GAIB: The Bridge for Compute-Backed Real-World Yield

The Genesis of a New Asset Class

Two powerful trends are converging: the rise of AI infrastructure as a capital-intensive, revenue-generating industry and the growth of DeFi as an open, programmable source of liquidity.

Together, they set the stage for a new frontier: the financialisation of real-world AI infrastructure.

Since ChatGPT’s release, access to compute has become one of the world’s most valuable resources. NVIDIA now earns over $41.1 billion per quarter from its data-center business, while major tech firms spend billions each year expanding GPU clusters and robotic systems.

But this rapid growth has exposed a major gap: the total cost of compute is rising faster than the capital available to fund it.

Meanwhile, decentralised finance holds vast amounts of idle liquidity searching for reliable yield with exposure to productive, real-world activity. The result is a clear imbalance: AI’s most valuable assets remain under-financed, while crypto’s deepest liquidity remains under-used.

GAIB’s Founding Thesis

GAIB bridges this gap by creating a programmable economic layer that connects on-chain capital to off-chain AI infrastructure. It transforms physical AI assets (from GPUs to robotics fleets) into tokenised, yield-generating instruments. This approach redefines compute and robotics as a productive financial asset by leveraging decentralised capital to fund productive AI assets to enable a new primitive with sustained yield.

By aligning AI’s demand for capital with DeFi’s demand for transparent, verifiable real-world AI yield, GAIB establishes a new, more efficient way to finance the digital economy. This means turning compute and robotics into the foundation of a new asset class.

The Untapped Opportunity: Compute as Canonical Yield

The Structural Divide

AI’s fast-tracked ascension exposed the limitations of existing capital markets. The core bottleneck is not software innovation, but hardware intensity: compute, not code, drives cost. High-performance GPUs (e.g., NVIDIA H100, H200, B200 and B300) acquisition account for a majority of AI data center’s annual capital expenditure, yet financing remains concentrated among hyperscalers and a handful of specialised credit funds.

Traditional private credit, while lucrative, is inherently illiquid, geographically fragmented, and largely inaccessible to retail or on-chain capital.

The Capital Intensity of Compute

Furthermore, the economics of AI reveal a simple truth: compute is the new capital asset.

A single NVIDIA H200 card now exceeds $30,000, and full data center deployments routinely require nine-figure investments. Hyperscalers collectively allocate more than $50 billion annually to AI-specific capex, yet even they face persistent supply bottlenecks and cyclical reinvestment pressures. With hardware obsolescence occurring roughly every 12–18 months, these infrastructures demand continuous refinancing simply to sustain capacity.

This perpetual upgrade cycle turns compute into an inherently recurring yield asset: capital-intensive, yet continuously productive. It possesses every trait of a sound financial primitive: tangible collateral, predictable operational output, and repeatable cash flows.

While global AI infrastructure spending is projected to exceed $7 trillion by 2030, most of it remains privately financed. Compute scarcity has already spawned informal grey markets for GPU rentals and co-location arbitrage, signalling the emergence of a new, yield-generating real-world asset class.

The DeFi Dilemma

Meanwhile, DeFi’s once-lucrative yield landscape has deteriorated. Protocols dependent on emissions-based incentives are struggling to sustain returns, and most real-world tokenisation efforts remain confined to low-yield assets such as treasuries and invoices. The market’s appetite has shifted away from synthetic rewards toward verifiable yield, derived from tangible, productive activity rather than inflationary token mechanics.

Between these two worlds lies a profound opportunity: Unfinanced, yield-rich compute infrastructure on one side and idle, yield-hungry capital on the other.

