The State of Crypto Cards and What’s Next

Introduction

2025 marked a breakout year for crypto cards, transitioning from niche onramps into increasingly used payment instruments. Across both deposits and spending, crypto cards exhibited strong growth → driven by a combination of improved UX, broader chain support, and rising comfort with stablecoin-denominated spending.

This report provides an ecosystem-level overview of crypto card activity for the last 2 years (Dec ‘23 - Oct ‘25), focusing on observable on-chain behaviour across leading card providers.

Executive Summary

Crypto cards moved from experimentation to real usage in 2025, with deposits and spending both exhibiting sustained, exponential growth.

Deposits continue to lead spending, with stablecoins dominating deposits behaviour → accounting for nearly all deposited collateral and reinforcing debit-like, volatility-averse spending patterns.

Rain-based cards lead usage, yet the majority of users remain as micro-spenders → indicating top-of-wallet behaviour usage for daily purchases

Growth is expected to continue for 2026, with additional layers of profitability, interchange economics, and credit-adjacent factors included vs. pure focus on onboarding alone.

Methodology & Scope

This report analyzes crypto card activity using on-chain-verifiable data, prioritizing observed economic behaviour over self-reported metrics.

Card Coverage

Type 1 cards: On-chain, verifiable deposits and spending (e.g., Rain-based Cards, Gnosis Pay Card, MetaMask Card)

Type 2 cards: On-chain, verifiable deposits only (e.g., WireX Card, RedotPay Card, Holyheld Card)

Type 3 cards: CEX-issued cards (e.g., Binance Card, Bybit Card, Nexo Card) → Excluded from analysis due to limited data availability

Analytical Approach

Deposit analysis → Includes both Type 1 and Type 2 cards to capture broader liquidity inflows

Spending analysis → Restricted to Type 1 cards, where transactions are directly observable on-chain

For wallet-native cards where spending does not follow a traditional deposit flow, spending activity is treated as deposits for analytical consistency. Non-stablecoin balances are normalized using trailing twelve-month mean prices to express all volumes in USD-equivalent terms

Deposits: Where Liquidity Enters the System

Deposits scaled first, and fastest:

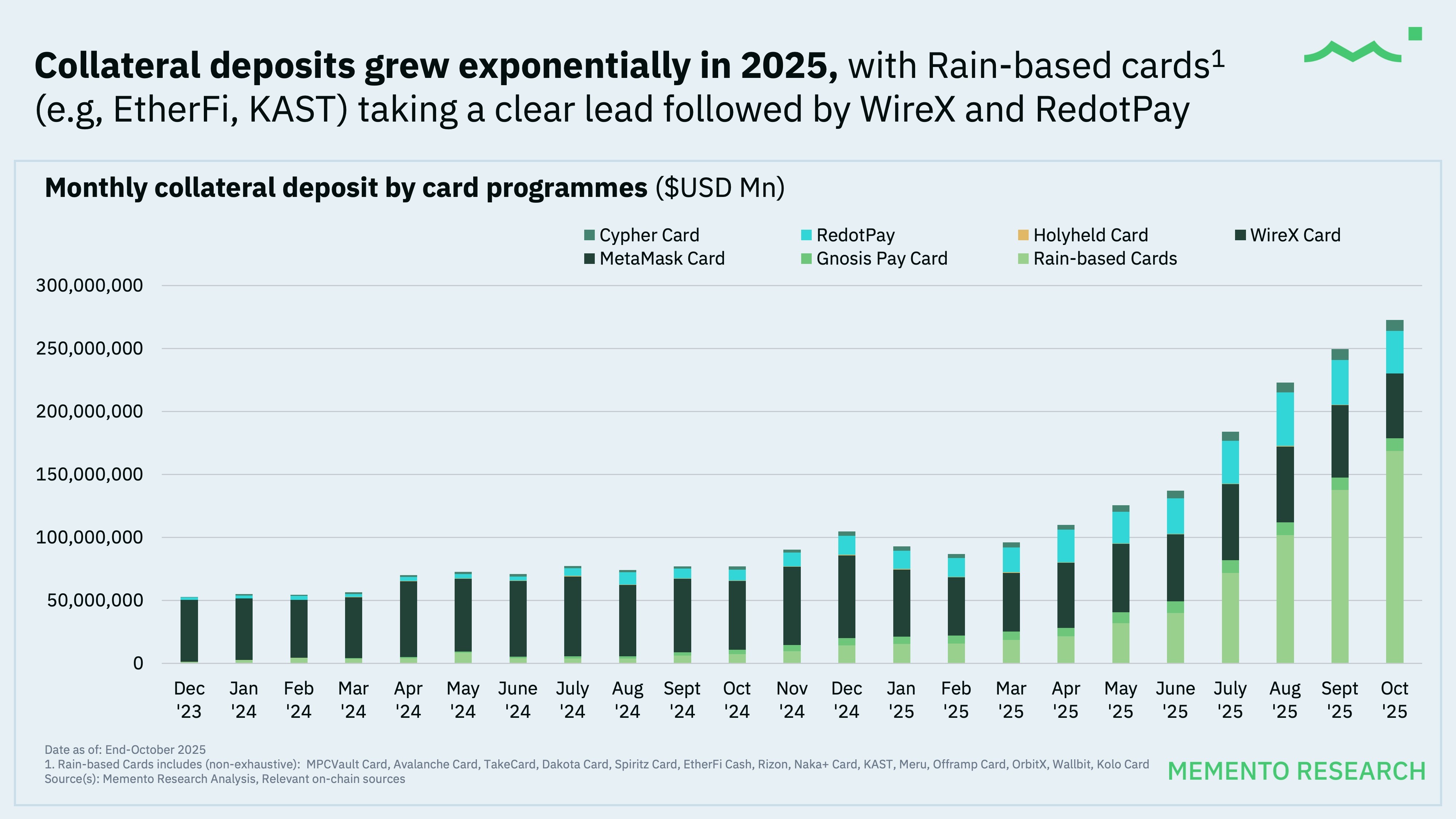

Monthly crypto card collateral deposits grew exponentially through 2024 and accelerated further in 2025.

