surface area for potential vulnerabilities. This precise approach ensures secure and efficient asset management.

With integrated governance mechanisms like time locks and community oversight, Solv Guard combines flexibility and transparency, empowering DeFi users to access sophisticated yield opportunities while safeguarding their funds against unauthorized actions or vulnerabilities.

Rigorous Audits

Solv Protocol Backing and Audit Showcase – Source: Solv Protocol Documentation

Solv Protocol undergoes extensive security audits by industry-leading firms such as Quantstamp, Certik, SlowMist, Salus, and Secbit to ensure its infrastructure remains robust and reliable.

As Bitcoin continues to solidify its role as the ultimate store-of-value asset, trust is the cornerstone of any staking platform. Solv Protocol’s steadfast commitment to security not only safeguards the integrity of Bitcoin holdings but also empowers users to unlock their assets’ full potential within DeFi ecosystems.

This dedication to trust and security establishes Solv Protocol as a leader in the evolving landscape of Bitcoin staking, providing users with the confidence needed to engage in the next generation of decentralized finance.

Solv Protocol: Unique Product with Multiple Verticals

Solv Protocol transcends the conventional boundaries of staking, such as those found in the Babylon ecosystem, by pioneering a broader vision for BTC finance through its SAL. Beyond standard staking, SolvBTC empowers Bitcoin holders with diverse yield strategies, including validator rewards, trading profits, and innovative Real-World Asset (RWA) integrations.

This composable framework allows SolvBTC to dynamically adapt to market conditions and capitalize on emerging narratives. For example, during periods of high interest rates, SolvBTC can pivot to RWA-focused strategies to optimize yields, demonstrating its flexibility and commitment to maximizing user returns. With this adaptability, Solv Protocol positions itself as a transformative force in BTC finance, unlocking limitless possibilities for yield generation and integration.

Solv’s Edge in Bitcoin Staking

Since the inception of Babylon’s Bitcoin staking ecosystem, Solv Protocol’s SolvBTC.BBN has effectively captured significant sector dominance by leveraging its early establishment and first-mover advantage within the sector.

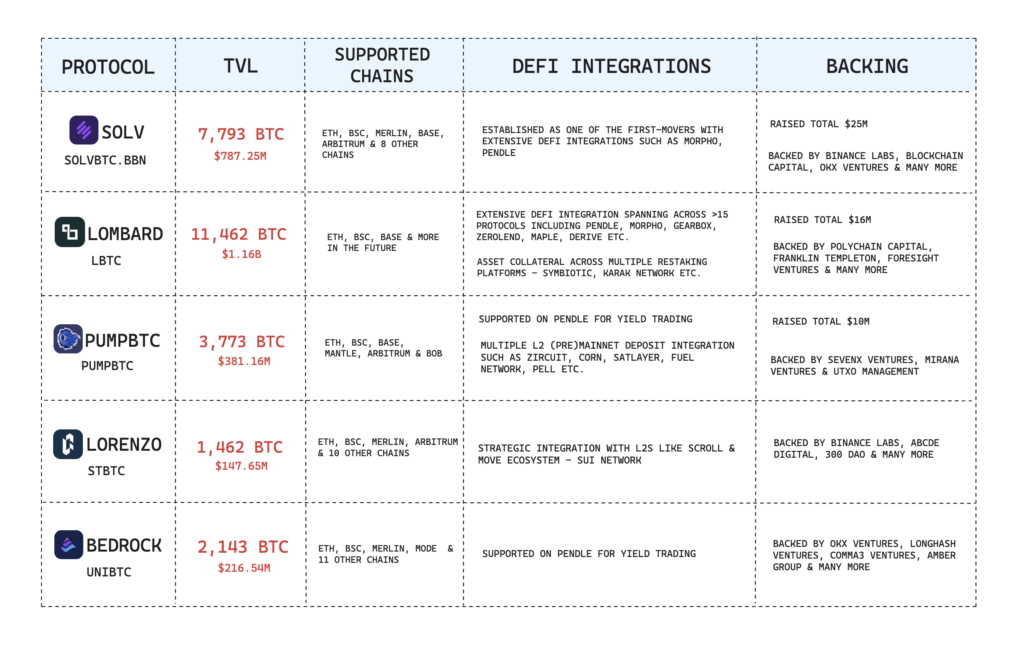

BTC-Fi LST Protocol Comparison Table

Within the Babylon ecosystem, SolvBTC.BBN has established itself as a trusted and versatile asset in the ranking as the 2nd most popular LST behind Lombard.