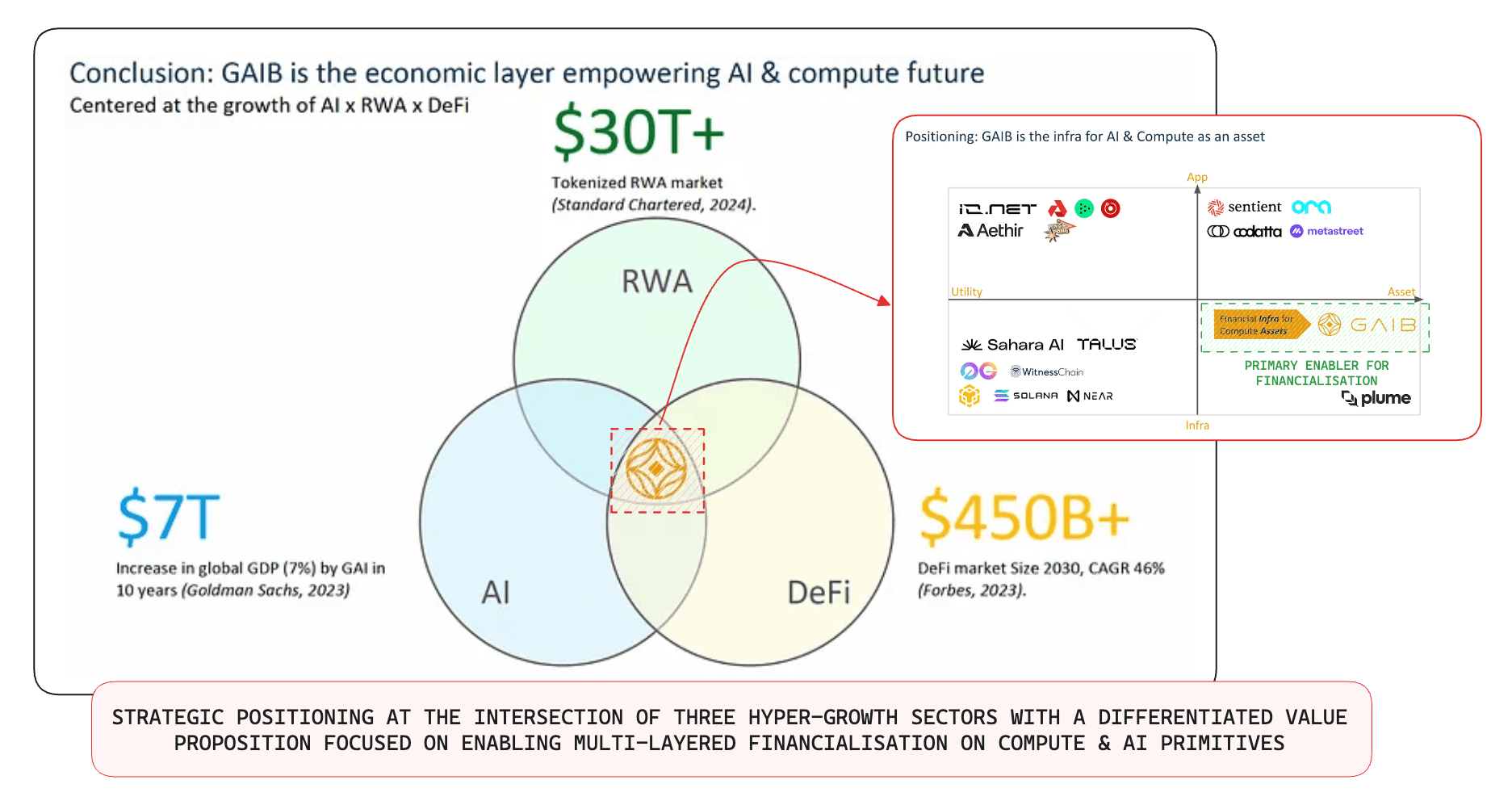

GAIB’s Total Addressable Market Venn Diagram - Source: GAIB

This is where GAIB abstracts this productivity into composable yield units, bridging real-world AI infrastructure with on-chain yield accrual and creating a transparent, programmable mechanism for financing the infrastructure that powers modern intelligence.

Each GPU cluster, robotics hardware generates predictable cash flows but until now, these yields were inaccessible to on-chain investors.

GAIB aims to transform these GPU and robotics-backed financing deals into a digital token, enabling composable participation in AI’s growth cycle. In this architecture, compute becomes a liquid, collateralised primitive — one that simultaneously finances innovation and rewards capital providers.

The Yield Crossroads: Where On-Chain Capital Meets Off-Chain Productivity

As outlined earlier, DeFi’s main limitation is the lack of sustainable, real-world yield. Most returns remain tied to speculative activity or short-term incentives, while AI and robotics infrastructure generate verifiable cash flows that remain largely illiquid and inaccessible.

GAIB merges these systems through a dual-sided marketplace:

Side | Problem | GAIB’s Solution |

|---|---|---|

AI Infrastructure Operators | Capital-intensive hardware; constrained financing cycles. | Access to on-chain liquidity via tokenised financing deals. |

DeFi Capital Providers | Diminishing real yields; over-reliance on synthetic returns mostly driven by token emissions. | Exposure to real AI yield tied to compute and robotics utilisation. |

This structural convergence creates a two-in-one opportunity: yield diversification for DeFi and scalable capital access for AI.

The Canonical Bridge Between AI, Robotics and Finance

GAIB’s architecture extends beyond tokenisation. It builds a verifiable, on-chain settlement and yield framework, where each financed asset (from GPU racks to robotics fleets) is cryptographically represented, yield-tracked, and composable within DeFi.

This programmable layer allows for fractionalised beneficial ownership of GAIB’s portfolio , liquidity pooling, and automated yield routing which unlocks the next era of real-world yield: compute-backed finance. By design, GAIB stands not as another DeFi protocol, but as the canonical economic bridge between decentralised capital and AI’s industrial backbone.

A Strategic Nexus: GAIB’s Role in Tokenised Private Markets and AI-Backed Yield

Private Credit Meets Programmable Liquidity

GAIB sits precisely at this intersection, where the demand for real-world financing meets the supply of programmable liquidity.