Rain-based cards consistently led deposit volumes, driven by their role as the underlying card infrastructure for a variety of popular crypto card programs → including EtherFi Cash, KAST, Offramp, and the Avalanche Card.

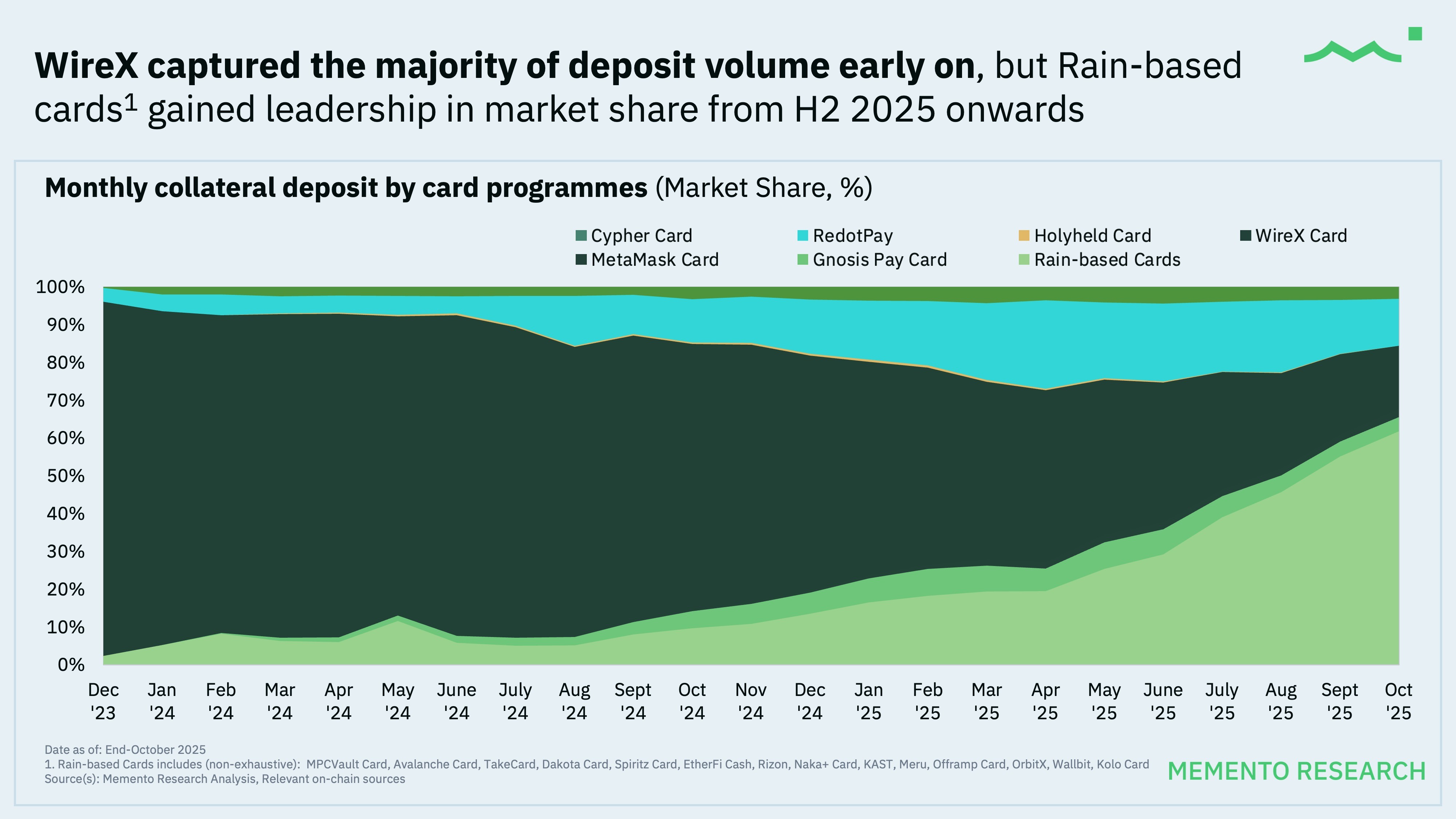

Market share consolidated early, then fragmented:

WireX captured the majority of deposit volume throughout much of 2024, but Rain-based cards gained leadership in market share from H2 2025 onwards.

Takeaway: From H2 2025 onwards, a wave of new card programs launched using Rain as their core infrastructure partner, driving higher deposit inflows and accelerating new cardholder onboarding.