SolvBTC.BBN is one of the top players in both chain coverage diversity and integrations, natively minted across 13 blockchains and widely accepted in top-tier DeFi protocols. These include lending platforms like Morpho and Venus, as well as yield tokenization pioneers such as Pendle Finance. This extensive adoption highlights SolvBTC.BBN’s interoperability and its pivotal role in the broader DeFi ecosystem.

First-Mover Advantage in BTC-Fi

As an early entrant to the BTC-Fi space, Solv Protocol has capitalized on its proactive adoption of Babylon’s ecosystem, solidifying its position as a leading innovator. With SolvBTC.BBN serving as a cornerstone product, Solv continues to drive adoption and utility in DeFi, offering users unparalleled access to Bitcoin’s potential as a yield-generating asset.

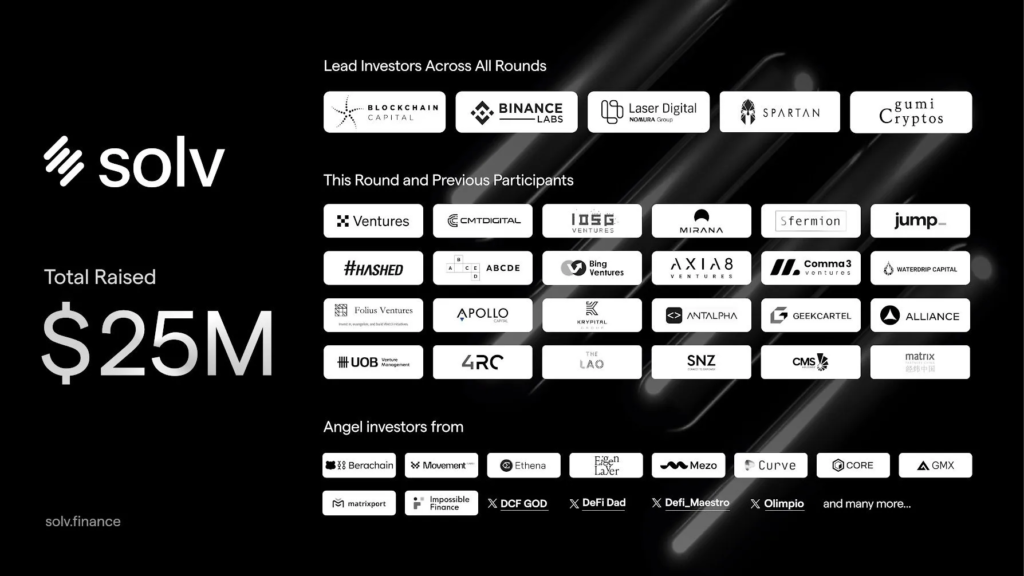

Premier Backing and Recognition

Solv Protocol boasts one of the most highly accredited investor portfolios among its competitors, including backing from Binance Labs, Blockchain Capital, OKX Ventures, and other prominent players. This strong institutional support not only validates Solv’s vision but also bolsters trust and confidence in its solutions.

Through superior integrations, strong institutional backing, and strategic early positioning, Solv Protocol stands apart from its competitors, cementing its reputation as a potential leader in the BTC-Fi landscape.

Beyond Staking: Multi-Source Yield Strategies

SolvBTC redefines the standard for Liquid Staking Tokens (LSTs), offering Bitcoin holders the ability to earn yields while maintaining liquidity. Its composable design allows users to select flexible, underlying yield-generating strategies tailored to their financial goals, unlocking Bitcoin’s potential across various DeFi ecosystems.