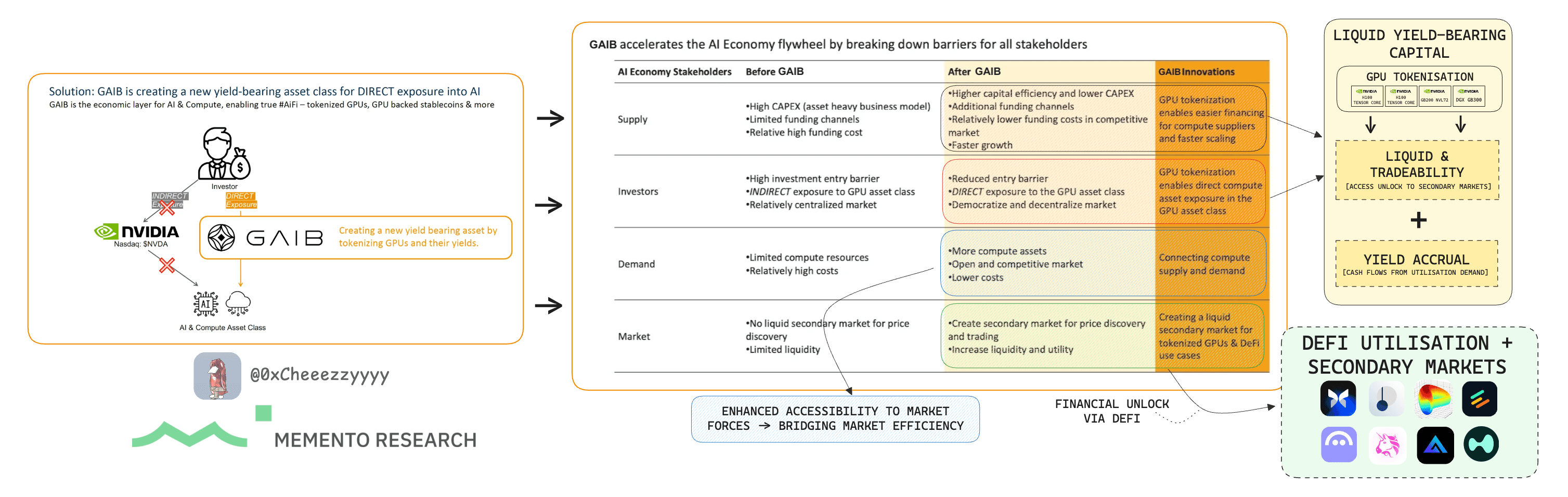

GAIB’s Value Proposition & Economic Flywheel Outline - Source: GAIB

This is achieved via its asset tokenisation layer, where GAIB aggregates verified AI infra operators spanning data centers, robotics facilities and energy infra (coming soon) into a standardised pool of financing deals. GAIB’s portfolio subsequently fractionalised into liquid on-chain tokens representing claims on productive output, democratising access to high-yield infrastructure markets that were once the exclusive domain of private equity and institutional lenders. Capital providers (from retail participants to DAOs and treasuries) can now earn AI-backed, real-world yield in a fully transparent and composable manner.

In essence, GAIB functions as a programmable conduit through which decentralised capital finances frontier AI infrastructure that transforms an opaque, illiquid private credit market into an open, verifiable, and scalable financial ecosystem.

GAIB Synthetic Stablecoin Model: AID & sAID

GAIB Protocol Mechanics Outline - Source: GAIB Documentation

The Canonical Stable Version: AID

GAIB’s dual-token system revolves around AID, a synthetic dollar fully backed by U.S. Treasury reserves, cash equivalents, and major stablecoins, and sAID, its yield-bearing counterpart.

AID is minted when capital enters the protocol and burned when profits are distributed or redeemed, ensuring its supply always reflects the value of underlying assets. It functions as an entry point to GAIB’s tokenized portfolio of AI infrastructure, and a base currency in the broader DeFi ecosystem.

Accessing Yield Through Staking: sAID

Users can stake AID to mint sAID, a yield-bearing token whose value gradually increases as protocol revenues accumulate from sources such as GPU, robotics financing and U.S. Treasury yields. The yield is reflected through an evolving exchange rate between sAID and AID, while redemptions allow users to withdraw their principal and accrued yield after a short cooldown period.

Both tokens maintain full composability, enabling their use across DeFi applications such as yield tokenisation, structured yield vaults, or risk-tiered strategies.

Together, AID and sAID form the economic foundation of GAIB via pairing the stability of a synthetic dollar with the yield potential of AI infrastructure, and allowing users to participate directly in the growth of the on-chain AI economy.

A New Paradigm: Programmable Yield Distribution and Amplification

GAIB’s tokenised architecture goes way beyond infrastructure exposure. It amplifies the yield potential of this primitive across layers.