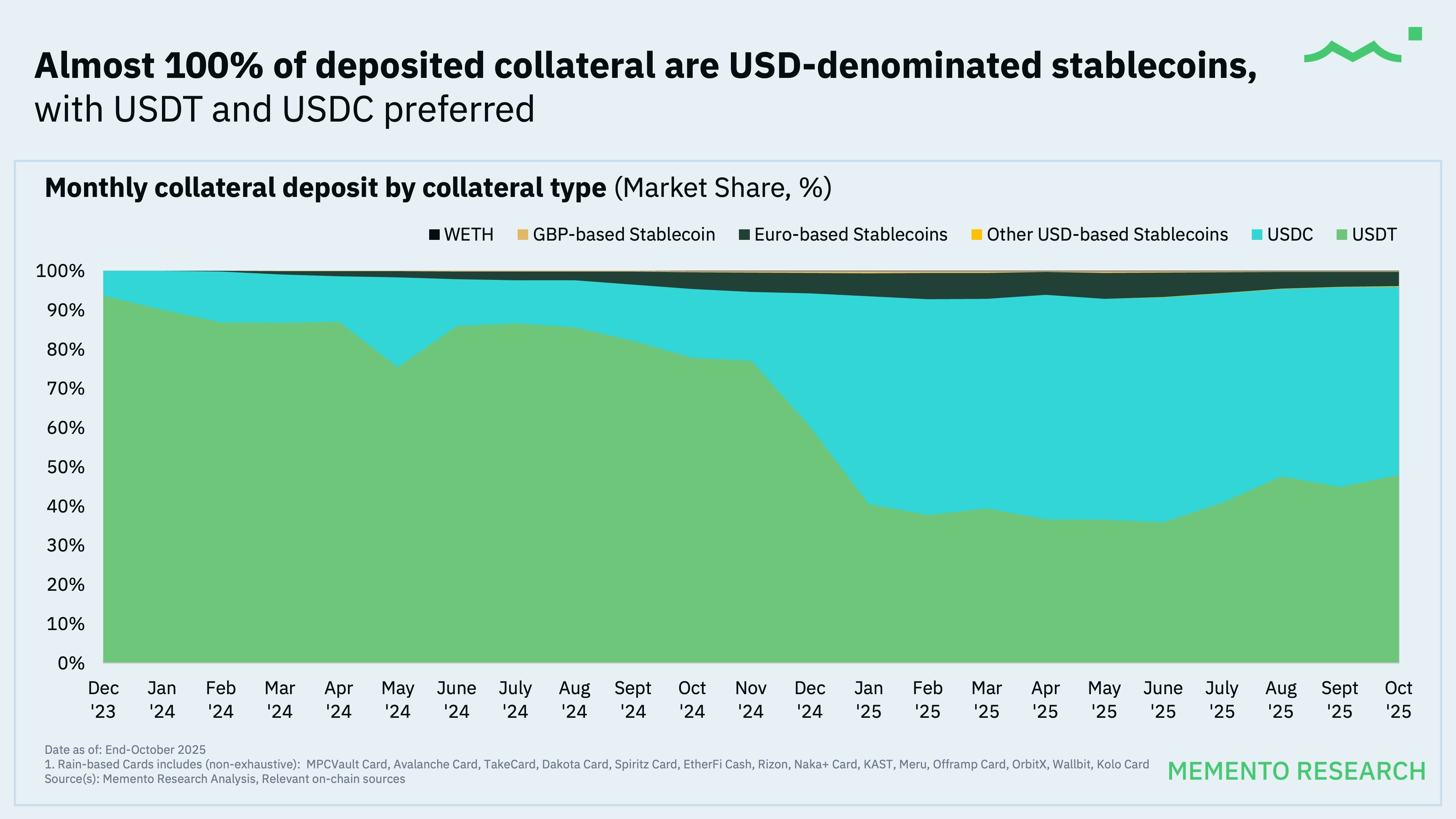

Stablecoins dominate almost entirely:

Across the full dataset, nearly 100% of deposited collateral consists of USD-denominated stablecoins with USDT & USDC as key leaders.

This reinforces that crypto cards today function closer to international payment accounts than speculative spending instruments, even for non-US based cardholders.