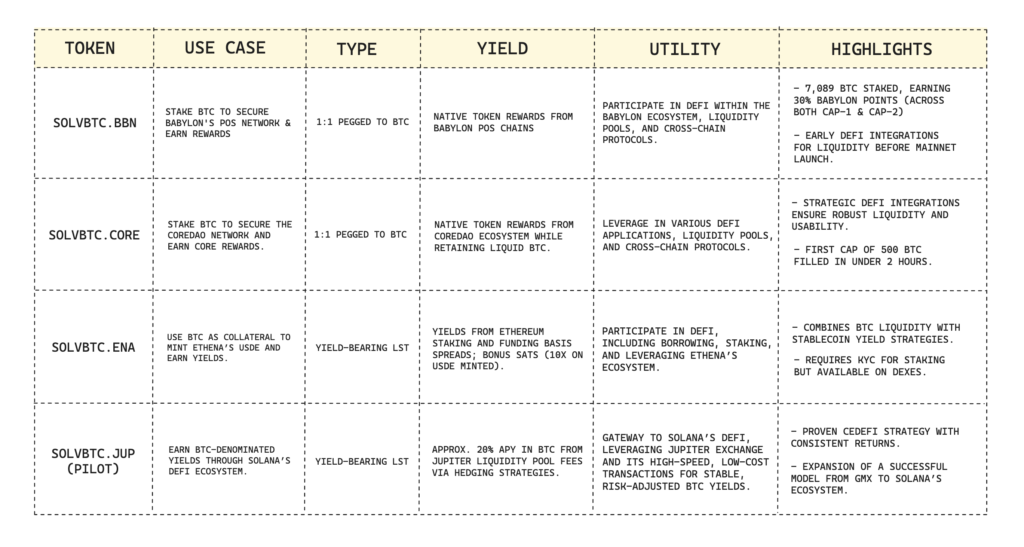

Solv BTC LST Comparison Table

SolvBTC.LSTs come in two forms: Pegged LSTs, providing stable, 1:1 Bitcoin representation for seamless cross-chain liquidity, and Yield-Bearing LSTs, which accrue staking rewards over time for enhanced earning potential.

Both token types support cross-chain transfers, easy access to DeFi applications like lending and trading, and continuous yield generation. This transforms Bitcoin from a static store of value into a dynamic, yield-generating asset.

Empowering Bitcoin Holders

SolvBTC’s multi-source yield model offers Bitcoin holders unprecedented access to decentralized financial systems, allowing them to turn BTC into a productive and versatile asset. By addressing challenges like liquidity fragmentation and usability, SolvBTC maximizes utility extraction without sacrificing accessibility.

This innovation positions SolvBTC as a transformative solution, enabling Bitcoin holders to fully participate in the DeFi landscape while earning consistent yields.

Unlike other BTC-Fi projects, Solv Protocol goes beyond Babylon LSTs and wrapped BTC.

TLDR: Solv Protocol’s Edge

Solv Protocol goes beyond being a leading liquid staking player in Babylon’s Bitcoin staking ecosystem. With a robust suite of products, it empowers Bitcoin holders to access diverse yield-generating strategies, including staking rewards, validator incentives, trading profits, and RWAs. By integrating deeply across DeFi platforms, SolvBTC unlocks Bitcoin’s potential as a productive and versatile asset in the evolving financial landscape.