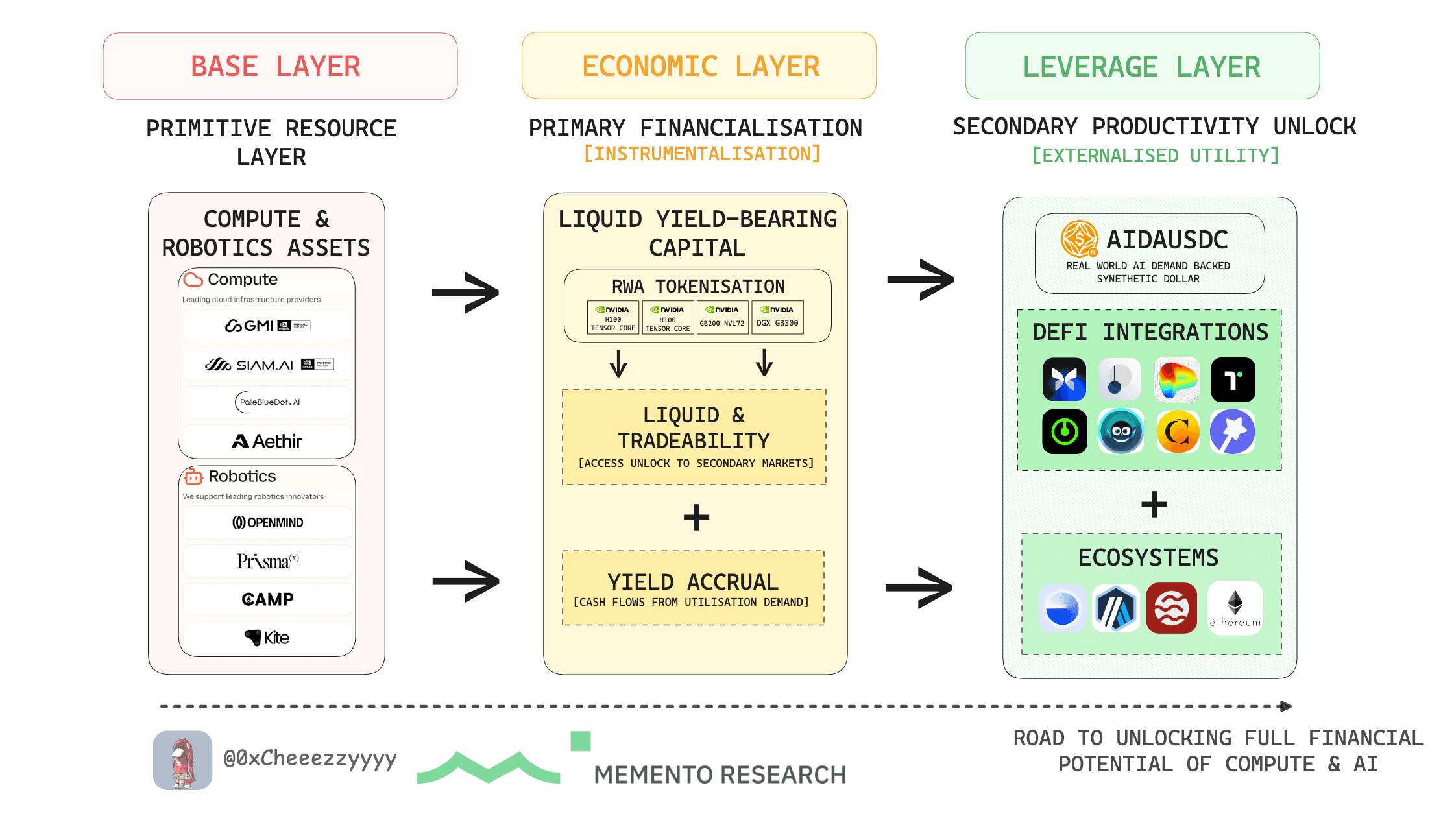

GAIB’s Multi-layered Financial Primitive - Source: 0xCheeezzyyyy, MementoResearch

By integrating composable DeFi primitives, each compute-backed asset becomes a yield-stackable unit where it is capable of interacting with a robust variety of DeFi protocols to generate layered returns:

Base Layer: Compute yield from infrastructure operations (e.g., GPU rentals, robotics services).

Economic Layer: Tokenised yield tokens (e.g., PT-AIDa) traded on secondary markets.

Leverage Layer: Recursive borrowing or structured yield products that extend asset composability in DeFi for enhanced capital efficiency and productivity.

This composability transforms static yield into dynamic financial productivity that enables capital to compound through interoperable layers while maintaining real-world backing.

Differentiated Tokenised Real-World Infrastructure: Compute and Robotics

GAIB’s real-world yield foundation is built on the tokenisation of productive AI infrastructure, spanning both compute and robotics. By financing, fractionalising, and mapping these assets on-chain, GAIB creates a continuous flow where real-world performance translates directly into programmable financial value.

Compute Ecosystem: Tokenising AI Infrastructure

GAIB partners with a global network of compute providers across both enterprise-grade and decentralised domains to ensure scalability, reliability, and diversification of yield sources.

GMI Cloud: One of NVIDIA’s six global reference partners, operating seven data centres across five countries with over $95M financed.

Siam.AI: Thailand’s first sovereign-level NVIDIA Cloud Partner. Its $30M GPU tokenisation partnership with GAIB marks Southeast Asia’s first GPU RWA transaction and establishes a key regional foothold.

Aethir: A leading decentralised GPU network with 40,000+ GPUs (including 3,000+ H100s), which partnered with GAIB to pilot GPU tokenisation on BNB Chain.

PaleBlueDot.AI: A rapidly expanding decentralised GPU cloud partner strengthening GAIB’s presence within the DePIN and AI infrastructure ecosystems.

Robotics: Financing Embodied Intelligence

Extending its financing framework, GAIB applies the same compute tokenisation model to the embodied AI (robotics) sectors. Robotics assets here are structured through SPVs, with operational cash flows distributed on-chain via AID/sAID, converting real-world automation into programmable yield.

PrismaX: Provides exposure to a teleoperation network that monetises motion and vision data through a validated commercial model.

OpenMind: Robotics Network enabling identity, data trust, and interoperability for autonomous systems.

CAMP Network: Introduces traceable on-chain data licensing and royalty mechanisms through traceability verification agreements, transforming robot-generated data into verifiable, monetisable digital assets and accelerating embodied intelligence adoption.

Ultimately, these collaborations bridge compute and robotics demand with on-chain capital, allowing investors to earn AI-powered real yield through sAID while fuelling the growth of the on-chain AI economy.

A New Era of On-Chain Yield Opportunities

Post mainnet launch, AID and sAID tokens should continue its pre-launch trajectory of integrating with key DeFi partners and expand yield potential, liquidity access and composability on-chain.

AID and sAID holders can expect a broad range of yield and liquidity opportunities across leading protocols, including:

Pendle Pools: Structure fixed and variable yield strategies by splitting into Principal (PT) and Yield (YT) tokens

DEX Liquidity Pools: AID and sAID will be paired across major DEXes, offering LPs sustainable rewards through trading fees and incentive programs. These pools will also help ensure there is a deep secondary market liquidity.