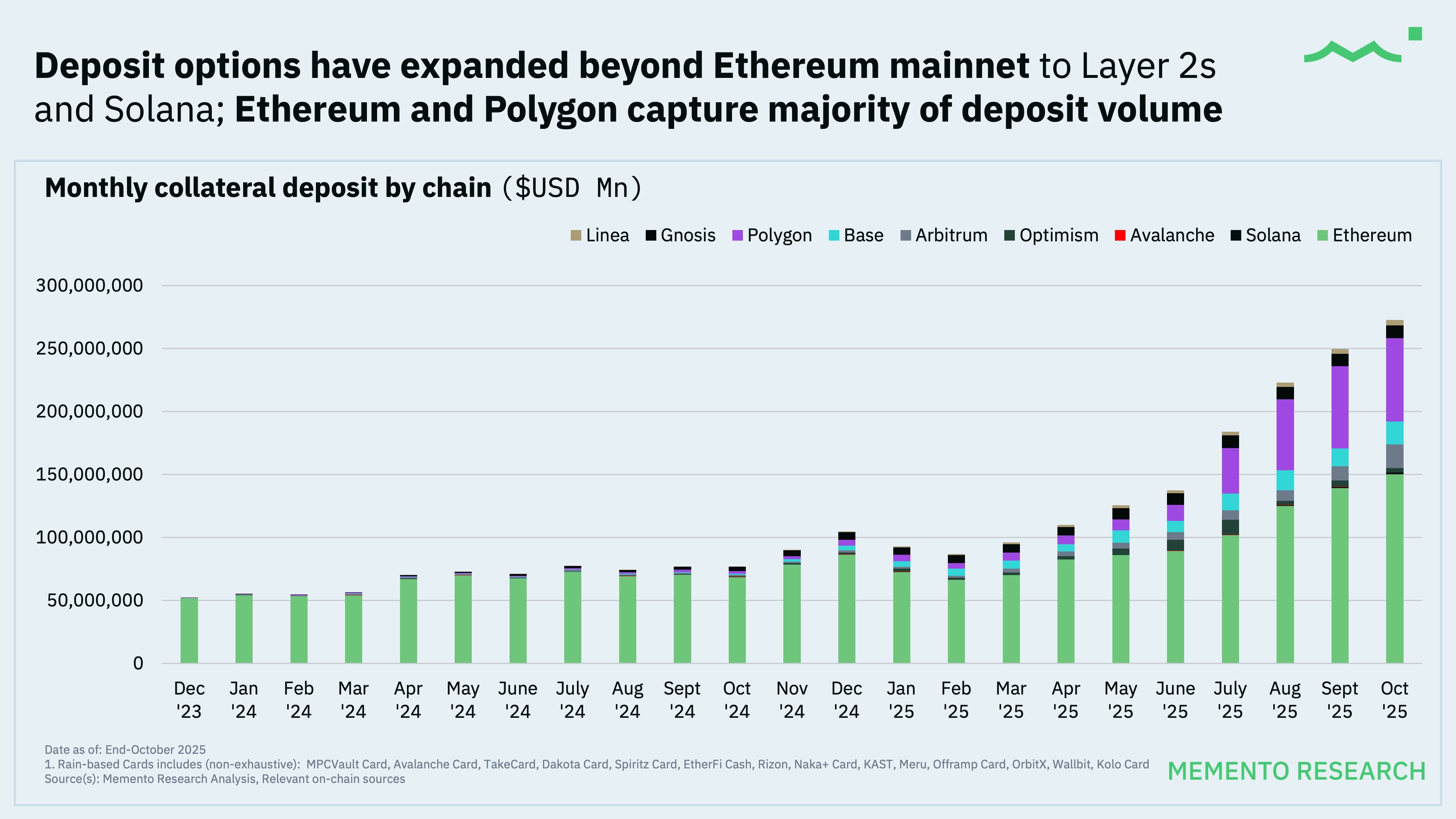

Ethereum and Polygon anchor deposits, but multi-chain usage is rising:

While Ethereum and Polygon remain the primary deposit rails, secondary chains (Base, Arbitrum, Optimism, Solana) are steadily gaining share.

The shift to multichain reflects:

Lower transaction costs, enabling for more frequent top-ups.

Card providers optimizing routing rather than forcing single-chain usage → Multichain deposits have evolved to be a hygiene feature.