Solv Protocol: Leading The Forefront of Bitcoin Utilization

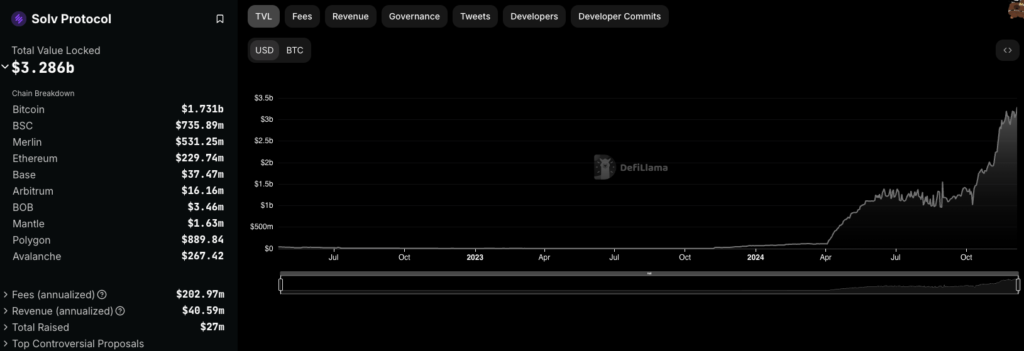

Solv Protocol has firmly established itself as a global leader in Bitcoin staking, securing an impressive 31,900 BTC (~$3.28 billion) in TVL year-to-date and serving a rapidly growing user base of 529,000+ worldwide.

Solv Protocol TVL Analytics – DefiLlama

With the emergence of Babylon’s liquid staking ecosystem, Solv Protocol has claimed the #2 spot in the Bitcoin restaking landscape, capturing an impressive 33.18% market share.

What sets Solv apart is its commitment to being transparent, permissionless, and universally accessible—a platform built not for shareholders but for the community. By redefining Bitcoin reserves, Solv transforms Bitcoin from a passive store of value into an actively managed, yield-generating resource for holders, unlocking new opportunities in the evolving DeFi landscape.

On-Chain Utilization: The Superior Bitcoin Reserve

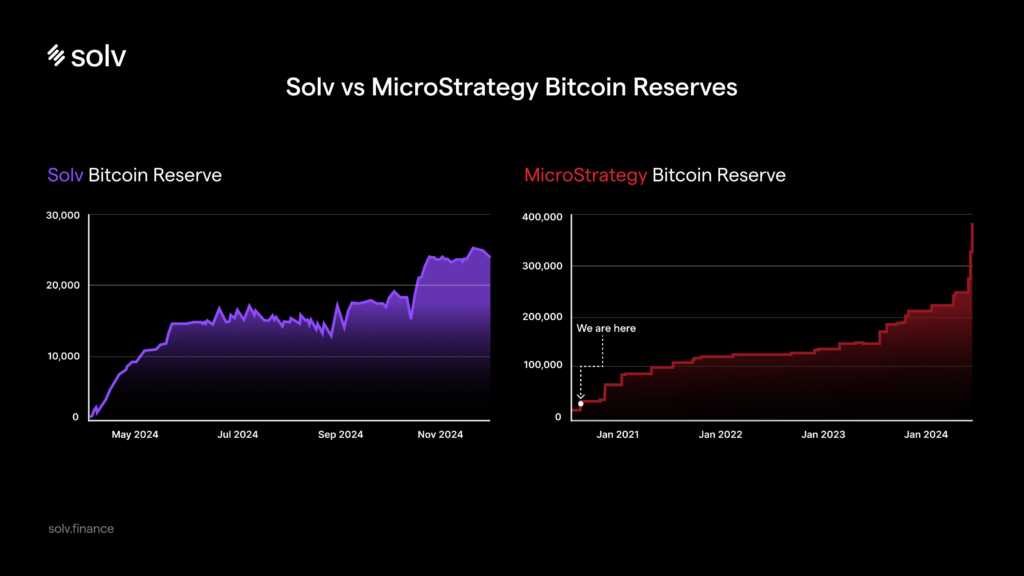

Solv vs MicroStrategy Bitcoin Reserves – Source: Solv Protocol

Rooted in the foundational principles of DeFi—asset composability and yield maximization that revolutionized permissionless finance during DeFi Summer 2020—Solv Protocol emerges as the premier on-chain Bitcoin reserve.

Dubbed the “On-Chain MicroStrategy”, Solv Protocol offers a secured and scalable solution for passive Bitcoin holdings while unlocking the potential for yield generation through innovative DeFi strategies.