Lending and Borrowing Collateralisation: AID and sAID should be integrated into top lending markets as accepted collateral, unlocking new leverage and liquidity routes for participants seeking to compound returns or access stable liquidity without exiting their yield positions.

As GAIB’s ecosystem scales, new opportunities will emerge and expand AID and sAID’s role within the broader DeFi economy.

Much like Ethena’s USDe and sUSDe, which have become integrated primitives across money markets, LSD platforms, and derivatives protocols, AID and sAID are poised to follow a similar trajectory. As market adoption deepens, they could evolve into core yield assets underpinning the next generation of on-chain, compute-backed finance.

Transparency and Institutional Compatibility

Transparency is also central to GAIB’s design. Every yield stream and capital flow is on-chain verifiable, with real-time data from operator oracles and audit partners ensuring full visibility from asset origination to yield distribution.

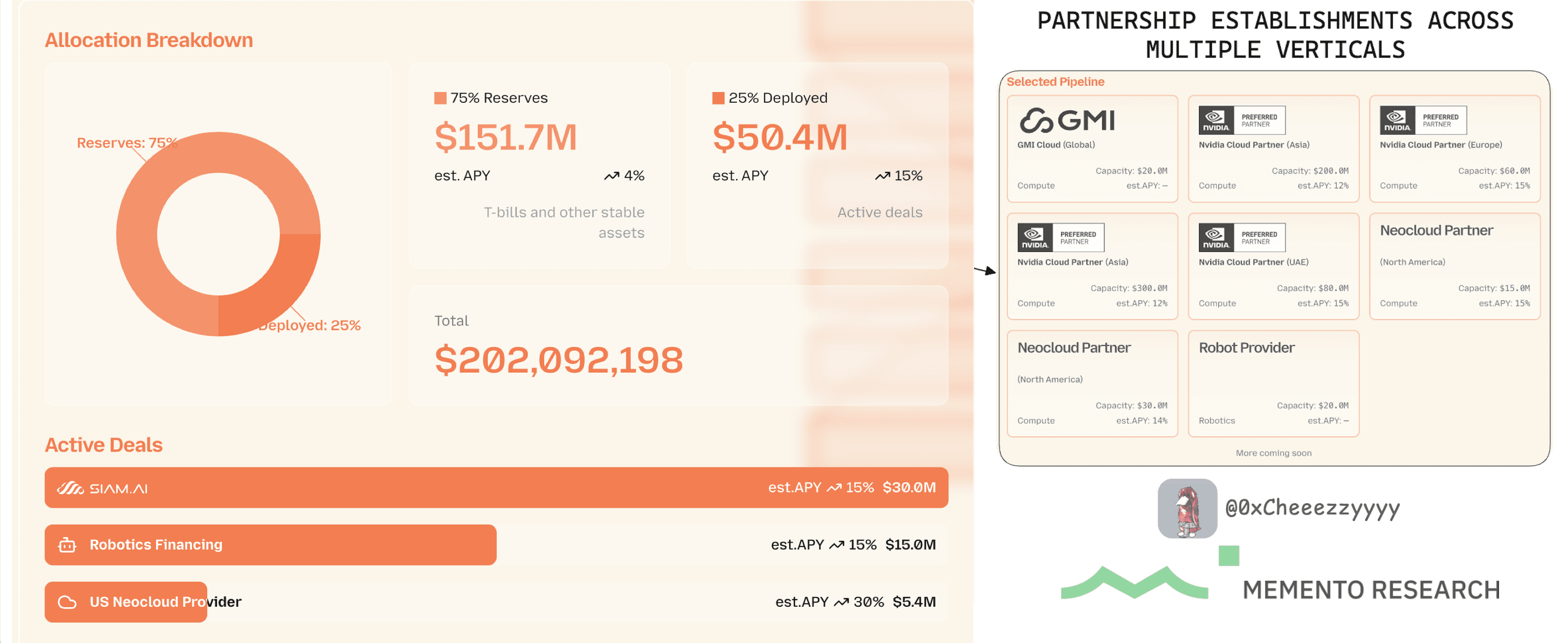

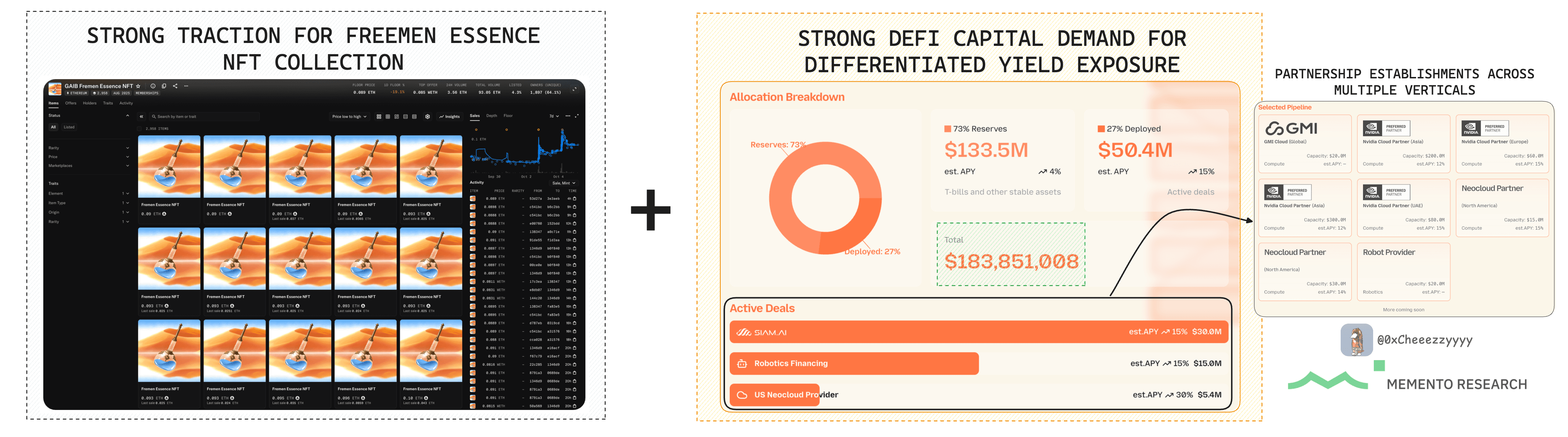

GAIB Reserves Allocation Breakdown - Source: GAIB

At the asset level, compute nodes and robotics operators undergo verification before inclusion in credit pools. Yield tracking occurs continuously, tying accruals to utilisation metrics such as uptime, power efficiency, or compute throughput. On the distribution side, capital flows are transparently recorded on-chain, allowing liquidity providers and token holders to trace exactly how returns are generated and allocated.