Spending Behaviour: How Crypto Cards Are Actually Used

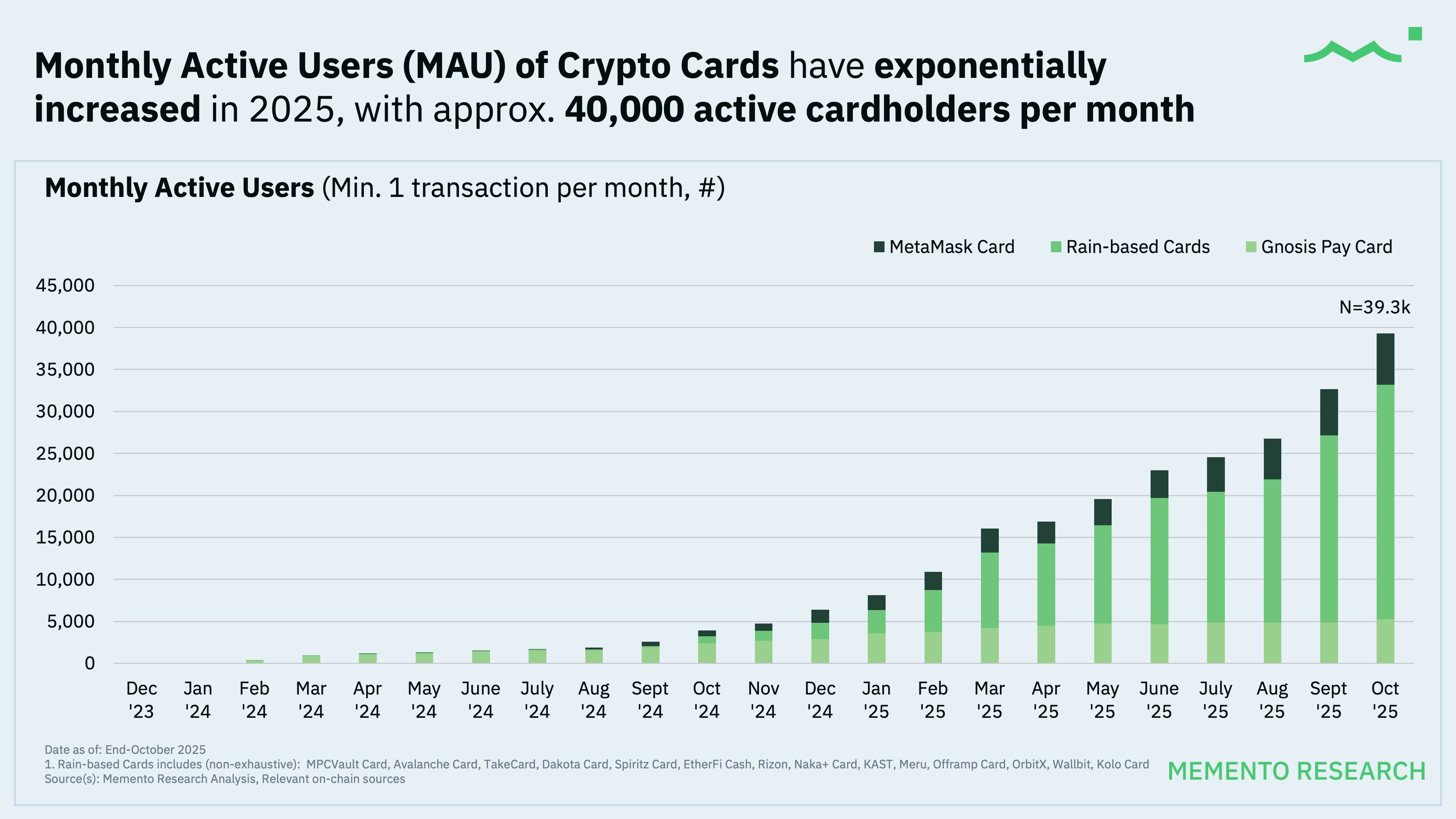

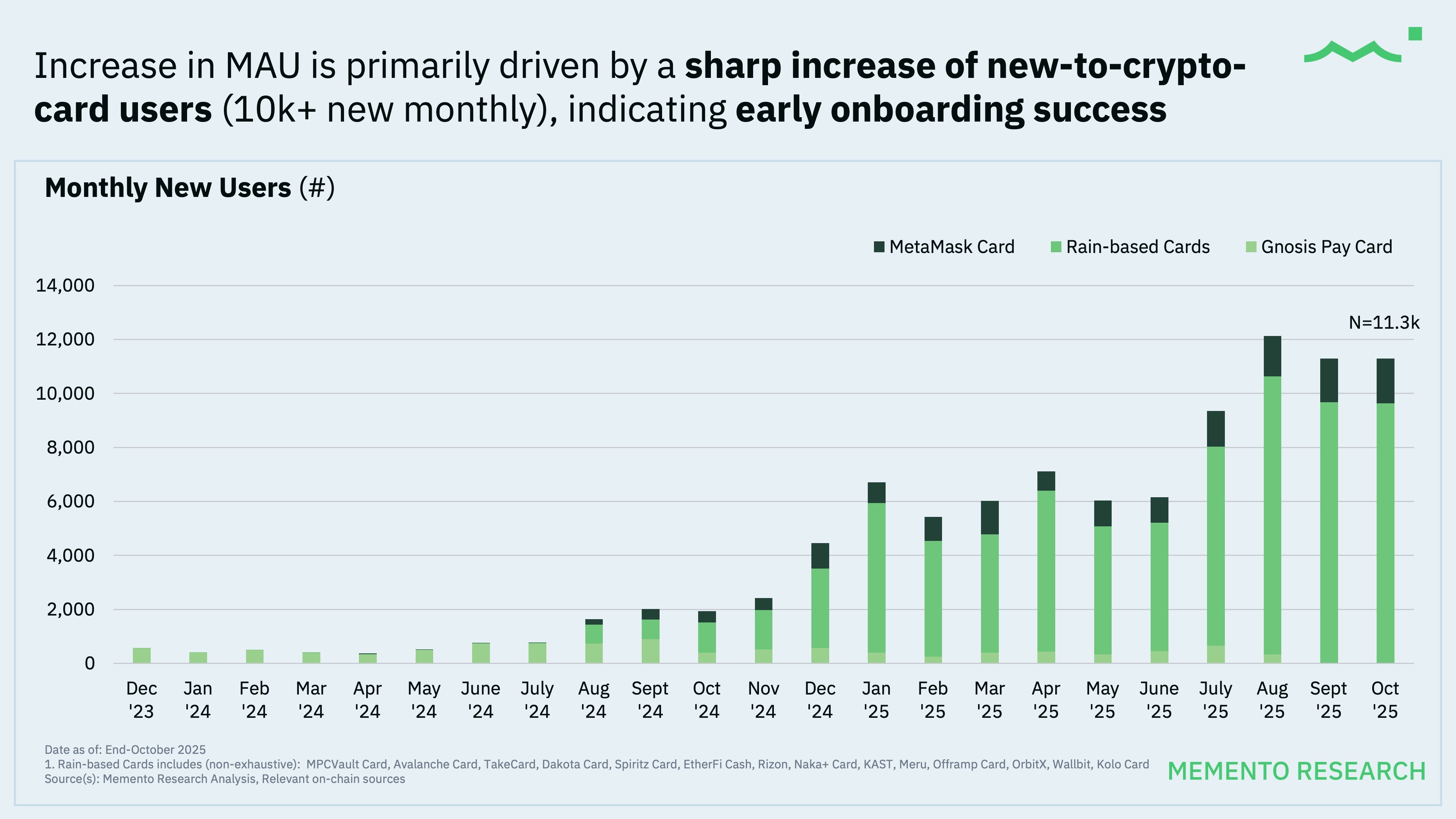

Monthly Active Users (MAU) continue to scale rapidly in 2025:

MAU reached ~40,000 active cardholders per month by end-October, indicating growing comfort with crypto cards as a repeat-use payment instrument vs. one-off experimentation.