Leading with Exceptional Utilization

With an impressive 90% utilization rate, Solv Protocol stands as the #1 DeFi protocol for BTC deposits. It outpaces traditional financial instruments like ETFs and private companies, while also ranking competitively with governments in terms of Bitcoin holdings. This high utilization showcases Solv’s efficiency and ability to meet the demands of modern BTC holders.

Empowering Bitcoin Holders

Over 42,000 users are actively earning Bitcoin through SolvBTC.LSTs, illustrating the protocol’s capacity to transform idle BTC into dynamic, yield-generating assets. These milestones cement Solv Protocol’s position as a leader in Bitcoin staking, revolutionizing decentralized finance and unlocking new possibilities for Bitcoin’s utility in DeFi ecosystems.

Solv Expansive Ecosystem

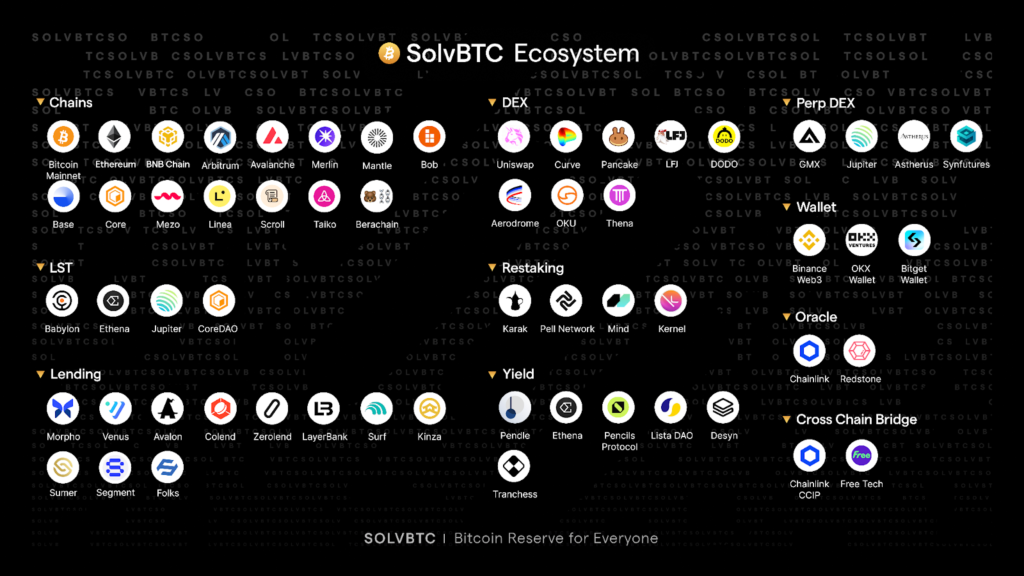

Extensive DeFi Integrations Across Various Sector Domains

SolvBTC has established itself as a cornerstone of the DeFi ecosystem, providing extensive utility across lending, yield generation, and cross-chain interoperability.

SolvBTC Ecosystem – Source: Solv Protocol

Recognized as a blue-chip collateral, it is supported by top-tier lending protocols like Venus (BNB Chain) and Morpho and plays a critical role in crypto-security within restaking protocols such as Karak and Pell Network.

Maximising Reward Opportunities

SolvBTC is also deeply integrated into the yield sector, powering innovative strategies on platforms like Pendle Finance and Ethena. A standout offering is the SolvBTC Ethena Vault (SolvBTC.ENA), which generates multiple reward streams including (1) USDe yields, (2) Ethena SATs, and (3) Solv Points.

This vault enables Bitcoin holders to leverage their BTC as collateral to borrow stablecoins, mint Ethena’s USDe, and earn yields from Ethereum staking and delta hedging strategies, delivering a competitive net APY of ~15%.

With endless strategic possibilities and flexible integration opportunities, SolvBTC redefines Bitcoin’s role in the yield economy.