This built-in auditability strengthens investor confidence and bridges the long-standing divide between DeFi and institutional finance. By embedding verifiability at its core, GAIB evolves private credit from an opaque, illiquid market into a transparent, programmable, and institution-ready yield ecosystem.

A Strategic Niche Positioning: GAIB’s Differentiated Edge with Compute Finance

Early-Mover Advantage: Establishing the Canonical Position

GAIB’s early entry into the intersection of AI infrastructure and DeFi offers a rare opportunity to define a market before it matures. By securing a foothold in a high-margin yet underdeveloped vertical, GAIB occupies a differentiated lane long before fragmentation and copycat models emerge.

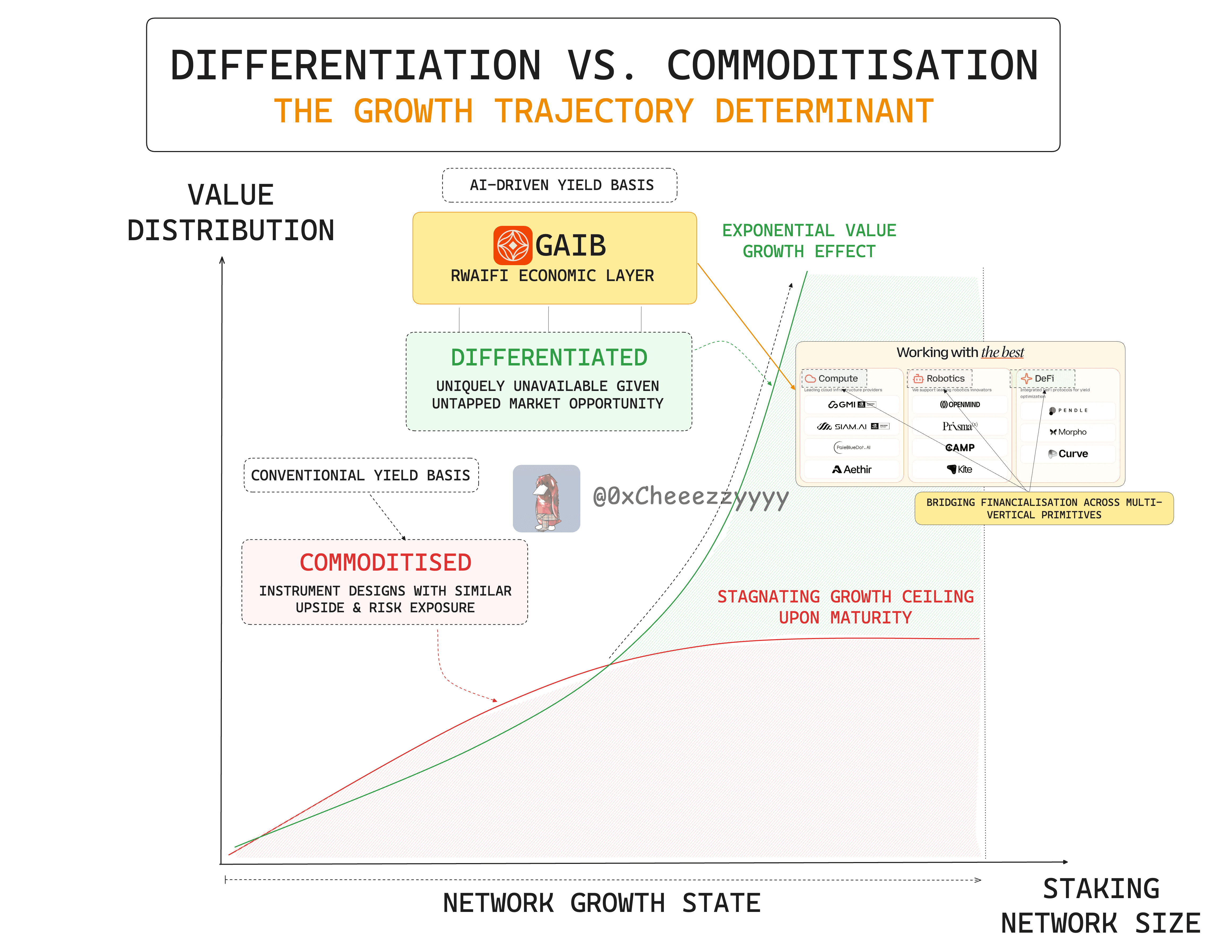

Financial Primitives: Differentiation vs. Commoditisation - Source: 0xCheeezzyyyy, MementoResearch

Its advantage rests on a set of unique levers that reinforce one another over time:

Vertical Focus & Defensibility

GAIB operates within a technically complex and largely uncontested domain that demands both deep expertise in AI infrastructure and sophisticated financial structuring. This specialisation creates a natural barrier to entry, insulating GAIB from generic competitors and positioning it as the go-to protocol for AI-backed yield.