New user growth key factor for driving overall adoption, remaining firmly in an “onboarding-led” growth phase. This suggests that crypto card as an industry is still early in its adoption curve, with distribution and access continuing to expand.

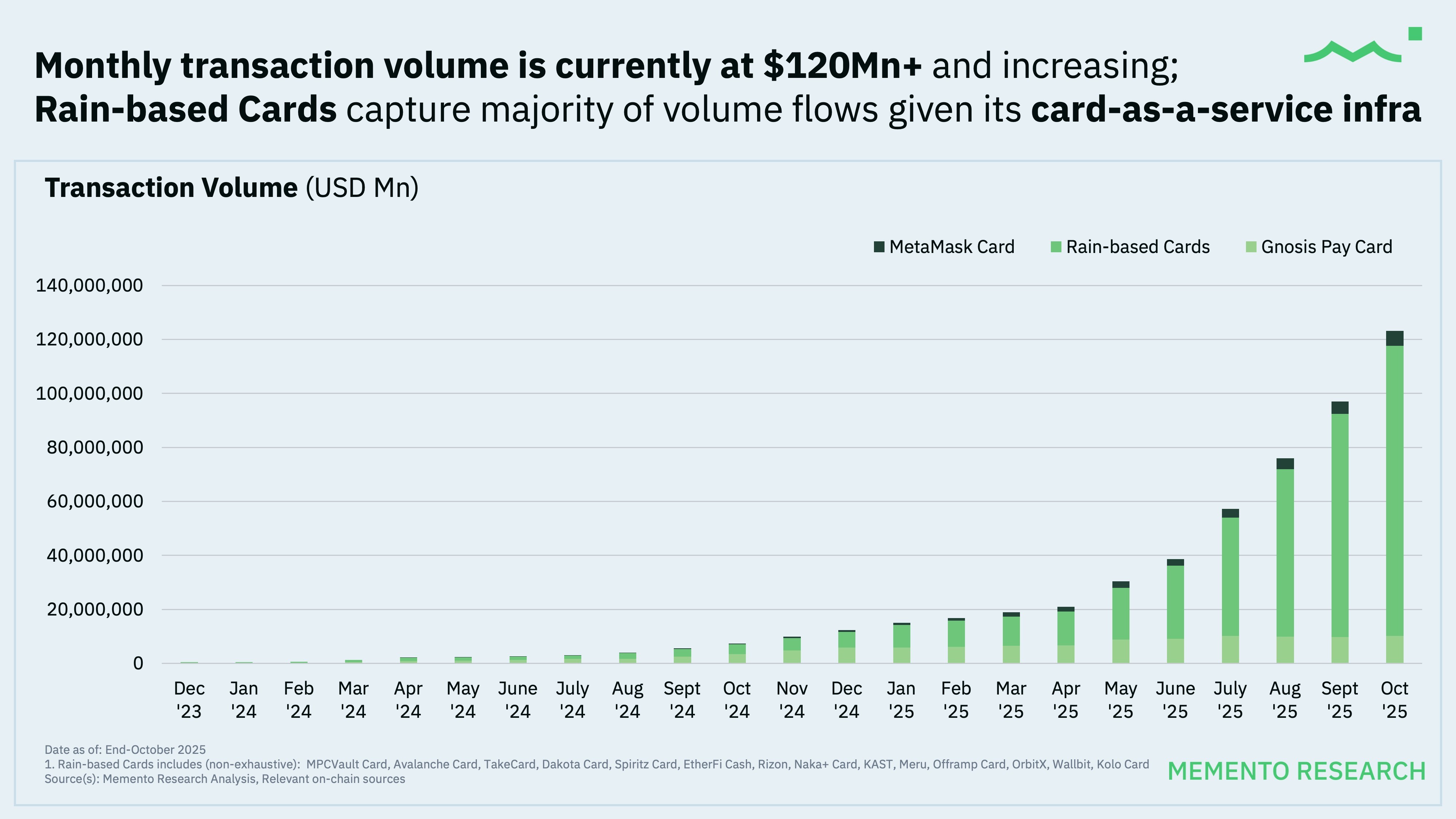

Transaction volumes exceeded $120M per month, with Rain-based cards dominating volume flows through shared infrastructure.

Rain-based cards capture the majority of volume due to their role as card-as-a-service infrastructure across multiple card programs; This Rain-based card dataset is best interpreted on a trend-level basis.