Robust Cross-Chain Interoperability

In an increasingly interconnected, roll-up-centric future, where ecosystems operate across multiple blockchains and virtual machines, interoperability is crucial to navigating the growing horizontal landscape of DeFi.

SolvBTC excels in cross-chain interoperability, seamlessly spanning 15 blockchains with the support of Chainlink CCIP and Free Tech, ensuring accessibility and flexibility for users. This integration positions SolvBTC as a versatile and reliable asset, unlocking Bitcoin’s full potential within the dynamic DeFi ecosystem.

Looking ahead, SolvBTC is poised to expand further by integrating with next-generation Layer 1 ecosystems like Sonic, Berachain, and HyperEVM, allowing users to tap into emerging yield-generating strategies on these platforms. This forward-looking adaptability cements SolvBTC’s role as a cornerstone asset in the evolving cross-chain DeFi landscape.

Onboarding The Next Wave: Centralized Exchange Wallet Partnerships

Centralized Exchange (CEX) wallet partnerships are key to Solv Protocol’s mission to onboard the next wave of DeFi and Bitcoin staking users, particularly retail participants deterred by crypto’s complexity.

By integrating with tier-1 platforms like Bitget, Binance, and OKX, Solv taps into a user base of hundreds of millions, expanding accessibility and participation. CEX wallets simplify crypto adoption through user-friendly interfaces, lowering technical barriers for non-crypto-native users.

Successful models like Base’s DeFi growth through Coinbase wallet integration highlight the potential for CEX wallets to drive large-scale adoption. These partnerships bridge traditional finance and DeFi, empowering users to engage seamlessly.

The Endgame: TradFi Integration

Solv Protocol’s ultimate vision extends beyond DeFi, aiming to position itself as a decentralized Bitcoin reserve that bridges the gap between TradFi and decentralized ecosystems. By foraying into the untapped potential of traditional financial markets, Solv unlocks new avenues for liquidity and yield generation, reinforcing Bitcoin’s utility as a global financial asset.

Solv Protocol x HashKey

A key milestone in this journey is Solv’s partnership with HashKey Chain, a pivotal step in bridging institutional-grade infrastructure with decentralized solutions. This collaboration showcases Solv’s capability to integrate with TradFi, making Bitcoin accessible to funds and institutional investors, while delivering unparalleled transparency and flexibility through its SAL.

By enabling institutional adoption and fostering trust among prominent players in TradFi, SolvBTC solidifies its reputation as a premier asset for both retail and institutional participants, setting a new benchmark for the future of Bitcoin in global finance.

Fund Raising & TGE

Solv Protocol: Fundraising Partners

Solv Protocol has successfully raised a total of $25 million in financing, with the latest $11 million round pushing its valuation to $200 million. Backed by prominent investors such as Binance Labs, Blockchain Capital, OKX Ventures, and Nomura subsidiary Laser Digital, Solv has established a strong foundation for growth.

The strategic round was no coincidence. With over 20,000 BTC staked ($1.3 billion) deployed across 10 major blockchain networks, Solv Protocol is channeling this capital to accelerate product development. The focus lies on expanding its innovative SAL ecosystem, driving Bitcoin’s evolution from a store of value to a cornerstone of DeFi and beyond.

Final Thoughts

Solv Protocol’s journey to redefine Bitcoin’s role in the cryptocurrency landscape is only just beginning. By integrating DeFi’s core principles—security, scalability, and accessibility—with its novel SAL, Solv unlocks yield and utility for Bitcoin holders that extend far beyond conventional use cases.

Rather than simply leveraging current BTC-Fi opportunities, Solv is set to chart new frontiers in utility and adoption, seamlessly bridging DeFi, centralized exchanges, and TradFi. With strong backing from trusted investors and a resilient infrastructure, Solv Protocol’s vision as the “On-Chain MicroStrategy” is not just a goal—it’s a transformative roadmap for Bitcoin’s future in DeFi.

Authors: @0xCheeezzyyyy, Memento Research

This report was written in partnership with Solv Protocol. This report has been prepared for informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the report’s content as such.