Trust Through Early Traction

Early on-chain traction, verified partnerships, and transparent deal disclosures have established GAIB’s credibility in an emerging space often defined by opacity. This trust functions as a network moat, compounding with every new participant, integration, and transaction recorded on-chain.

Compounding Dominance

As adoption scales, liquidity, users, and integrations reinforce one another through Metcalfe’s Law dynamics. Each incremental participant increases the network’s utility and data depth, amplifying yield discovery and institutional engagement. This self-reinforcing loop drives value capture and strengthens GAIB’s position as capital and data consolidate around it.

Canonical Role Formation

Over time, GAIB’s operational maturity and reputational head start enable it to shape industry norms from liquidity routes and credit structuring to institutional frameworks for verifiable AI yield. This allows GAIB to evolve beyond a first mover into the canonical infrastructure layer for AI and compute finance, setting the standards others will follow.

GAIB’s Promising Early Traction

GAIB’s early traction illustrates both scale and conviction rarely seen for protocols pre-mainnet, transforming its debut into a market-wide proof of concept for AI-backed finance.

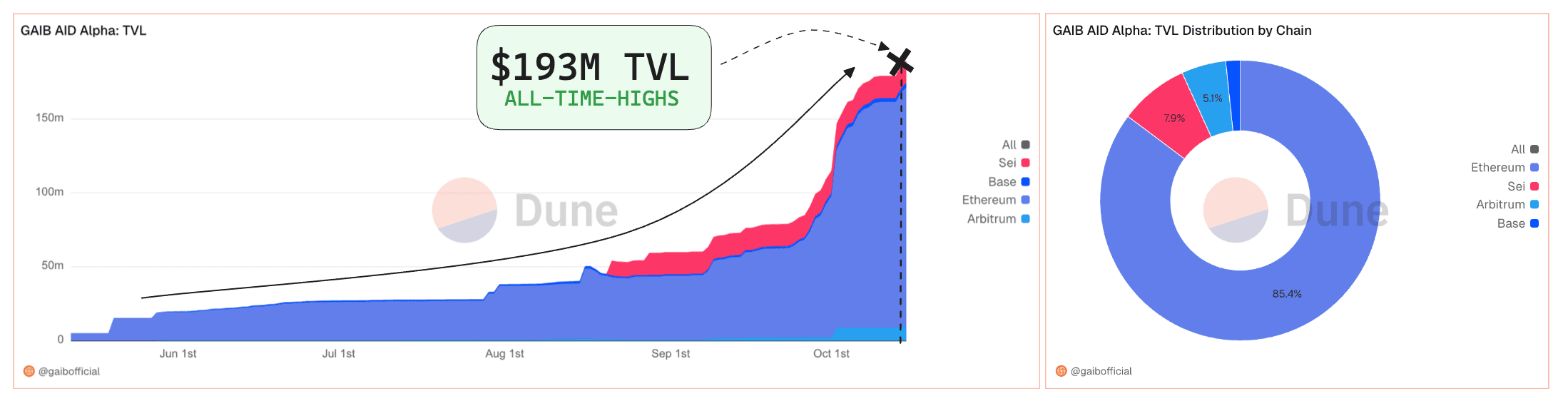

GAIB AID Alpha Historical TVL & Chain Breakdown - Source: Dune

Within its initial campaign window, the protocol secured $200 million in deposits, with the initial $125 million cap filled in under one hour — a rate of inflow that signals strong demand and validates compute yield as an emerging asset class.

GAIB Fremen Essence NFT Collection on Opensea & AID Transparency Dashboard - Source: Opensea, GAIB

Momentum extended beyond capital formation. Over 120,000 wallets joined across GAIB’s pre-deposit initiatives, spanning retail users, DeFi-native capital, and AI infrastructure operators. The accompanying Fremen Essence NFT collection (2,500 units) — sold out in under one minute on public whitelist — reinforced GAIB’s brand identity and deepened user engagement, while strategic partner collaborations amplified reach across DeFi and compute ecosystems alike.

The results indicate that investors increasingly view compute yield as a credible new asset class, with GAIB leading early development.