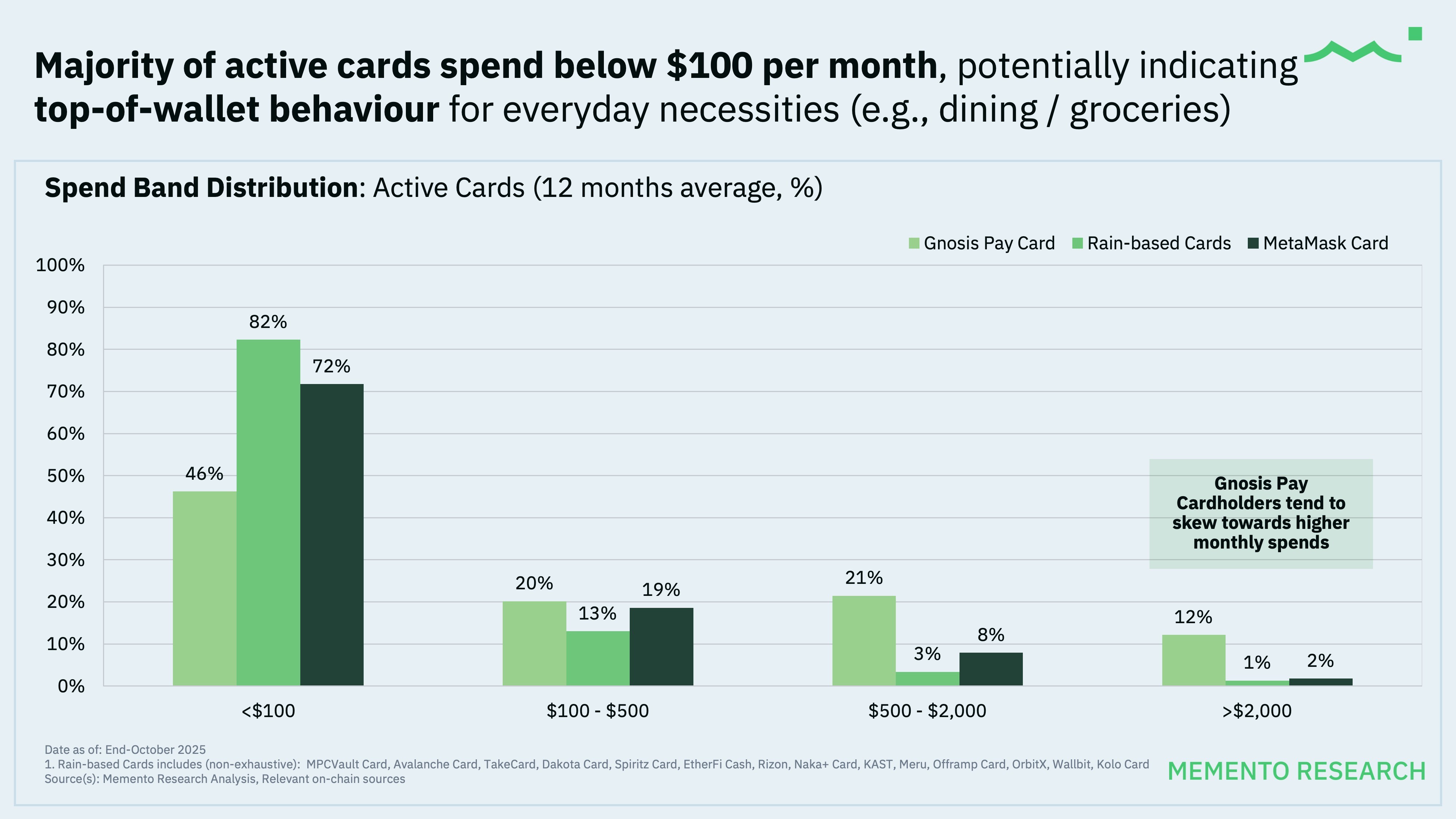

Spending remains low-ticket and controlled, likely indicating that cards are primarily used for everyday spends.

Low-ticket cardholder usage could also point to users using crypto cards as an offramp option, skipping the stables → fiat manual conversion altogether. Gnosis Pay cardholders skew toward higher monthly spend bands, suggesting more consistent primary-card usage.

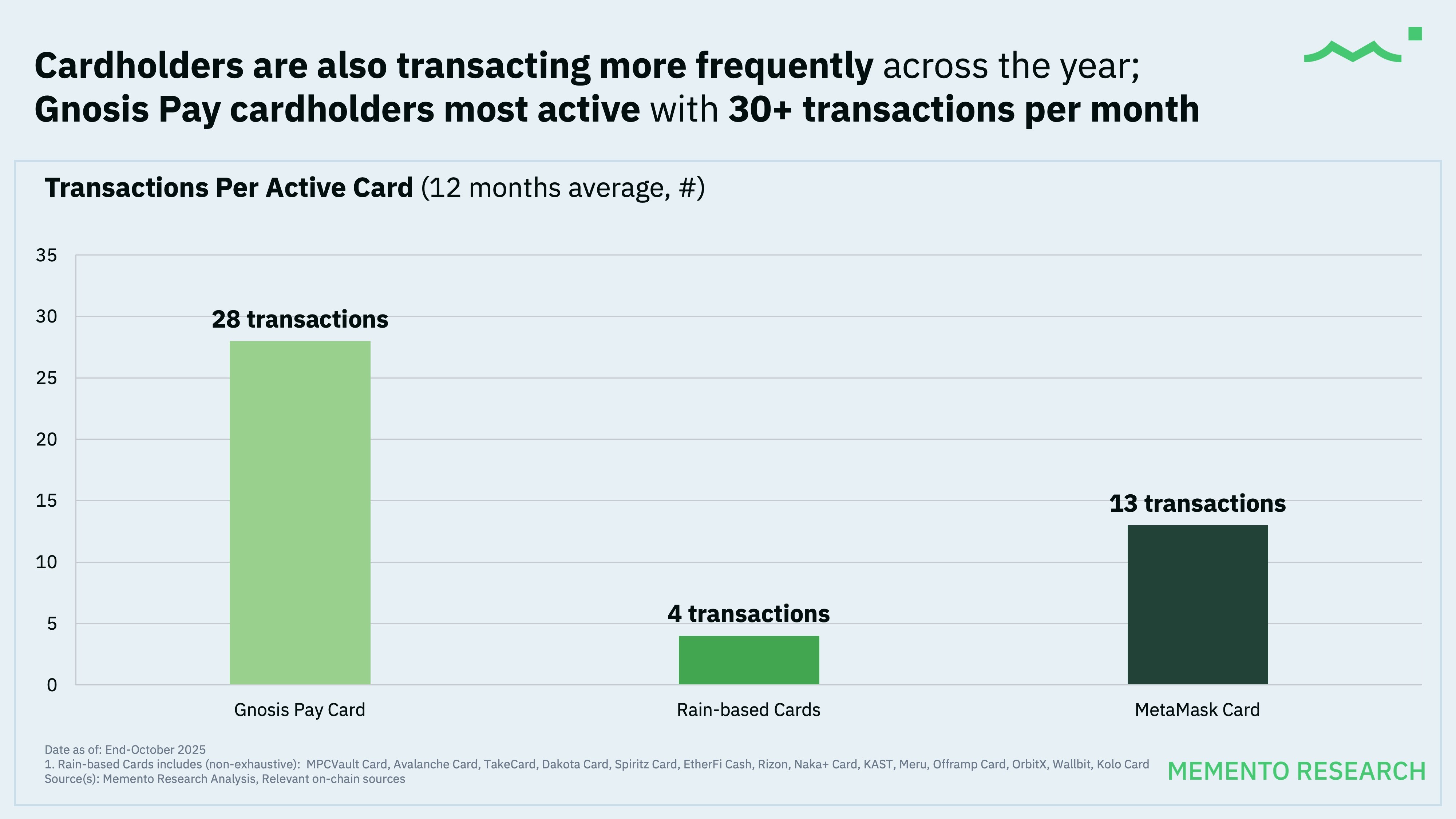

Transaction frequency is also increasing over time, with active cardholders transacting more frequently across the year; Similar to spends, Gnosis Pay cardholders are most active, averaging 30+ transactions per month, consistent with day-to-day payment behaviour.

Key Takeaways:

More people are actually using crypto cards → not just signing up, with spending and activity picking up steadily through 2025.

Usage looks like everyday spending, with users relying on stablecoins for small, regular purchases rather than big or speculative transactions.

Infrastructure providers play an outsized role, with shared card-as-a-service models driving volume concentration and shaping how the ecosystem scales.

Looking Ahead to 2026

The 2025 data shows that crypto cards have moved beyond experimentation into early adoption. Deposits, spending, and active usage scaled meaningfully, but behaviour remains deliberate and prepaid card-like, anchored by stablecoins rather than speculative assets.

Today, crypto cards function primarily as bridging payment rails between onchain liquidity and real-world spend, rather than full replacements for traditional credit cards.

Looking into 2026, growth is expected to be shaped less by onboarding momentum and more by economic sustainability and product design.

As usage scales, card providers will need to balance expansion with interchange economics (e.g. cross-border versus domestic flows), routing efficiency, and increasing operational complexity.

Key considerations to note:

Privacy is still a concern: Transactions are on-chain which makes spending doxxable. All it takes is just one address clustering/linkage or a CEX deposit address that leaves behind behavioural footprints (timing, amounts, etc) and on-chain sleuths can trace ownership

Public data also makes it easier to analyse, and to game: Competitors can monitor flows, copy incentives, and run predatory offers to vampire attack high-value users

Most programs are not vertically owned: They sit on top of issuers, processors, and a few “crypto card-as-a-service” providers. This obviously creates a single point of failure and restrictions - one compliance incident or policy change upstream can lead to sudden restrictions or shutdowns

High-risk merchant categories: Gaming, online casinos, adult entertainment tend to see higher fraud and dispute/chargeback rates, which triggers tighter controls from card networks and issuers. These categories often face stricter AML scrutiny depending on jurisdiction

The moat is distribution and relationships: Many standalone card brands will struggle because the moat is not the card itself, it is the distribution. And this comes in the form of a CEX integration, merchant partnerships or owning compliance relationships

Most cards today are debit, not credit: This significantly limits TAMs and margins. Real credit requires proper underwriting, loss management, and regulatory/issuer approvals which is a totally different ball game

Most cards in the market currently offer similar core propositions, with limited differentiation beyond selected cardholder rewards such as cashback or points. Continued reliance on prepaid-like structures and a small set of card-as-a-service providers, such as Rain, may present long-term challenges for crypto card issuers seeking to compete with large incumbent banks on a global scale.

Key themes to watch:

Expansion from prepaid models → credit-adjacent designs, similar to the Coinbase One AMEX Card

Continued dominance of stablecoins as the primary unit of account

Greater focus on profitability and unit economics as competition intensifies

Crypto cards are increasingly becoming embedded payment primitives within wallets and apps. While 2025 established demand, 2026 will determine which models can scale sustainably.