Faith in Innovation Through Accreditations

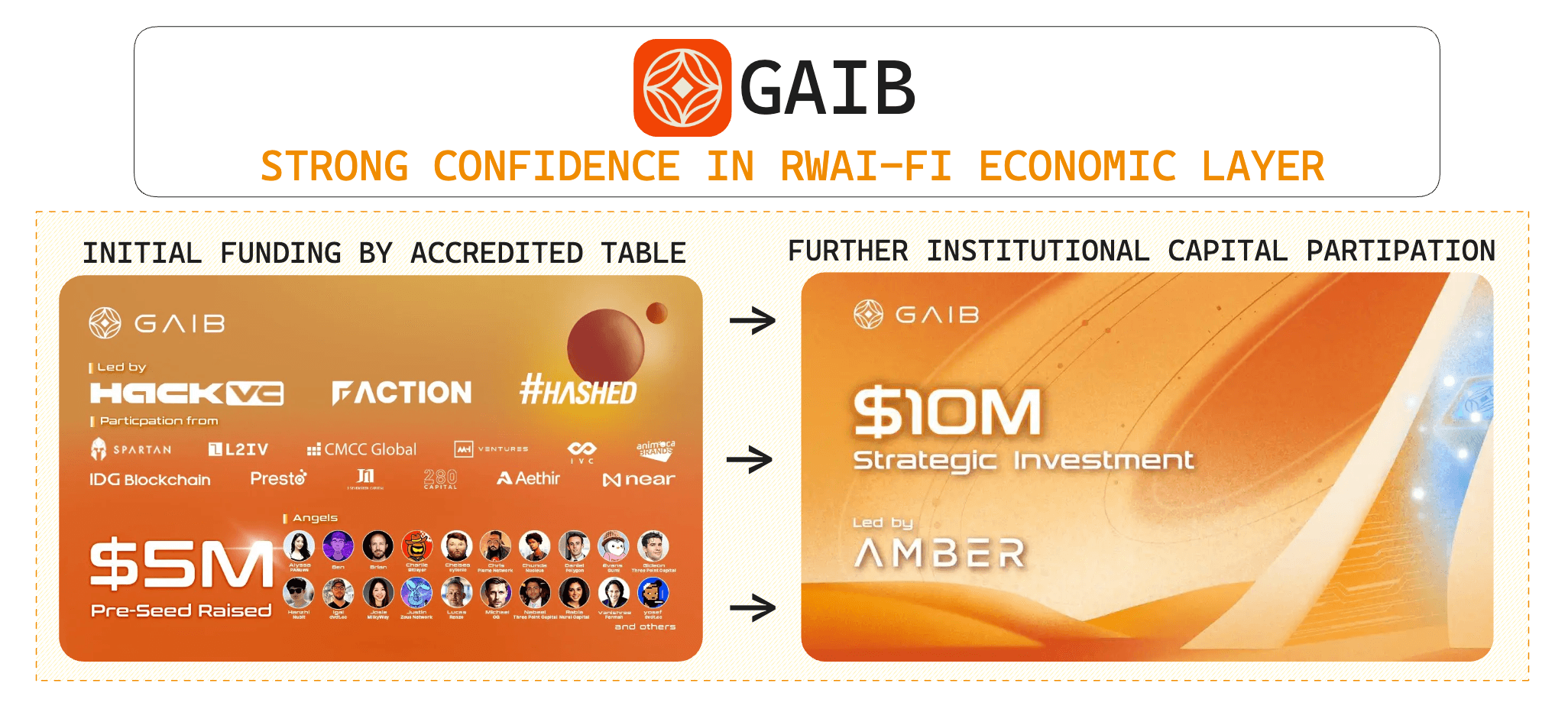

GAIB’s vision has attracted strong conviction from leading global investors.

GAIB $5M Pre-Seed Round & $10M Strategic Investment - Source: GAIB

In December 2024, the project secured a $5 million pre-seed round led by Hack VC, Faction, with participation from The Spartan Group, L2IV, CMCC Global, Animoca Brands, IVC, MH Ventures, Presto Labs, J17, IDG Blockchain, 280 Capital, Aethir, and the NEAR Foundation, among other notable institutions and industry angels. This early backing underscored broad confidence in GAIB’s mission to redefine how compute infrastructure is financed on-chain.

Building on that momentum, GAIB completed a $10 million strategic round in July 2025, led by Amber Group alongside several prominent Asian investors. The new capital further anchors institutional participation in the emerging market for on-chain AI infrastructure. It accelerates GAIB’s efforts to tokenise GPU assets, expand infrastructure, and advance financial product development.

Final Thoughts and Moving Forward

Finance is undergoing a structural shift where capital efficiency, programmability, and transparency are embedded directly into infrastructure. As AI moves from an application to essential infrastructure, compute is becoming an increasingly scarce digital commodity, and financing it is emerging as one of the defining opportunities of the decade.

Today, GAIB already generates meaningful on-chain cashflows from GPU and robotics operations. At roughly $200M TVL, the protocol delivers strong revenue efficiency relative to peers:

$20M+ in annual user yield

$7M in annualized protocol revenue (1% tokenization fee + 20% platform fee)

Higher yield efficiency than treasury or basis-trade models per $1 TVL

The protocol’s fundamentals are anchored in real yield, verifiable revenue, and scalable integrations rather than short-term speculation.

As partnerships expand across chains, lending markets, and institutional vaults, AID and sAID could evolve into foundational yield assets for the AI economy, much like how USDe and sUSDe became staples across DeFi’s money markets.

However, different risks do exist, ranging from execution and regulatory clarity to sustaining consistent operator performance. Still, the structural foundations remain sound.

If the team executes with consistency and transparency, GAIB has the potential to become the canonical bridge between capital and intelligence, shaping how the next era of real-world yield is financed and distributed.

Authors: @0xCheeezzyyyy, Memento Research

This report was written in partnership with GAIB. This report has been prepared for informational purposes only. It does not constitute investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the report’s content as such.